Understanding the price of Kansas crude oil is crucial for producers, traders, and anyone with a stake in the regional energy market. Unlike the globally quoted West Texas Intermediate (WTI) benchmark, Kansas oil has its own unique pricing dynamics. This guide will break down everything you need to know, from the key factors that move the needle to practical tools for staying informed.

We will explore the specific characteristics of Kansas crude, the primary drivers of its price, and how it compares to other benchmarks. You will also get a step-by-step guide on tracking prices and a checklist for making informed decisions based on this vital data.

# What is Kansas Crude Oil?

Kansas is a significant oil-producing state, primarily yielding a type of crude known as Kansas Common. This is a medium-grade, sweet crude oil, meaning it has a relatively low sulfur content, which makes it less expensive to refine into products like gasoline and diesel compared to sour crudes. The price of Kansas crude oil is typically quoted at the trading hub in Cushing, Oklahoma, which is the same delivery point for WTI futures. However, it trades at a differential—a discount or premium—to the WTI price. This differential is the key to understanding the local price.

Several factors influence this differential, including the quality of the crude, local supply and demand, pipeline capacity to Cushing, and the operational status of regional refineries. When local supply is high or pipeline constraints exist, the Kansas price can trade at a deeper discount to WTI.

# Key Factors Driving the Price of Kansas Crude Oil

The price of Kansas crude oil is not set in a vacuum. It is a function of both global forces and hyper-local conditions. Here are the primary drivers:

GLOBAL BENCHMARK PRICES: The most significant overarching factor is the price of WTI crude oil. Since Kansas crude is priced as a differential to WTI, when WTI rises or falls due to OPEC decisions, global economic outlook, or geopolitical events, the price of Kansas crude generally moves in the same direction.

LOCAL SUPPLY AND DEMAND: Production levels within Kansas and surrounding states directly impact the local balance. A surge in production from the Anadarko Basin, for instance, can overwhelm local takeaway capacity, pushing the Kansas discount wider. Conversely, strong demand from regional refineries in Kansas, Oklahoma, and Missouri can narrow the discount.

TRANSPORTATION AND LOGISTICS: Pipeline capacity to the Cushing hub is critical. Congestion or maintenance on these pipelines can trap crude in Kansas, forcing producers to accept lower prices. The cost of alternative transport, like rail or truck, also sets a floor for how wide the discount can become.

REFINERY MARGINS AND OPERATIONS: The health and configuration of nearby refineries matter. If refineries optimized for sweet crude are running at high utilization rates, they will bid more aggressively for Kansas Common, supporting its price. A refinery outage can have the opposite effect, creating a local glut.

QUALITY DIFFERENTIALS: While Kansas Common is sweet, its exact gravity and other properties can vary slightly. These quality differences compared to the WTI specification result in a permanent, structural discount. Changes in refinery preferences for specific crude slates can adjust this quality premium or discount.

# Kansas Crude vs. Other Benchmarks: A Comparative Table

To fully grasp the price of Kansas crude oil, it helps to compare it directly with other major North American crude oil benchmarks. The following table highlights the key differences.

| Crude Benchmark | Primary Trading Hub | Key Characteristics | Typical Price Relationship to WTI |

|---|---|---|---|

| Kansas Common | Cushing, OK | Medium-grade, sweet crude. Regional production. | Trades at a discount (e.g., $1-$5 per barrel below). |

| West Texas Intermediate (WTI) | Cushing, OK | Light, sweet crude. Main U.S. benchmark. | The benchmark price itself. |

| Brent Crude | North Sea (International) | Light, sweet crude. Global waterborne benchmark. | Typically trades at a premium to WTI. |

| Western Canadian Select (WCS) | Hardisty, Alberta | Heavy, sour crude. Requires more refining. | Trades at a large discount to WTI ($15-$25+). |

This comparison shows that the price of Kansas crude oil occupies a specific niche. It is more valuable than heavy sour crudes like WCS due to its quality but less valuable than the premier light sweet benchmark, WTI, due to its regional nature and specific grade.

# How to Track the Price of Kansas Crude Oil: A 5-Step Guide

Staying updated on the price of Kansas crude oil requires knowing where to look. Here is a practical, step-by-step guide.

STEP 1: IDENTIFY THE CORRECT PRICE ASSESSMENT. The most widely referenced price is the “Kansas Common at Cushing” assessment published by price reporting agencies (PRAs) like Platts or Argus. These are not real-time exchange prices but carefully assessed values based on verified trades and bids/offers.

STEP 2: BOOKMARK KEY FINANCIAL AND ENERGY NEWS SITES. Major financial news outlets (Bloomberg, Reuters) and dedicated energy news services (S&P Global Commodity Insights, Oil Price Information Service) report on daily energy markets. They often mention regional differentials, including Kansas, in their market wrap-ups.

STEP 3: MONITOR THE WTI FUTURES PRICE. Since Kansas crude is priced as a differential, you must know the base. The WTI futures price, traded on the New York Mercantile Exchange (NYMEX), is readily available on financial data websites like Investing.com or Yahoo Finance. The active front-month contract is the most relevant.

STEP 4: CALCULATE THE ACTUAL PRICE. The formula is simple: Kansas Price = WTI Price + Kansas Differential. Remember, the differential is usually a negative number (a discount). For example, if WTI is $80.00 per barrel and the Kansas differential is -$3.50, the price of Kansas crude oil would be $76.50 per barrel.

STEP 5: SET UP ALERTS FOR MARKET MOVEMENTS. Use the alert functions on news websites or trading platforms to notify you when keywords like “Kansas differential,” “Mid-Continent crude,” or “Cushing storage” appear in headlines. This helps you catch breaking news that could affect prices.

Based on my experience analyzing regional oil markets, I have found that the most significant price swings for Kansas crude often come from unplanned pipeline outages or sudden changes in refinery demand. These localized events can cause the differential to widen dramatically in a matter of days, underscoring the importance of real-time monitoring.

# Common Mistakes and Misconceptions

A WARNING FOR NEW MARKET OBSERVERS: One of the biggest mistakes is assuming the price of Kansas crude oil moves in perfect lockstep with the headline WTI price you see on TV. It does not. You can have a day where WTI rises by $2, but the Kansas discount widens by $1. The net effect? Kansas crude only gained $1 per barrel. Always track both the benchmark and the differential.

Another common error is overlooking basis risk. If you are hedging physical Kansas crude production using standard WTI futures contracts, you are exposed to the risk that the Kansas-WTI differential will change. This basis risk can sometimes outweigh the benefit of the hedge itself. Specialized financial instruments, like basis swaps, exist to manage this exact risk.

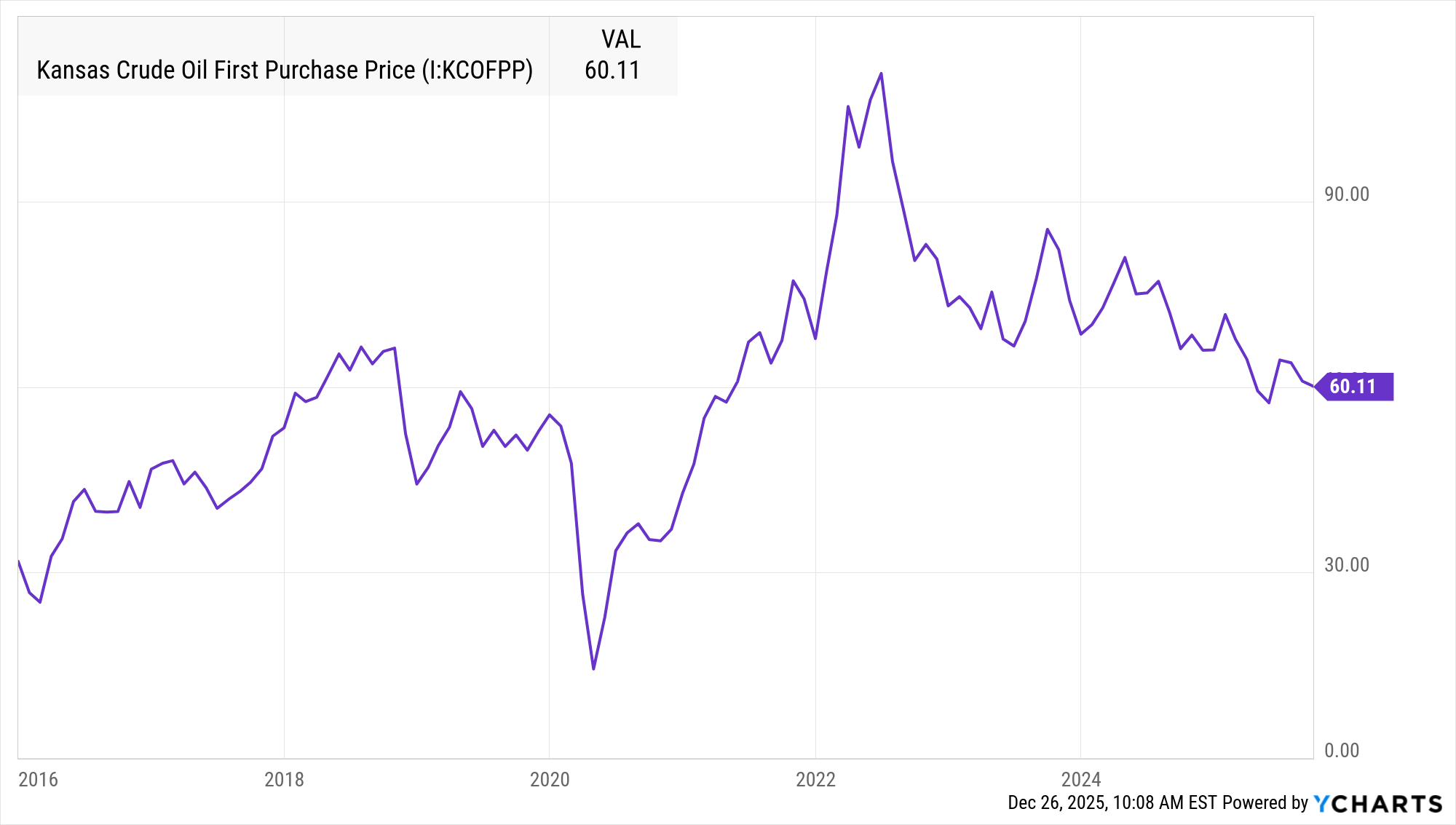

# The Impact of Market Trends and Data

Long-term trends significantly shape the landscape for Kansas oil producers. The U.S. Energy Information Administration (EIA) notes that crude oil production in Kansas averaged about 94,000 barrels per day in 2023, a fraction of leading states like Texas but still a substantial volume. (来源: U.S. Energy Information Administration). This production level ensures Kansas remains a relevant player in the Mid-Continent market.

Furthermore, the expansion of pipeline infrastructure over the last decade has generally reduced volatility in the Kansas differential by improving access to the Cushing hub. However, as production patterns shift and new pipelines are built to other markets, the flow dynamics—and thus the price of Kansas crude oil—continue to evolve. Keeping an eye on pipeline project announcements is a key part of fundamental analysis.

# Your Practical Checklist for Navigating Kansas Crude Prices

Use this actionable checklist to build your understanding and strategy around the Kansas crude oil market.

– Confirm you are looking at the “Kansas Common at Cushing” price assessment from a reputable source.

– Always calculate the final price using the formula: WTI Price + Kansas Differential.

– Monitor weekly EIA reports for national inventory levels, especially at the Cushing hub.

– Follow news related to pipeline operations and refinery maintenance in the Mid-Continent region.

– Understand the difference between outright price risk and basis risk before hedging.

– Compare the Kansas differential to historical ranges to gauge if the current price is strong or weak.

– Consider subscribing to a dedicated energy market report for deeper analysis and forward curves.

By methodically working through this guide and checklist, you will transform from a passive observer to an informed participant in the market for Kansas crude oil. The price of Kansas crude oil is a nuanced but essential metric, and mastering its drivers is a powerful advantage.