# The Ultimate Guide to the Gartner Magic Quadrant for Supply Chain: What It Is and How to Use It

If you are researching supply chain technology, you have likely encountered the term Gartner Magic Quadrant. This single phrase carries immense weight in the business world. But what exactly is it, and more importantly, how can you use it to make a smart software decision? This guide will break down everything you need to know about the supply chain Gartner Magic Quadrant, moving beyond the hype to provide actionable insights.

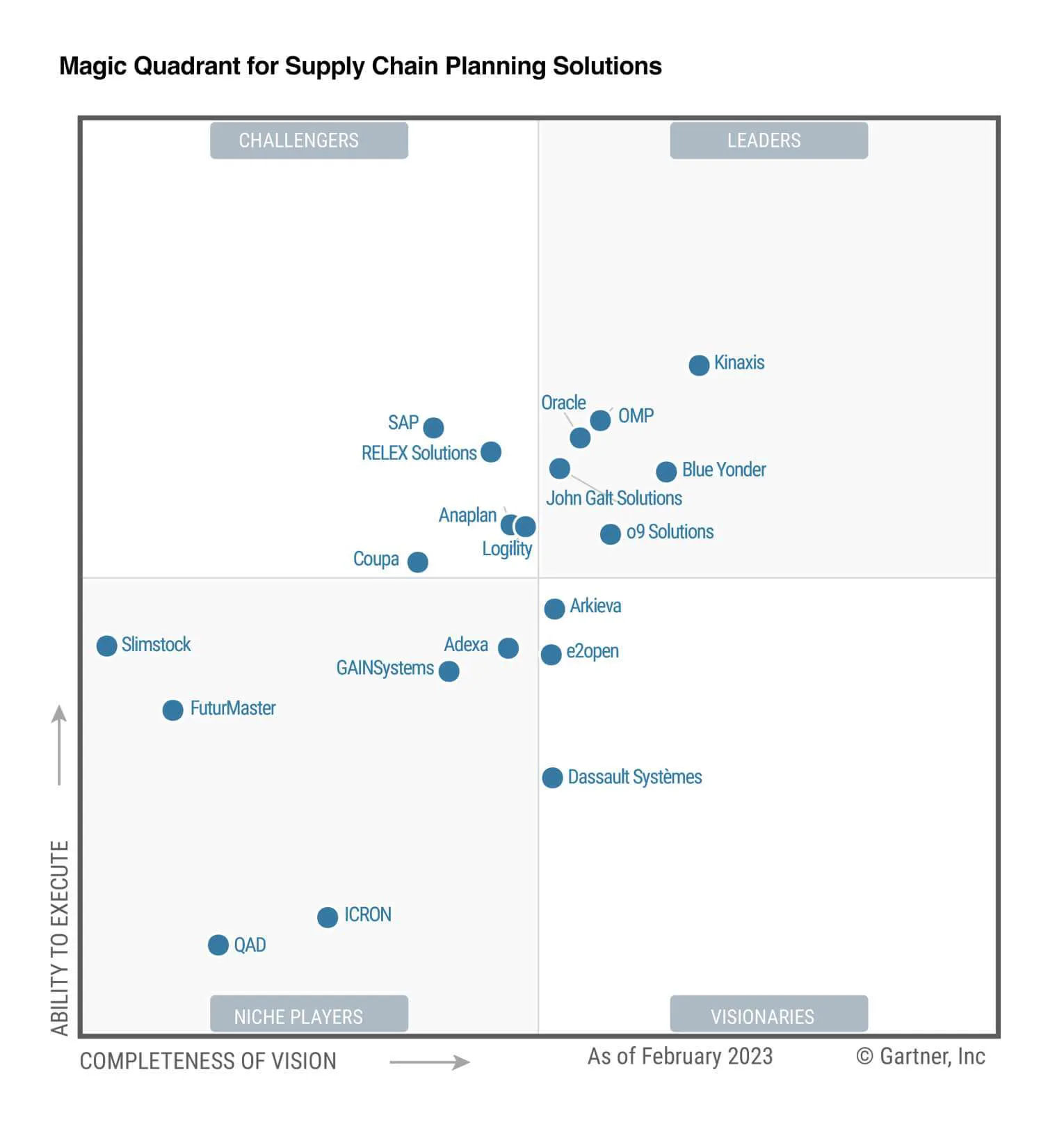

At its core, the Gartner Magic Quadrant is a research methodology and visual tool. Gartner, a leading research and advisory firm, uses it to evaluate technology providers within a specific market. The evaluation is based on two primary criteria: completeness of vision and ability to execute. Vendors are then plotted on a four-quadrant graph: Leaders, Challengers, Visionaries, and Niche Players.

For supply chain leaders, this report is often the starting point for vendor shortlisting. However, a common mistake is treating the quadrant as a simple ranking chart. The position of a vendor tells a story about their strategy and market focus. Understanding that story is key to a successful selection process.

## Understanding the Four Quadrants of the Gartner Framework

The magic quadrant graph is divided by a vertical axis (Completeness of Vision) and a horizontal axis (Ability to Execute). This creates four distinct categories.

LEADERS demonstrate both strong execution and a clear, forward-thinking vision. They have a proven track record, significant market share, and a comprehensive product suite. Choosing a Leader often represents a safe, strategic bet for large enterprises. However, their solutions can be complex and expensive.

CHALLENGERS excel in ability to execute. They have robust, reliable products and strong sales execution but may lack the innovative vision of Leaders. They are often well-established players who dominate specific regions or verticals. A Challenger could be an excellent choice if operational stability is your top priority.

VISIONARIES are strong on the completeness of vision axis. They understand market trends and innovate aggressively, often introducing disruptive technologies. Their ability to execute, however, may not yet be fully proven. Partnering with a Visionary can offer a competitive edge but may involve higher risk.

NICHE PLAYERS focus successfully on a specific segment of the market. They may have excellent functionality for a particular industry or a limited set of use cases. Their vision and execution are tailored to that niche. For organizations with very specific needs, a Niche Player can be the perfect fit, often offering better value and focus than a broad-platform Leader.

## Key Supply Chain Technology Markets Covered by Gartner

Gartner publishes several Magic Quadrants relevant to the supply chain domain. Each report focuses on a distinct software category. Recognizing which report aligns with your needs is the first critical step.

The most prominent is likely the Magic Quadrant for Supply Chain Planning Solutions. This evaluates vendors that offer tools for demand planning, inventory optimization, and sales and operations planning (S&OP). Another crucial report is the Magic Quadrant for Warehouse Management Systems (WMS), which assesses software for managing warehouse operations from receiving to shipping.

For transportation, you would look at the Magic Quadrant for Transportation Management Systems (TMS). Furthermore, Gartner covers broader enterprise suites with the Magic Quadrant for ERP. Many of these ERP vendors have strong embedded supply chain modules. According to Gartner’s own data, through 2026, 50% of all supply chain organizations will invest in applications that support artificial intelligence and advanced analytics capabilities (来源: Gartner). This trend directly influences the criteria and vendor positioning in these reports.

## A Practical Comparison: Leaders vs. Visionaries

To illustrate how quadrant positioning translates to real-world differences, lets compare typical attributes of a Leader and a Visionary in the supply chain planning space. The following table outlines key contrasts.

| Evaluation Criteria | Typical Leader Profile | Typical Visionary Profile |

|---|---|---|

| Core Strength | Market stability, global support, proven ROI | Innovative technology (e.g., AI/ML), unique algorithms |

| Product Approach | Integrated, comprehensive suite | Best-of-breed, modular, often cloud-native |

| Ideal Customer | Large, global enterprises with complex needs | Midsize to large firms seeking a specific disruptive advantage |

| Implementation & Cost | Longer timelines, higher total cost | Potentially faster deployment, variable pricing models |

| Risk Profile | Lower perceived risk | Higher risk due to less proven scale |

This comparison is not about which is better. It is about which profile aligns with your company’s appetite for innovation, risk, and investment. A Fortune 500 company might prioritize the global footprint of a Leader, while a fast-growing retailer might bet on the predictive accuracy of a Visionary.

## How to Use the Magic Quadrant Report: A 5-Step Action Plan

Simply downloading the report is not enough. You must actively use it as one tool in a broader process. Here is a step-by-step guide to leveraging the supply chain Gartner Magic Quadrant effectively.

STEP 1: IDENTIFY THE CORRECT REPORT. Ensure you are looking at the Magic Quadrant for the specific technology category you need (e.g., WMS, TMS, Planning). Do not rely on an ERP report if you need a best-of-breed WMS.

STEP 2: LOOK BEYOND THE GRAPH. The graphic is an attention-grabber, but the real value is in the 20-30 page accompanying document. Read the vendor strengths and cautions meticulously. These sections reveal critical details about product limitations, implementation challenges, and support issues.

STEP 3: CROSS-REFERENCE WITH YOUR REQUIREMENTS. Map the vendors in the Leaders, Challengers, and Visionaries quadrants against your detailed business requirements and use cases. A Niche Player in the quadrant might be the “Leader” for your specific industry need.

STEP 4: CONDUCT YOUR OWN DUE DILIGENCE. Use the report as a shortlist, not a final verdict. Schedule live demos, request proof-of-concept trials, and talk to customer references. Ask references about the implementation experience and the accuracy of the vendor’s claims.

STEP 5: NEGOTIATE WITH INSIGHT. Knowledge from the report is power during negotiations. Understanding a vendor’s market position and their stated “cautions” can provide leverage when discussing contract terms, pricing, and service level agreements.

## Common Pitfalls and What to Avoid

A major warning for all procurement teams is to avoid quadrant fixation. Do not assume that only vendors in the Leaders quadrant are worth considering. This is a critical mistake. The quadrant is a snapshot of a broad market. Your company is not the broad market. You have unique constraints, capabilities, and strategic goals.

Another frequent error is using an outdated report. Gartner updates these quadrants annually, and markets can shift rapidly. A vendor’s position can change significantly from one year to the next. Always ensure you are working with the most recent publication. Furthermore, remember that Gartner’s evaluation is just one perspective. It is an authoritative one, but it should be combined with insights from other analyst firms, user review sites, and independent consultants.

From my experience consulting with supply chain teams, the most successful selections happen when the Magic Quadrant is used as a conversation starter. It provides a common language and framework for the evaluation committee. We often use it to challenge our own assumptions. For example, if our internal bias is toward a well-known Leader, we deliberately spend extra time evaluating a high-potential Visionary to ensure we are not missing a transformative opportunity.

## The Future of Supply Chain Technology Evaluation

The supply chain technology landscape is evolving at a breathtaking pace. The criteria Gartner uses in its Magic Quadrant are also adapting. We are seeing much greater emphasis on composability, AI-driven decision-making, and sustainability capabilities. A vendor’s vision on these fronts is becoming as important as their current execution.

In fact, a 2023 survey by McKinsey found that 70% of supply chain transformations that leverage advanced analytics and AI report a significant improvement in service levels (来源: McKinsey & Company). This data point underscores why visionary vendors pushing the envelope on AI are gaining attention, even if their execution scale is still growing. The future quadrants will likely continue to reflect this tension between established scale and disruptive innovation.

Your goal should be to find a partner that not only solves today’s problems but can also adapt to tomorrow’s challenges. The supply chain Gartner Magic Quadrant is a powerful tool to begin that journey, provided you use it wisely.

IMPLEMENTATION CHECKLIST

FINALIZE YOUR BUSINESS AND TECHNICAL REQUIREMENTS BEFORE REVIEWING THE REPORT.

DOWNLOAD THE MOST RECENT GARTNER MAGIC QUADRANT FOR YOUR SPECIFIC TECHNOLOGY CATEGORY.

READ THE FULL ANALYST REPORT, FOCUSING ON STRENGTHS AND CAUTIONS FOR EACH VENDOR.

CREATE A SHORTLIST OF 3-5 VENDORS SPANNING MULTIPLE QUADRANTS BASED ON YOUR NEEDS.

SCHEDULE DETAILED DEMOS AND REQUEST ACCESS TO A TRIAL OR SANDBOX ENVIRONMENT.

CONTACT CUSTOMER REFERENCES, ESPECIALLY THOSE IN A SIMILAR INDUSTRY.

VALIDATE VENDOR CLAIMS AGAINST YOUR OWN DATA AND USE CASES.

USE INSIGHTS FROM THE REPORT TO INFORM CONTRACT AND PRICING NEGOTIATIONS.