# The Ultimate Guide to the Car Industry Value Chain: A 2024 Breakdown

Understanding the car industry value chain is not just for executives and investors. For anyone involved in automotive, from suppliers to marketers, grasping this complex web of activities is the key to spotting opportunities, managing risks, and driving innovation. This guide provides a comprehensive, expert-level breakdown of the modern automotive value chain, its critical components, and the powerful forces reshaping it today.

We will move beyond a simple definition. Instead, we will dissect each primary and support activity, examine the disruptive trends, and provide actionable insights. By the end, you will have a clear map of how value is created, captured, and transformed in one of the world’s most vital industries.

## What is the Automotive Value Chain? A Foundational Model

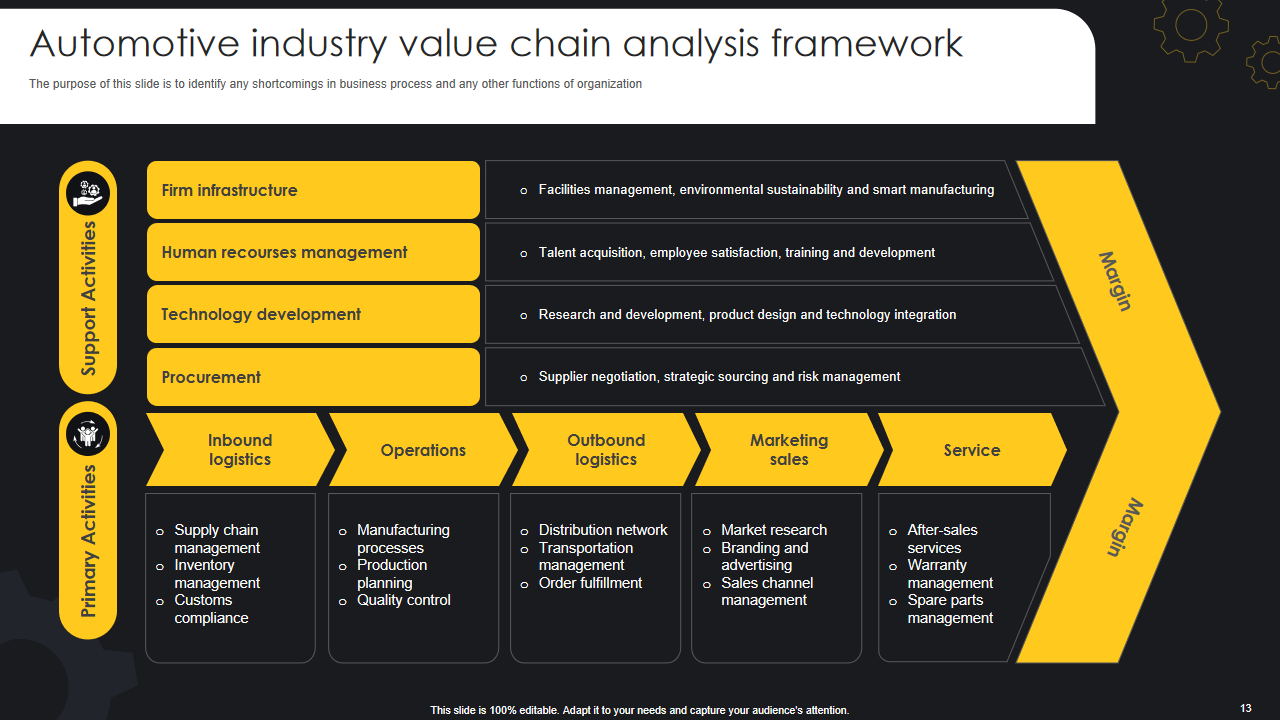

At its core, the automotive value chain is a model that describes the full range of activities required to bring a vehicle from a concept to the end customer and beyond. It is a sequence of processes where value is added at each step. The classic model, inspired by Michael Porter’s work, divides these activities into two categories: Primary Activities and Support Activities.

Primary Activities are the direct steps in creating and delivering the product. Support Activities underpin and enable the primary functions. This framework helps companies identify where they can build a competitive advantage, whether through cost leadership or differentiation. In the context of the auto industry, this chain has historically been linear and capital-intensive, but that is changing rapidly.

## Deconstructing the Primary Activities: From Raw Material to Road

The primary activities form the backbone of the automotive manufacturing process. Let us trace the journey.

INBOUND LOGISTICS: This involves sourcing, receiving, and storing the vast array of raw materials and components. Think steel, aluminum, plastics, glass, and thousands of pre-assembled parts like semiconductors, seats, and infotainment systems. Efficient inbound logistics is a massive cost and complexity center, especially with today’s globalized supply networks.

OPERATIONS: This is the heart of manufacturing—the transformation of inputs into the final product. It encompasses stamping, welding, painting, and final assembly. Automotive assembly plants are marvels of precision and efficiency, often utilizing advanced robotics and just-in-time production systems to minimize waste and inventory costs.

OUTBOUND LOGISTICS: Once the car is built, it must be distributed. This activity covers everything from managing finished vehicle inventory to transportation via car carriers, trains, and ships to dealership networks around the world. This step is crucial for getting the right vehicle to the right market at the right time.

MARKETING AND SALES: This is where brand building, advertising, promotions, and the dealership sales process come into play. The goal is to generate demand and facilitate the purchase. The traditional dealership model is under significant pressure from direct-to-consumer sales approaches pioneered by companies like Tesla.

SERVICE: The value chain does not end at the sale. After-sales service includes maintenance, repairs, warranty work, and the supply of spare parts. This segment is a high-margin revenue stream and a critical touchpoint for customer loyalty and brand perception.

## The Critical Role of Support Activities

These functions may not be directly visible in the final car, but they are essential for the primary activities to function effectively.

FIRM INFRASTRUCTURE: This includes overall management, planning, finance, accounting, and quality control systems. It is the organizational backbone.

HUMAN RESOURCE MANAGEMENT: Recruiting, training, and retaining skilled talent for engineering, design, manufacturing, and sales is more critical than ever as the industry shifts towards software and electrification.

TECHNOLOGY DEVELOPMENT: This is arguably the most dynamic support activity today. It spans R&D for vehicle platforms, powertrains (especially electric motors and batteries), autonomous driving software, and connected car technologies. Annual global automotive R&D spending is immense, exceeding $125 billion according to a report by Strategy&. This investment is fueling the industry’s transformation.

PROCUREMENT: The process of sourcing the materials, components, and services needed for production. Strategic procurement is vital for managing costs, ensuring quality, and securing supply for critical items like lithium for batteries.

## The Digital Disruption: How Technology is Reshaping the Chain

The traditional, linear car industry value chain is being bent, broken, and rebuilt by technological forces. This digital transformation is creating new value pools and eroding old ones.

ELECTRIFICATION is redefining the core of the vehicle. The internal combustion engine and its complex transmission system are being replaced by batteries, electric motors, and power electronics. This shifts value from mechanical expertise to electrochemical and software expertise. The battery itself can represent up to 40% of a vehicle’s total cost, making battery supply chain management a top strategic priority.

CONNECTIVITY AND AUTONOMOUS DRIVING are turning cars into data centers on wheels. This introduces entirely new layers to the value chain: software development, data management, cloud services, and AI/ML model training. The value is migrating from hardware to software and services.

NEW BUSINESS MODELS like Mobility-as-a-Service (MaaS), subscription plans, and over-the-air feature upgrades are changing how value is captured. The relationship is shifting from a one-time transaction to a continuous service relationship with the customer over the vehicle’s lifetime.

## A Comparative Analysis: Traditional vs. Electric Vehicle (EV) Value Chain

To visualize the shift, let us compare the focal points of a traditional automotive value chain versus a modern electric vehicle-centric one.

| Value Chain Stage | Traditional Automotive Focus | Electric Vehicle (EV) Focus |

|---|---|---|

| Core Powertrain | Internal Combustion Engine (ICE), Transmission, Exhaust Systems | Battery Pack, Electric Motor, Power Electronics, Thermal Management |

| Key Suppliers | Mechanical component specialists, tier-1 integrators | Battery cell manufacturers, semiconductor firms, software companies |

| R&D Priority | Engine efficiency, emissions control, drivetrain refinement | Battery energy density, charging speed, autonomous software, vehicle OS |

| After-Sales/Service | Fluid changes, mechanical repairs, exhaust system maintenance | Battery health monitoring, software updates, high-voltage system service |

| Revenue Model | Primarily vehicle sales, financed purchases, parts & service | Vehicle sales + potential software subscriptions, energy services, data monetization |

## A 5-Step Guide to Analyzing Your Position in the Automotive Value Chain

Whether you are a startup, a supplier, or a professional, you can use this framework to assess your strategic position.

STEP 1: MAP YOUR ACTIVITIES. Clearly identify which primary and support activities your company or role directly contributes to. Are you in inbound logistics for semiconductors? Are you in technology development for ADAS software?

STEP 2: IDENTIFY YOUR DIRECT LINKS. Determine who your immediate upstream suppliers and downstream customers are. Understand their needs, pressures, and alternatives.

STEP 3: ASSESS VALUE CAPTURE. Analyze the profit margins and competitive intensity at your specific link in the chain. Is value being commoditized, or is there room for differentiation?

STEP 4: SCAN FOR DISRUPTION. Evaluate how trends like electrification, autonomy, and connectivity could erode your current link or create a new, valuable link nearby. For example, will your mechanical component be replaced by a software function?

STEP 5: FORMULATE A STRATEGY. Based on your analysis, decide on a path: Fortify your position in your current link through cost or quality leadership, or pivot to invest in an emerging, high-value link in the transforming chain.

## Common Pitfalls and Strategic Warnings

A critical mistake is viewing the automotive value chain as a static model. It is a living system in flux. Another major error is focusing solely on internal optimization without considering the structural shifts happening upstream and downstream. For instance, a brilliant manufacturing process becomes irrelevant if the core technology it assembles is phased out.

From my experience consulting with automotive suppliers, I have seen many companies excel at operational efficiency but fail to allocate sufficient resources to strategic foresight. They optimize for the present chain while the ground is shifting beneath them. The most resilient players are those building dual competencies—mastering today’s mechanical world while aggressively learning the digital and electric world.

## The Future Horizon: What Comes Next?

The end-state of this transformation is not yet clear, but the direction is. The car industry value chain is evolving into a more circular, software-defined, and service-oriented ecosystem. Concepts like the circular economy will push for greater reuse and recycling of materials, especially batteries. The vehicle platform may become standardized, with value concentrated in the software stack and user experience. Furthermore, as vehicles generate exabytes of data, new players from the tech sector will claim significant portions of value.

According to a McKinsey & Company analysis, shared mobility and data-driven services could create a market worth over $1.5 trillion by 2030. This represents value that is largely additive or shifted from traditional areas, fundamentally altering the profit pools across the entire automotive value chain.

## Your Actionable Checklist for the Modern Automotive Landscape

To navigate this complex environment, keep this checklist in mind:

EVALUATE the impact of electrification on your product, service, or skillset today.

INVESTIGATE how software and data are creating new opportunities in your segment of the chain.

ANALYZE your dependencies on single points of failure in the global supply chain.

NETWORK with professionals and companies not just in traditional auto, but in tech, energy, and telecommunications.

LEARN continuously about battery technology, connectivity protocols, and autonomous vehicle sensor suites.

PLAN for multiple future scenarios, not just a linear extension of the past.

The automotive industry is undergoing its most significant transformation in a century. By deeply understanding the evolving car industry value chain, you position yourself not as a spectator, but as an active participant in shaping the future of mobility.