# The Ultimate Guide to the Pharmaceutical Value Chain: Components, Challenges, and Digital Transformation

The pharmaceutical value chain is the complete journey of a medicine, from a molecule in a lab to a pill in a patient’s hand. It is a complex, high-stakes, and heavily regulated network of activities. Understanding this chain is not just for industry insiders. Investors, policymakers, healthcare professionals, and even informed patients benefit from grasping how value is created, captured, and delivered. This guide provides a comprehensive look at the modern pharmaceutical value chain, its critical stages, persistent challenges, and the digital forces reshaping its future.

We will break down this intricate process into its core components. Following that, we will examine the major pain points and risks at each link. Finally, we will explore the technological innovations driving efficiency and transparency across the entire ecosystem.

## The Core Components of the Pharmaceutical Value Chain

The pharmaceutical value chain can be segmented into two broad phases: Research and Development (R and D) and Commercialization. Each phase contains several distinct but interconnected stages.

1. DISCOVERY AND RESEARCH: This is the genesis. Scientists conduct basic research to identify biological targets (like a protein involved in a disease) and then screen thousands to millions of compounds to find potential “hits” that interact with the target. This stage is characterized by high failure rates and long timelines, often taking 3-6 years.

2. PRECLINICAL DEVELOPMENT: Once a promising compound is identified, it undergoes rigorous laboratory and animal testing. The goals are to assess its safety, biological activity, and formulation. Data from this stage supports an application to regulatory bodies (like the FDA) to begin testing in humans.

3. CLINICAL DEVELOPMENT: This is the most costly and time-consuming part of R and D, typically lasting 6-7 years. It involves three phases of human trials:

* Phase I: Tests safety and dosage in a small group of healthy volunteers.

* Phase II: Evaluates efficacy and side effects in a larger group of patients.

* Phase III: Confirms efficacy, monitors adverse reactions, and compares the treatment to standard or placebo in a large patient population.

4. REGULATORY REVIEW AND APPROVAL: After successful Phase III trials, the company submits a massive dossier of data to health authorities. The review process, which can take 1-2 years, determines if the drug’s benefits outweigh its risks for the intended population.

5. MANUFACTURING AND PRODUCTION: Upon approval, the drug enters full-scale production. This involves active pharmaceutical ingredient (API) manufacturing, formulation into final dosage forms (tablets, injections, etc.), packaging, and rigorous quality control. The supply chain for pharmaceuticals must be exceptionally reliable and compliant with Good Manufacturing Practices (GMP).

6. MARKETING, SALES, AND DISTRIBUTION: This commercial phase involves market access strategies, pricing negotiations with payers, marketing to healthcare professionals, and establishing distribution channels to wholesalers, pharmacies, and hospitals.

7. POST-MARKETING SURVEILLANCE (PHARMACOVIGILANCE): Monitoring does not stop at approval. Companies must continuously collect and analyze data on real-world safety and effectiveness, reporting any adverse events to regulators.

## Critical Challenges and Risks in the Chain

Each stage of the pharmaceutical value chain is fraught with unique challenges that impact cost, time, and patient access.

The most glaring challenge is the astronomical cost and risk of R and D. The average cost to develop a new prescription drug and bring it to market is estimated at $2.3 billion (source: Tufts Center for the Study of Drug Development). Furthermore, over 90% of drug candidates that enter clinical trials fail. This high attrition rate forces companies to recoup costs from the few successes.

Regulatory hurdles add another layer of complexity. Navigating different requirements across global markets (FDA, EMA, etc.) is a monumental task. Even after approval, pricing and reimbursement pressures from governments and insurance payers can limit market access and profitability.

Within the supply chain, ensuring integrity is paramount. Counterfeit drugs, temperature excursions for biologics, and logistical bottlenecks pose significant risks to patient safety and product efficacy. A single quality failure can lead to massive recalls, reputational damage, and regulatory action.

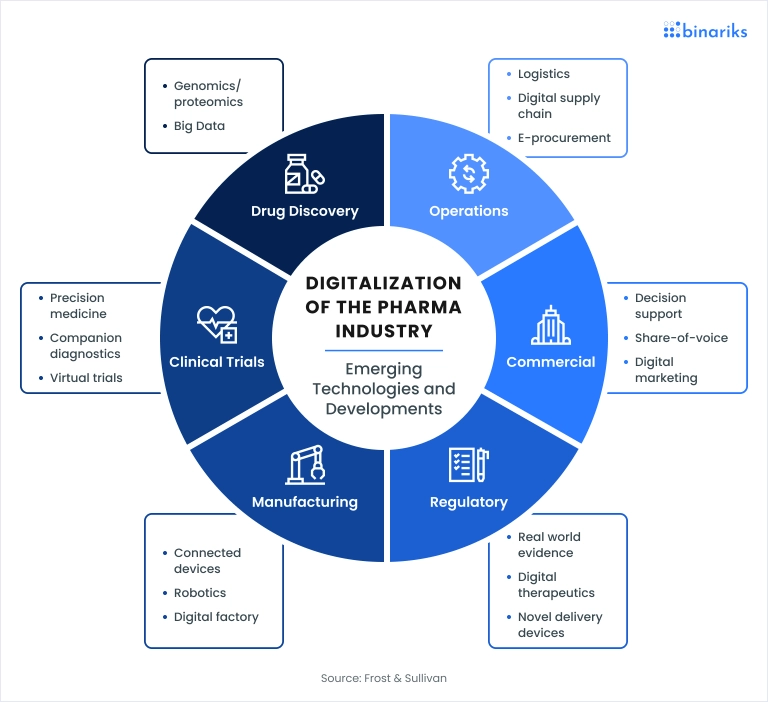

## The Digital Transformation: A New Era for the Value Chain

Technology is no longer a support function; it is fundamentally rewiring the pharmaceutical value chain. This transformation aims to enhance efficiency, collaboration, and patient-centricity.

Artificial Intelligence and Machine Learning are accelerating drug discovery by predicting molecular behavior and identifying novel drug candidates in silico, drastically reducing early-stage time and cost. In clinical trials, digital tools like Electronic Data Capture (EDC), wearable sensors, and telemedicine platforms enable decentralized trials, improving patient recruitment, retention, and data quality.

Blockchain technology promises unprecedented supply chain transparency. By creating an immutable ledger for each product batch, stakeholders can track a drug’s journey from factory to patient, instantly verifying authenticity and preventing counterfeit infiltration.

The rise of Real-World Evidence (RWE) is transforming pharmacovigilance and market access. By analyzing data from electronic health records, insurance claims, and patient registries, companies can demonstrate the real-world value of their treatments beyond controlled clinical trials.

To illustrate the shift, compare the traditional versus digitally-enabled approaches to two key stages:

| Value Chain Stage | Traditional Approach | Digitally-Enabled Approach |

|---|---|---|

| Drug Discovery | Manual lab screening of compound libraries; trial and error. | AI-driven in-silico modeling and simulation to prioritize high-probability candidates. |

| Clinical Trials | Paper-based data collection; site-centric patient visits. | Decentralized trials using eConsent, wearable devices, and direct-to-patient supply. |

| Supply Chain | Paper-based batch records; siloed tracking systems. | IoT sensors for real-time condition monitoring; blockchain for end-to-end traceability. |

| Post-Marketing | Passive adverse event reporting from healthcare providers. | Active monitoring via social listening, RWE platforms, and patient apps. |

## A 5-Step Guide to Mapping Your Company’s Value Chain

Whether you are a startup or an established player, understanding your specific position and linkages is crucial. Here is a practical guide to mapping your segment of the pharmaceutical value chain.

STEP 1: INTERNAL ACTIVITY AUDIT. List every single activity your organization performs, from early research to customer support. Be granular. Categorize them as primary (directly adding value) or support (enabling primary activities).

STEP 2: IDENTIFY EXTERNAL PARTNERS. Map out all your key external relationships. This includes API suppliers, contract research organizations (CROs), logistics providers, wholesalers, marketing agencies, and technology vendors.

STEP 3: DOCUMENT INFORMATION AND PRODUCT FLOWS. For each activity and partner connection, trace the physical flow of materials and the digital flow of data and information. Where are the handoffs? Where does data get stored or transformed?

STEP 4: ANALYZE COST DRIVERS AND VALUE CREATION. Attach major cost centers to each activity. Then, identify which activities are truly creating unique value for the end patient or customer versus those that are merely cost centers.

STEP 5: PINPOINT VULNERABILITIES AND OPPORTUNITIES. With the full map visualized, identify single points of failure, regulatory bottlenecks, data silos, and areas where technology adoption is lagging. These are your targets for improvement and innovation.

COMMON MISTAKE TO AVOID: A frequent error in value chain analysis is focusing solely on internal operations. The modern pharmaceutical value chain is an ecosystem. Your map is incomplete if it does not deeply integrate your key partners, suppliers, and even customers (payers, providers). The most significant risks and opportunities often lie at these interface points.

Based on my experience consulting for mid-sized biotechs, the most transformative insights often come from step 3 and step 5. We once mapped the data flow for safety reporting and discovered a 14-day lag between a partner CRO and the client’s pharmacovigilance team, solely due to manual data entry and email-based processes. Identifying this single bottleneck allowed for a targeted automation solution that significantly reduced compliance risk.

## The Future: Towards a Patient-Centric, Agile Ecosystem

The end goal of optimizing the pharmaceutical value chain is not just corporate profitability. It is to deliver better health outcomes faster and more efficiently to patients worldwide. The future points to a more connected, transparent, and patient-centric model. We will see a blurring of lines between traditional stages, with continuous feedback loops from real-world patient data directly informing R and D priorities. Agile manufacturing and personalized medicines will further challenge the traditional linear chain, pushing the industry towards more flexible, on-demand networks.

The companies that thrive will be those that view their value chain not as a fixed sequence, but as a dynamic, intelligent network that can learn and adapt.

CHECKLIST FOR PHARMACEUTICAL VALUE CHAIN OPTIMIZATION:

– Conduct a full internal and external activity map annually.

– Evaluate AI and data analytics tools for discovery and clinical stages.

– Assess supply chain partners for digital maturity and traceability capabilities.

– Integrate a real-world evidence strategy into post-marketing plans.

– Audit data flows to identify and eliminate manual, error-prone handoffs.

– Develop key performance indicators for each chain segment beyond cost.

– Foster a culture of cross-functional collaboration to break down internal silos.

– Engage with patients and payers early to align development with real-world needs.