The Indian economy GDP is one of the most watched economic indicators in the world. As the world’s fifth-largest economy and its fastest-growing major one, India’s Gross Domestic Product figure is more than just a number. It is a story of ambition, challenge, and immense potential. This guide will provide you with a comprehensive, expert-level understanding of what drives India’s GDP, its current trajectory, and the critical factors that will shape its future.

WHAT IS GDP AND HOW IS IT MEASURED IN INDIA?

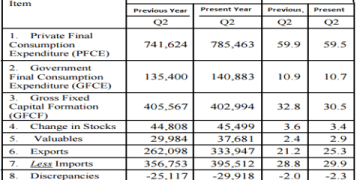

Gross Domestic Product, or GDP, represents the total monetary value of all finished goods and services produced within a country’s borders in a specific time period. For the Indian economy, GDP is the primary scorecard of its economic health. The Ministry of Statistics and Programme Implementation (MoSPI) is the official body that calculates and releases GDP data in India. They use two main methods: one based on economic activity (at factor cost) and the other based on expenditure. The expenditure method, which sums up Consumption, Investment, Government Spending, and Net Exports, is most commonly referenced in public discourse. Understanding this breakdown is key to analyzing the Indian economy GDP story, as shifts between these components reveal underlying strengths and weaknesses.

THE HISTORICAL TRAJECTORY AND CURRENT STANDING

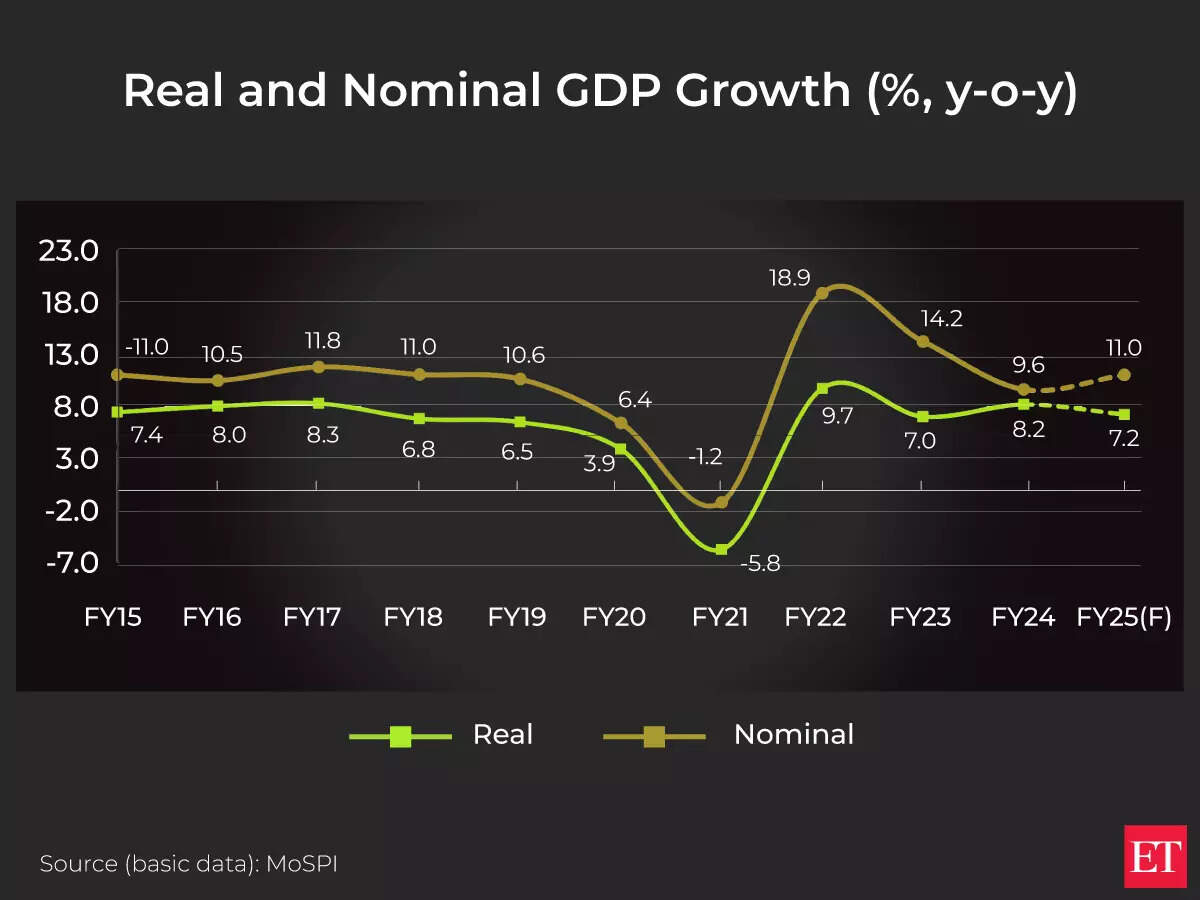

India’s economic journey since independence in 1947 has been transformative. After decades of modest growth under a planned economy, the landmark liberalization reforms of 1991 unleashed a new era. The Indian economy GDP growth rate accelerated, averaging over 6% annually in the decades that followed. A pivotal moment came in 2022 when India overtook the United Kingdom to become the world’s fifth-largest economy. As of the latest data, India’s nominal GDP stands at approximately 3.7 trillion USD. More impressively, despite global headwinds, India has consistently posted high growth rates. For the fiscal year 2023-24, the Indian economy GDP growth is estimated at a robust 7.6%, significantly outpacing most major economies (source: Ministry of Statistics and Programme Implementation, Government of India). This resilience highlights the economy’s growing internal momentum.

KEY DRIVERS OF INDIA’S GDP GROWTH

Several powerful engines are propelling the Indian economy GDP forward. We can break them down into primary sectors.

The services sector is the dominant force, contributing over 50% to India’s GDP. This includes world-class IT and software exports, financial services, telecommunications, and a booming tourism and hospitality industry. India’s role as the “back office of the world” continues to be a major growth pillar.

The industrial sector, including manufacturing, construction, mining, and utilities, contributes about 25-30%. Government initiatives like “Make in India” aim to boost this share by attracting foreign direct investment into manufacturing, positioning India as a global alternative manufacturing hub.

Agriculture, while its share in GDP has declined to around 15-18%, remains crucial. It employs nearly half of India’s workforce. Monsoon performance, minimum support prices, and technological adoption directly impact rural demand and, consequently, overall economic sentiment.

From my experience analyzing economic trends, I have observed that the interplay between digital adoption and consumer behavior is becoming an unofficial fourth driver. The explosion of digital payments, e-commerce, and fintech is creating a new, data-rich layer of economic activity that traditional metrics are still catching up to.

CHALLENGES AND HEADWINDS

Despite the optimistic Indian economy GDP projections, significant challenges persist. Income inequality remains high, with wealth concentrated in urban centers. The informal sector, which employs a vast majority of the workforce, lacks job security and social benefits. Infrastructure gaps in logistics, power, and water supply can hamper manufacturing ambitions. Geopolitical tensions and global economic slowdowns also pose external risks, affecting exports and foreign investment flows. Furthermore, the need to transition to a green economy while ensuring energy security for growth is a complex balancing act.

A CRITICAL COMPARISON: CONSUMPTION VS. INVESTMENT-LED GROWTH

A central debate in India’s economic policy revolves around the source of growth. The following table contrasts the two primary models:

| Growth Model | Description | Pros for India | Cons for India |

|---|---|---|---|

| Consumption-Led Growth | GDP growth driven primarily by private household spending on goods and services. | Taps into a large domestic market, provides immediate demand for businesses, and is less reliant on volatile global markets. | Can lead to high imports and trade deficits, may not create enough high-quality jobs, and is susceptible to inflation eroding purchasing power. |

| Investment-Led Growth | GDP growth driven by capital formation—spending on infrastructure, factories, and equipment by both government and private sector. | Builds long-term productive capacity, creates jobs in construction and manufacturing, and enhances future growth potential. | Requires massive capital, has a longer lag before benefits materialize, and can be hampered by bureaucratic delays and land acquisition issues. |

The ideal path for the Indian economy GDP is a sustainable mix, but current policy is distinctly shifting focus towards boosting investment to build foundational capacity.

HOW TO ANALYZE INDIAN GDP DATA: A 5-STEP GUIDE FOR INVESTORS AND ANALYSTS

Reading beyond the headline Indian economy GDP number is essential. Follow this guide for a deeper analysis.

STEP 1: Look at the Real vs. Nominal GDP Growth. Always prioritize real GDP growth, which is adjusted for inflation (GDP at constant prices). A high nominal growth figure during high inflation can be misleading.

STEP 2: Break Down the Expenditure Side. Examine the contributions of Private Final Consumption Expenditure (PFCE), Gross Fixed Capital Formation (GFCF), Government Spending, and Net Exports. Is growth coming from consumption or investment?

STEP 3: Analyze Sectoral Performance (GVA). Look at the Gross Value Added (GVA) data for eight core sectors: agriculture, industry, and six service sub-sectors. This shows which parts of the economy are actually producing value.

STEP 4: Check for Revisions. Indian GDP data often undergoes significant revisions in subsequent releases. Note the trend of revisions—are previous estimates being upgraded or downgraded?

STEP 5: Corroborate with High-Frequency Indicators. Cross-check GDP trends with other data like GST collections, auto sales, PMI indices, and bank credit growth. These provide a more real-time pulse.

COMMON MISINTERPRETATIONS TO AVOID

A critical warning for anyone following the Indian economy GDP: do not mistake high GDP growth for uniform development. A rising GDP does not automatically mean reduced poverty, better healthcare, or higher quality education for all citizens. These are measured by different indices like the Human Development Index. Furthermore, GDP does not account for environmental degradation or resource depletion. A country can show strong GDP growth by over-exploiting its natural resources, which is unsustainable in the long run. Always contextualize GDP within broader social and environmental metrics.

THE FUTURE OUTLOOK AND GLOBAL POSITIONING

The future of the Indian economy GDP is bright but contingent on continued reform. Most international agencies project India to grow between 6% and 7% annually over the medium term, on track to become the third-largest economy by 2027 (source: International Monetary Fund World Economic Outlook). Key to this will be leveraging demographic dividend through job creation in labor-intensive sectors, deepening financial inclusion, and embracing the digital and green revolutions. India’s strategic position as a counterbalance in global supply chains presents a unique opportunity.

FINAL CHECKLIST FOR UNDERSTANDING INDIAN ECONOMY GDP

To master your analysis of India’s economic performance, use this actionable checklist.

Identify whether the cited GDP figure is nominal or real.

Examine the quarterly and annual growth trends, not just a single data point.

Review the breakdown of growth by expenditure components.

Assess the performance of key sectors like manufacturing, agriculture, and financial services.

Compare GDP growth with other macroeconomic indicators like inflation, unemployment, and fiscal deficit.

Consider the global economic context and its impact on exports and foreign investment.

Evaluate government policy announcements for their potential long-term impact on capital formation and productivity.

By moving beyond the headline number and applying this structured analysis, you will gain a true expert understanding of the forces shaping the remarkable story of the Indian economy GDP.