# The Ultimate Guide to SFL Dividend History: Analysis, Payouts, and Future Outlook

Understanding a company’s dividend history is a cornerstone of income investing. For those interested in the shipping sector, SFL Corporation Ltd. stands out as a notable player with a long track record of returning capital to shareholders. This deep dive into SFL dividend history will provide you with everything you need to know: from past payouts and yield calculations to the factors that influence its distributions and what the future may hold. Whether you are a current shareholder or conducting research, this guide offers a comprehensive analysis.

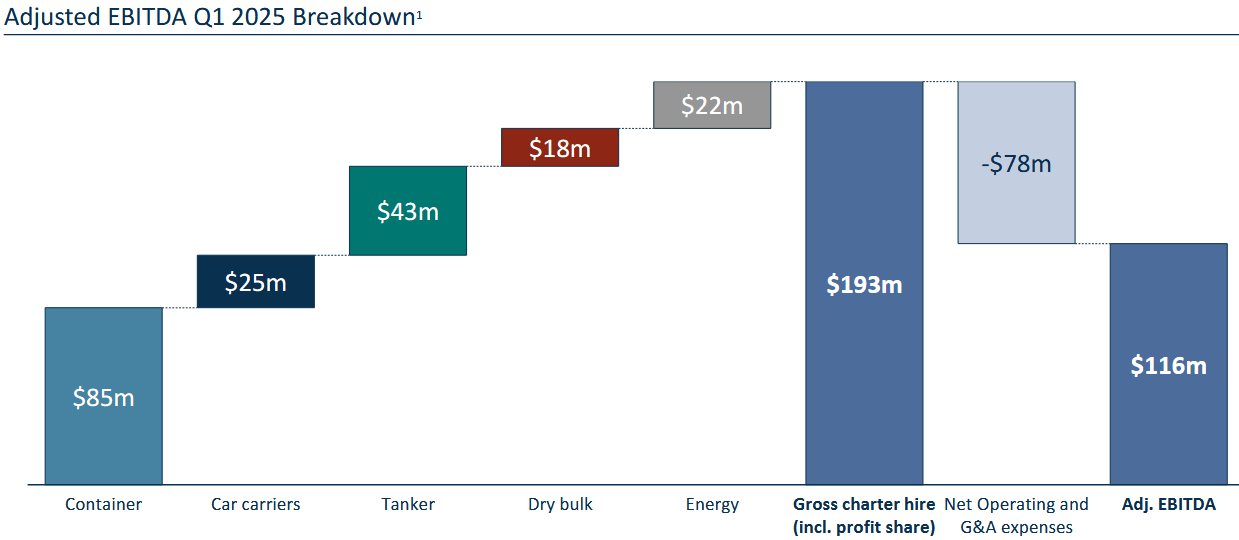

SFL, or Ship Finance International Limited, is a major ship owning and chartering company. Its business model involves owning vessels and long-term chartering them out to reputable operators. This structure is designed to generate stable, predictable cash flows, which in turn supports its dividend payments. The SFL dividend history is therefore a direct reflection of its operational performance and charter market health.

SEARCH INTENT AND KEY QUESTIONS

The search for “sfl dividend history” typically comes from an investor with an informational and analytical intent. This person is likely evaluating SFL as a potential income investment. They are not just looking for a list of dates and amounts. They want context. Key questions include: How reliable have the dividends been? What is the current yield? How does the payout relate to earnings? Are the dividends sustainable? What are the risks? This guide is structured to answer all these questions and more.

RELEVANT LSI KEYWORDS

To fully cover the topic, we will integrate related terms throughout this analysis. These include SFL dividend yield, SFL stock dividend, SFL dividend dates, SFL dividend 2024, and shipping company dividends. Understanding these terms in relation to the core SFL dividend history provides a complete picture.

# A Decade-Plus Look at SFL Dividend Payouts

SFL has built a reputation for consistent shareholder returns. The company initiated its dividend policy in 2004 and maintained quarterly payments for many years. A review of the SFL dividend history reveals a story of adaptation. During strong market periods, payouts were robust. However, the cyclical nature of shipping has led to adjustments.

For instance, following the global financial crisis and during severe industry downturns, SFL reduced its quarterly dividend to preserve capital. This is a critical point for investors: SFL’s management has prioritized the balance sheet during tough times, which is a prudent long-term strategy but impacts immediate income. In recent years, as the company secured long-term charters for its diversified fleet (including container ships, tankers, and offshore assets), dividend stability improved.

The most telling data comes from the dividend per share figures. According to financial data platforms, SFL’s annual dividend payout fluctuated between approximately $0.40 and $1.50 per share over the past decade. The current run-rate, as of mid-2024, sits at an indicated annual dividend of $1.00 per share, paid quarterly. It is essential to verify the latest declarations directly from SFL’s investor relations website for the most current information.

# How SFL’s Dividend Yield Compares to Peers

The dividend yield is a key metric for income investors. It is calculated by dividing the annual dividend per share by the current stock price. Because the stock price moves, the yield is dynamic. Based on a recent stock price and the indicated annual dividend, SFL’s yield has often been attractive relative to the broader market and even within its sector.

However, a high yield can sometimes signal market skepticism about sustainability. That is why analyzing the SFL dividend history and its coverage ratio is more important than looking at yield alone. Let us compare SFL’s dividend profile with two other shipping companies known for dividends: Frontline plc and Danaos Corporation.

COMPARISON OF SHIPPING COMPANY DIVIDENDS

| Company | Ticker | Recent Indicated Annual Dividend | Dividend Policy Focus | Primary Fleet Focus |

|---|---|---|---|---|

| SFL Corporation Ltd. | SFL | $1.00 | Stable payout from long-term charters | Diversified (Containers, Tankers, Offshore) |

| Frontline plc | FRO | Variable (linked to quarterly cash flow) | Variable payout, high in strong markets | Crude Oil Tankers |

| Danaos Corporation | DAC | $3.00 (plus special dividends) | Progressive with strong coverage | Container Ships |

This table highlights a crucial distinction. SFL’s approach, backed by its SFL dividend history, emphasizes predictability through long-term contracts. Frontline offers potentially higher but more volatile payouts tied to spot market rates. Danaos has recently provided very high yields supported by exceptional container market conditions. The “best” choice depends entirely on an investor’s risk tolerance and desire for income stability versus variable high yield.

# A Step-by-Step Guide to Analyzing SFL Dividend Sustainability

You cannot rely on past SFL dividend history alone to judge the future. Assessing sustainability is paramount. Here is a practical, five-step guide any investor can follow.

STEP 1: EXAMINE THE COVERAGE RATIO

Find the company’s quarterly earnings report. Look for “Adjusted Operating Cash Flow” or “Distributable Cash Flow.” Divide this number by the total dividend payout for the period. A ratio consistently above 1.0 (or 100%) indicates the dividend is well-covered by cash generation. SFL typically targets a coverage ratio that provides a comfortable buffer.

STEP 2: REVIEW DEBT AND BALANCE SHEET HEALTH

A strong balance sheet supports dividends during lean times. Check the net debt to equity ratio and liquidity position. High leverage can force a dividend cut if cash flow dips. SFL has historically managed its debt profile actively, often refinancing to extend maturities and reduce cost.

STEP 3: ANALYZE THE CHARTER BACKLOG

This is unique to shipping. SFL’s revenue visibility comes from its charter backlog. Access the latest presentation on its investor site. A long backlog with creditworthy counterparties provides confidence in future cash flows to pay dividends. The weighted average remaining charter term is a key metric to note.

STEP 4: UNDERSTAND THE MARKET CYCLES

Shipping is cyclical. Container shipping, tanker rates, and offshore drilling markets all move in cycles. Research the current state of the markets SFL is exposed to. Strong markets support charter renewals at higher rates, while weak markets pressure earnings. A report by Clarksons Research in 2023 noted that container ship charter rates had corrected from historic highs but remained above pre-pandemic levels, a relevant data point for part of SFL’s fleet.

STEP 5: LISTEN TO MANAGEMENT GUIDANCE

Finally, read the commentary in earnings releases and listen to conference calls. Management will often discuss the dividend policy outlook, capital allocation priorities, and any potential risks on the horizon. Their tone and clarity are qualitative but essential data points.

COMMON MISCONCEPTION WARNING

A HIGH YIELD IS NOT ALWAYS A GOOD YIELD. Many investors chase the highest-yielding stocks without understanding the underlying business. A yield that seems too good to be true often is. It can be a sign of a looming cut, a declining business, or a stock price that has crashed due to fundamental problems. Always prioritize dividend safety and sustainability over headline yield numbers. The SFL dividend history shows periods of reduction when market conditions warranted it a prudent move for the company’s long-term health.

# The Critical Factors Influencing Future SFL Dividends

Based on my experience analyzing maritime stocks, SFL’s future dividend payments hinge on a few interconnected factors. First, the successful re-chartering of vessels as existing contracts expire. The rates achieved on these new charters will directly impact cash flow. Second, the overall health of global trade and energy transportation demand. Economic slowdowns can reduce shipping volumes and pressure rates.

Third, and crucially, is interest expense. SFL, like all leveraged companies, is sensitive to interest rates. Rising rates increase financing costs, which can eat into distributable cash flow. The company’s ability to manage and hedge its interest rate exposure is a key skill. Fourth, unforeseen events like geopolitical disruptions or environmental regulations can create both risks and opportunities for vessel owners.

We have seen how SFL’s management navigated the pandemic volatility, demonstrating a focus on liquidity. This historical behavior is a useful, though not guaranteed, indicator of future actions. The company’s stated strategy is to grow the dividend progressively as its earnings base expands from new investments, suggesting a forward-looking optimism anchored in its chartering model.

# Final Checklist for Investors Researching SFL Dividend History

Before making any investment decision based on the SFL dividend history, use this actionable checklist. Do not proceed unless you have completed these steps.

VERIFY THE MOST RECENT DIVIDEND DECLARATION AND EX-DATE ON SFL’S OFFICIAL INVESTOR RELATIONS WEBSITE.

CALCULATE THE CURRENT DIVIDEND YIELD USING THE LATEST STOCK PRICE AND ANNUALIZED DIVIDEND.

READ THE LAST TWO QUARTERLY EARNINGS REPORTS, FOCUSING ON DISTRIBUTABLE CASH FLOW AND COVERAGE RATIO.

REVIEW THE COMPANY’S PRESENTATION TO UNDERSTAND THE CHARTER BACKLOG AND FLEET EXPOSURE.

ASSESS PERSONAL INVESTMENT GOALS TO DETERMINE IF SFL’S INCOME PROFILE AND ASSOCIATED RISKS ALIGN WITH THEM.

In conclusion, the SFL dividend history tells a story of resilience and adaptation in a cyclical industry. While not as steady as a utility, SFL has provided a meaningful income stream for shareholders over the long term, supported by a unique business model. By thoroughly analyzing its cash flow coverage, balance sheet, and market outlook, investors can make an informed judgment on whether SFL’s dividend fits their portfolio. Remember, past performance is a guide, not a guarantee. Diligent, ongoing research is the price of admission for successful income investing.