# The Ultimate Guide to the Modern Shoe Supply Chain: From Design to Delivery

The journey of a single pair of shoes from a designer’s sketch to your feet is a monumental feat of global logistics and coordination. This intricate network, known as the supply chain of shoes, is a complex ballet involving dozens of companies across multiple continents. Understanding this process is not just for industry insiders. For business owners, marketers, and conscious consumers, it reveals the true cost, effort, and innovation behind every step. This guide will walk you through every stage, highlight the latest trends, and provide actionable insights for navigating this dynamic landscape.

We will break down the traditional model, explore modern disruptions, and provide a clear comparison of different supply chain strategies. By the end, you will have a comprehensive view of how the global footwear industry operates.

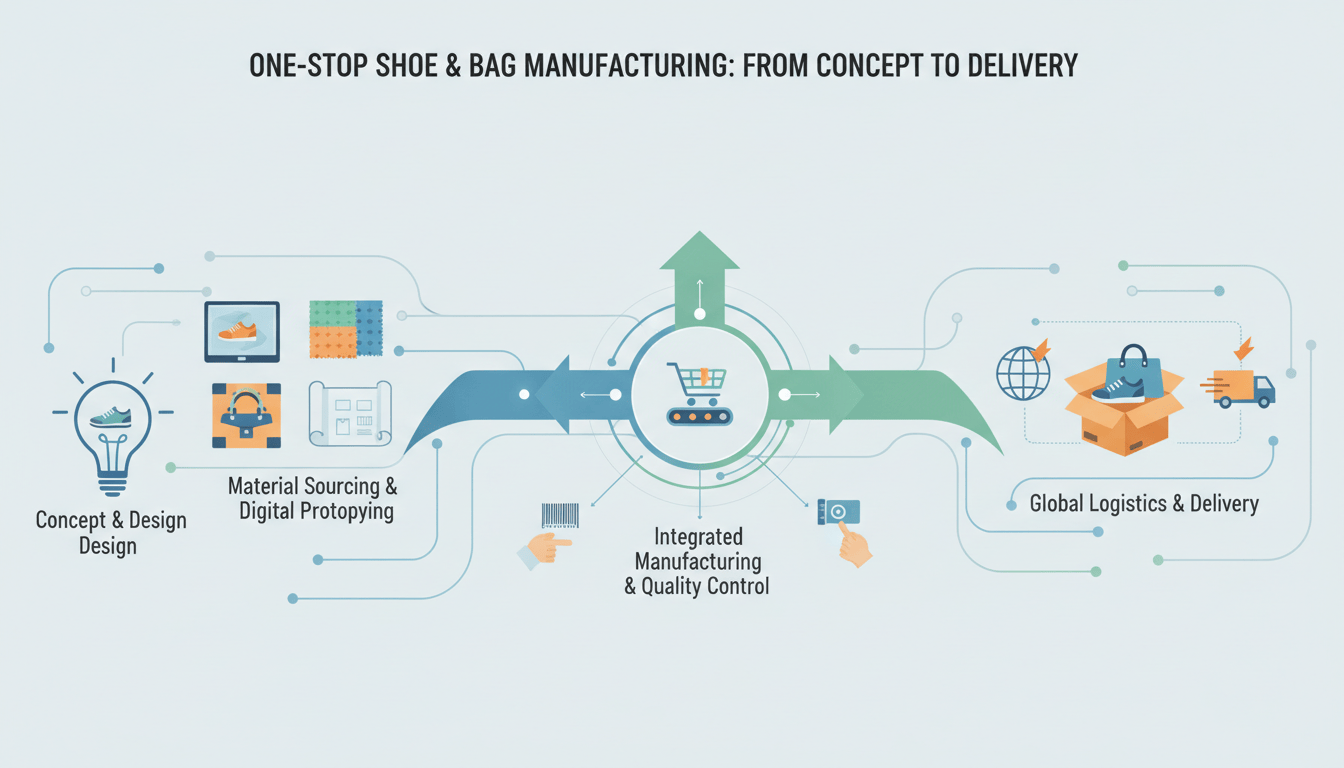

## The Five Core Stages of the Shoe Supply Chain

The traditional footwear supply chain can be visualized as a linear process with five distinct phases. Each stage depends on the successful completion of the previous one, creating a chain of events that must be meticulously managed.

1. DESIGN AND DEVELOPMENT: This is where ideas become tangible. Design teams create sketches and concepts based on market research, fashion trends, and performance needs. Once a design is approved, technical developers create detailed specifications, or “tech packs,” which include materials, colors, dimensions, and construction methods. Prototypes are then made and tested for comfort, durability, and aesthetics.

2. MATERIAL SOURCING AND PROCUREMENT: A shoe is a sum of its parts. This stage involves sourcing all necessary raw materials. This includes leather or synthetic uppers, textile linings, foam for midsoles, rubber for outsoles, laces, eyelets, adhesives, and packaging. Sourcing is global. Premium leather may come from Italy, specialized textiles from Taiwan, and rubber from Vietnam. Managing suppliers for quality, cost, and ethical compliance is a massive undertaking.

3. MANUFACTURING AND PRODUCTION: This is the transformation stage. Components are shipped to manufacturing facilities, typically located in countries with cost-competitive labor, such as China, Vietnam, Indonesia, and India. The production process involves cutting, stitching, lasting, molding, and assembly. Quality control checks are implemented at every substation to catch defects early. According to the World Footwear Yearbook, Asia accounts for over 87% of global shoe production, highlighting the region’s dominance in this phase.

4. LOGISTICS AND DISTRIBUTION: Once shoes are boxed and quality-approved, they enter the global logistics network. This involves freight forwarding, customs clearance, ocean or air transport, and warehousing. Shoes might be shipped in bulk to a central distribution center in North America or Europe before being broken down and sent to regional warehouses, retail stores, or directly to consumers. This stage is all about inventory visibility and speed.

5. RETAIL AND AFTER-SALES: The final link is getting the product to the end-user. This happens through wholesale to brick-and-mortar stores, direct-to-consumer online sales, or marketplace platforms like Amazon. The after-sales phase includes handling returns, exchanges, and customer feedback, which loops valuable information back to the design and development teams, closing the supply chain circle.

## Traditional vs. Agile vs. On-Demand: A Strategic Comparison

Not all shoe supply chains are built the same. The strategy a brand chooses impacts its cost, speed, sustainability, and customer connection. Here is a clear comparison of three dominant models.

| Aspect | Traditional (Push Model) | Agile (Hybrid Model) | On-Demand (Pull Model) |

|---|---|---|---|

| Core Philosophy | Produce in large batches based on forecasted demand. | Combine forecast with real-time data to adjust production. | Produce only after a customer order is placed. |

| Lead Time | Long (6-12 months) | Medium (3-6 months) | Short (Days to a few weeks) |

| Inventory Risk | VERY HIGH. High risk of overstock or stockouts. | MODERATE. Buffer stock is managed dynamically. | LOW. Virtually no finished goods inventory. |

| Cost Structure | Low per-unit cost, but high total cost from waste. | Balanced. Slightly higher per-unit cost than traditional. | Higher per-unit production cost. |

| Best For | Mass-market, predictable classic styles. | Fast-fashion and seasonal brands. | Customization, niche brands, and sustainability-focused companies. |

## The Digital Transformation: Technology Reshaping the Chain

Technology is no longer a support function. It is the backbone of a modern, responsive footwear supply chain. Key innovations include:

3D DESIGN AND DIGITAL SAMPLING: Brands like Adidas and Nike now use 3D software to create photorealistic shoe models. This eliminates the need for multiple physical prototypes, slashing development time and material waste. A digital sample can be shared instantly with teams across the globe for feedback.

INTERNET OF THINGS AND REAL-TIME TRACKING: Sensors in shipping containers and RFID tags on pallets provide real-time location and condition data. This means a brand can know if a shipment of leather is delayed at a port or if a warehouse’s temperature has spiked, threatening the product.

ARTIFICIAL INTELLIGENCE FOR DEMAND FORECASTING: AI algorithms analyze vast datasets from social media trends, past sales, weather patterns, and economic indicators to predict demand with far greater accuracy than humans. This helps optimize production schedules and inventory levels, reducing the bullwhip effect where small demand fluctuations amplify up the chain.

BLOCKCHAIN FOR PROVENANCE AND TRANSPARENCY: Consumers increasingly want to know the origin of their products. Blockchain creates an immutable ledger that tracks a shoe’s journey from raw material to store shelf, verifying ethical sourcing and authenticating products to combat counterfeits.

## A Five-Step Guide to Mapping Your Own Shoe Supply Chain

Whether you are auditing an existing operation or building a new brand, mapping your supply chain is the first step to optimization. Here is a practical guide.

STEP 1: IDENTIFY ALL DIRECT SUPPLIERS. List every company that provides materials or manufacturing services directly to you. This includes tanneries, component makers, and factories.

STEP 2: TRACE BACK TO TIER 2 AND 3 SUPPLIERS. For critical materials, ask your direct suppliers who *their* suppliers are. Where does the tannery get its hides? Where does the rubber supplier source its latex? This is crucial for sustainability audits.

STEP 3: DOCUMENT THE PHYSICAL FLOW. Chart the geographical journey of materials and finished goods. Note all transportation modes, hubs, and handoff points. Identify the longest lead-time legs.

STEP 4: MAP THE INFORMATION AND FINANCIAL FLOWS. How do orders, forecasts, and design specs flow from you to suppliers? How do invoices and payments move back? Identify bottlenecks in communication.

STEP 5: ANALYZE FOR RISK AND OPPORTUNITY. With the full map, pinpoint single points of failure, ethical risks, cost-intensive stages, and opportunities for consolidation or nearshoring. According to a McKinsey report, companies with high supply chain visibility can improve on-time delivery by up to 30%.

## Common Pitfalls and How to Avoid Them

WARNING: EVEN THE BEST-DESIGNED SUPPLY CHAIN CAN FAIL WITHOUT PROPER RISK MANAGEMENT. HERE ARE CRITICAL MISTAKES TO AVOID.

OVER-RELIANCE ON A SINGLE SOURCE: Relying on one factory or material supplier is a massive risk. A natural disaster, political issue, or quality failure can halt your entire operation. The solution is to develop a diversified supplier base, even if it requires slightly higher costs for resilience.

NEGLECTING SUPPLIER RELATIONSHIPS: Treating suppliers as disposable vendors leads to poor communication and low priority when capacity is tight. Building strategic, collaborative partnerships ensures better cooperation, innovation, and support during crises.

IGNORING SUSTAINABILITY AND ETHICS: Consumers and regulators are demanding transparency. Failing to ensure ethical labor practices and environmental responsibility in your supply chain can lead to devastating reputational damage and legal liability. Proactive auditing is non-negotiable.

POOR INVENTORY MANAGEMENT: This is the classic trap. Without accurate, real-time inventory data across all channels, you will inevitably face overstock and stockouts. Investing in an integrated inventory management system is essential.

In my experience consulting for footwear startups, the brands that survive and thrive are those that view their supply chain not as a cost center, but as a core strategic asset for brand building and customer satisfaction. The complexity is immense, but so is the opportunity for differentiation.

## Your Shoe Supply Chain Optimization Checklist

Use this actionable checklist to evaluate and improve your footwear supply chain operations.

– Conduct a full end-to-end supply chain mapping exercise at least once per year.

– Diversify your manufacturing base to include at least two primary geographic regions.

– Implement a digital product lifecycle management tool for design and development.

– Establish clear ethical and sustainability codes of conduct for all tier-1 suppliers.

– Invest in an integrated software platform that connects inventory, order, and supplier data.

– Develop key performance indicators for on-time delivery, defect rates, and lead times.

– Create a risk management plan that addresses geopolitical, environmental, and logistical disruptions.

– Foster open communication and collaborative planning with your top three strategic suppliers.

– Explore technologies like 3D sampling or on-demand manufacturing for specific product lines.

– Regularly collect and analyze customer feedback to inform demand forecasting and design.

The modern supply chain of shoes is a testament to human ingenuity and global collaboration. By understanding its depths, businesses can build systems that are not only efficient and profitable but also resilient, transparent, and aligned with the values of today’s conscious consumer. The next step is to take this knowledge and apply it, one strategic decision at a time.