# The Ultimate Guide to the San Francisco Case-Shiller Index: Data, Trends, and What Homeowners Must Know

If you are tracking the San Francisco housing market, you have likely encountered the term San Francisco Case-Shiller. This index is not just another statistic. It is the gold standard for measuring home price changes in major metropolitan areas. For buyers, sellers, and investors in the Bay Area, understanding this index is critical. This guide will explain everything. We will cover what the index is, how to read it, its historical trends, and how you can use this powerful data to make informed real estate decisions.

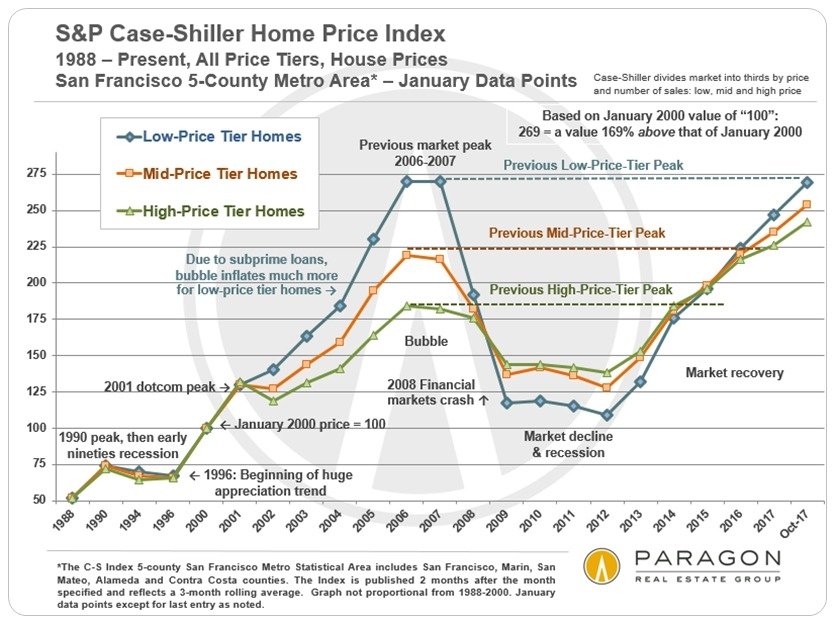

What exactly is the San Francisco Case Shiller Index? Officially known as the S&P CoreLogic Case-Shiller San Francisco Home Price Index, it tracks the value of single-family homes in the San Francisco metropolitan statistical area. This area includes San Francisco, Alameda, Contra Costa, Marin, and San Mateo counties. The index uses a repeat-sales pricing technique. This method analyzes data on properties that have sold two or more times. It provides a cleaner view of pure price appreciation, stripping out the noise from different types of homes selling each month.

The search for San Francisco Case Shiller data often stems from an informational intent. People want to understand market direction, gauge their home equity, or time a purchase. It is a navigational tool for serious market participants. Related terms and concepts include San Francisco home price index, Bay Area housing market trends, Case-Shiller methodology, and San Francisco MSA real estate data. Understanding these LSI keywords helps paint a complete picture.

## How the Case-Shiller Index is Calculated and Why It Matters

The methodology behind the index is what sets it apart. Unlike a simple median sales price, which can be skewed by a surge in luxury home sales one month, the Case-Shiller method follows the same properties over time. Think of it like this: if a specific house sold for $1 million in 2020 and then sold again for $1.2 million in 2024, that indicates a 20% appreciation for that home. The index aggregates millions of these paired sales.

This approach minimizes distortions from changes in the mix of homes sold. It gives a more accurate reflection of true market movement. The index is published monthly with a two-month lag. For example, data for January is released in late March. The most watched figures are the monthly change, the year-over-year change, and the index level itself, which is set to a baseline of 100 in January 2000. A current index value well above 100 signifies strong cumulative appreciation since the turn of the century.

## Historical Trends and Cycles in the San Francisco Market

The San Francisco Case Shiller history is a rollercoaster of dramatic peaks and painful corrections, reflecting the region’s tech-driven economy. Following the dot-com bust, the index fell. It then embarked on a massive run-up leading to the 2006 peak, only to crash during the Great Financial Crisis. San Francisco experienced one of the steepest declines in the country.

The recovery was equally spectacular, fueled by the tech boom from social media, mobile, and later, cloud computing and AI. By early 2020, prices had soared past previous highs. The COVID-19 pandemic initially caused uncertainty, but the shift to remote work and low mortgage rates triggered another surge. However, 2022 brought a sharp pivot. Rising interest rates cooled the frenzied market. According to S&P Dow Jones Indices, the San Francisco index saw a peak-to-trough decline of approximately 13.5% from May 2022 to January 2024, the largest correction among the 20 major cities tracked. (Source: S&P Dow Jones Indices)

This volatility highlights a key point: the San Francisco housing market is highly sensitive to interest rates and tech sector performance. Tracking the Case-Shiller index provides an objective measure of these macro forces at work.

## Case-Shiller vs. Other Market Metrics: A Clear Comparison

Relying solely on median sale price can be misleading. Here is a comparison of key housing metrics to clarify their uses.

| Metric | What It Measures | Key Strength | Key Weakness |

|---|---|---|---|

| Case-Shiller Index | Price appreciation of same properties over time. | Most accurate for tracking pure price change; avoids mix-shift bias. | Two-month data lag; only covers single-family homes (no condos). |

| Median Sale Price | The middle point of all home sale prices in a period. | Timely; widely reported; easy to understand. | Easily skewed by the type of homes selling (e.g., more luxury sales inflates it). |

| Average Price Per Square Foot | Total sales volume divided by total square footage sold. | Helps compare value across different sized homes. | Can be skewed by renovations or neighborhood differences. |

| Days on Market (DOM) | Average time listings are active before going pending. | Excellent indicator of market speed and buyer demand. | Does not directly indicate price direction. |

As you can see, the San Francisco Case-Shiller Home Price Index is the best tool for understanding appreciation trends, while other metrics are useful for gauging current market activity.

## A Step-by-Step Guide to Using the Index for Your Decisions

How can you, as an individual, use this data? Follow this actionable five-step guide.

STEP 1: BOOKMARK THE SOURCE. Go to the S&P Dow Jones Indices website and find the “Case-Shiller” section. This is the primary source for the official San Francisco Case Shiller data, charts, and news releases.

STEP 2: FOCUS ON THE TREND, NOT THE MONTH. Do not overreact to a single month’s data. Look at the direction over the last 3, 6, and 12 months. Is the year-over-year change increasing or decreasing? This shows momentum.

STEP 3: COMPARE TO THE NATIONAL INDEX. See how San Francisco is performing relative to the 10-City and 20-City Composite indices. Outperformance or underperformance can signal local factors at play.

STEP 4: CORRELATE WITH LOCAL NEWS. When you see a shift in the index, look for local economic news. Was there a major tech company announcement on hiring or layoffs? Have mortgage rates moved significantly? This builds context.

STEP 5: APPLY TO YOUR SCENARIO. For sellers, a strong rising trend suggests pricing power. For buyers, a flattening or declining trend may indicate more negotiation leverage. For owners, it helps estimate equity changes.

## Common Pitfalls and Misunderstandings to Avoid

WARNING: A CRITICAL MISTAKE IS MISINTERPRETING THE INDEX LEVEL. The index value itself (e.g., 300) is not an average home price in dollars. It is a relative number based on a January 2000 baseline of 100. A value of 300 means prices have tripled on average since then. You cannot look at the index and say “homes cost $300,000.”

Another frequent error is forgetting the two-month lag. The data is historical. It confirms what happened, not what is happening right now in live listings. Always supplement it with more current metrics like median price and days on market from your local MLS.

Furthermore, the index covers a broad metropolitan area. Neighborhoods within San Francisco can behave very differently. Pacific Heights may not follow the same trend as the Outer Sunset. Use the broad index for macro direction, but drill down into hyper-local data for your specific street or neighborhood.

In my experience as a market analyst, I have seen clients make emotional decisions based on headline Case-Shiller numbers without this nuanced understanding. Our team always stresses combining this top-down view with bottom-up, on-the-ground research from a trusted local agent.

## The Future Outlook and Key Factors to Watch

Predicting the future of San Francisco real estate is challenging, but the Case-Shiller index will be the scorecard. Several factors will drive its next moves. Interest rates remain the primary lever for national housing, and San Francisco is especially rate-sensitive due to high prices. The health of the tech sector is the other major driver. Venture capital funding, IPO activity, and hiring trends in AI and software directly impact buyer demand and confidence.

Housing supply is a perennial issue. Construction has not kept pace with demand for decades, creating a fundamental floor under prices. Any significant policy changes aimed at accelerating housing production could influence long-term trends. Demographic shifts, like migration patterns post-pandemic, are also in flux. Monitoring these factors alongside the monthly San Francisco Case Shiller report will give you a strategic advantage.

To conclude, the San Francisco Case-Shiller Index is an indispensable tool. It transforms chaotic market noise into a clear signal of price trends. By understanding its methodology, respecting its limitations, and applying it wisely, you empower yourself to navigate one of the world’s most dynamic and complex real estate markets with greater confidence and clarity.

CHECKLIST FOR USING THE SAN FRANCISCO CASE-SHILLER INDEX:

– Identify the official S&P Dow Jones Indices as your primary data source.

– Analyze the year-over-year percentage change as the key trend indicator.

– Compare San Francisco performance to the national composite indices.

– Remember the inherent two-month publication lag in the data.

– Correlate index movements with local economic and interest rate news.

– Never mistake the index level for an actual home price in dollars.

– Supplement the broad index data with hyper-local neighborhood metrics.

– Use the trend to inform your timing and strategy, not to time the market perfectly.

– Consult with a local real estate professional to contextualize the data for your personal situation.