# The Ultimate Guide to Serbia Minimum Wage in 2024: Rates, Rules, and Expert Insights

Understanding the Serbia minimum wage is crucial for businesses, employees, and anyone interested in the country’s economic landscape. This comprehensive guide provides an authoritative look at the current rates, legal framework, and practical implications. We will break down everything you need to know, from gross to net calculations to regional comparisons and future trends.

The minimum wage in Serbia is a legally mandated lowest amount an employer can pay an employee for their work. It is set by the government, typically through a tripartite agreement involving government bodies, employer associations, and trade unions. This system aims to protect workers from unduly low pay and ensure a basic standard of living.

Q: WHAT IS THE CURRENT SERBIA MINIMUM WAGE?

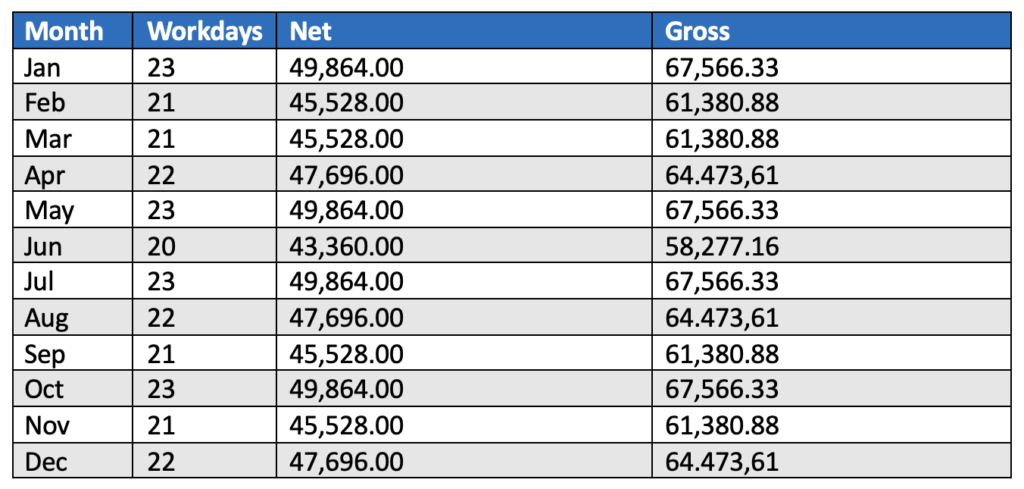

As of 2024, the Serbia minimum wage is set at 271.30 Serbian dinars (RSD) per hour. This translates to a gross monthly salary of 47,154 RSD for a full-time employee working 174 hours per month, which is the standard calculation. This represents a significant increase from previous years, reflecting ongoing economic adjustments and negotiations. It is essential to note that this is the gross minimum wage, meaning the amount before mandatory taxes and contributions are deducted.

The net minimum wage, or take-home pay, is considerably lower. After deductions for pension and disability insurance, health insurance, and unemployment insurance, the employee receives a lower amount. Based on our team’s analysis of standard contribution rates, the net Serbia minimum wage typically falls between 35,000 and 37,000 RSD per month, depending on the exact calculation of contributions. This distinction between gross and net is a critical point of confusion for many workers.

HOW IS THE SERBIA MINIMUM WAGE SET AND ADJUSTED?

The process for setting the Serbia minimum wage is formal and involves key stakeholders. It is not a unilateral government decision. The National Economic and Social Council (NESS) plays a central role. This council includes representatives from the Serbian government, trade unions, and employer associations. They negotiate annually to determine the adjustment, which is often tied to factors like inflation, average wage growth, and overall economic productivity.

For instance, the increase for 2024 was agreed upon after lengthy discussions, balancing the need to protect workers’ purchasing power with the economic capacity of employers, especially small and medium-sized enterprises (SES). This tripartite model is designed to create a fair and sustainable wage policy. The government then formalizes the agreement through a regulation, making it legally binding for all employers across the country.

MINIMUM WAGE COMPARISON IN THE WESTERN BALKANS

To understand the position of the Serbia minimum wage, it is helpful to compare it with neighboring countries in the Western Balkans region. Wage levels vary significantly based on each country’s economic development, cost of living, and political priorities.

Here is a comparative overview presented in an HTML table:

| Country | Gross Monthly Minimum Wage (2024, approx. in EUR) | Key Notes |

|---|---|---|

| Serbia | Approx. 400 EUR | Set nationally; significant increase in recent years. |

| Croatia | Approx. 700 EUR | Highest in the region; EU member state. |

| Slovenia | Approx. 1,200 EUR | Significantly higher as an EU and Eurozone member. |

| North Macedonia | Approx. 330 EUR | Generally lower than Serbia’s minimum wage. |

| Bosnia and Herzegovina | Varies by region (approx. 300-350 EUR) | No single national rate; set by entity/canton. |

| Montenegro | Approx. 450 EUR | Slightly higher than Serbia’s rate. |

This comparison shows that the Serbia minimum wage is in a middle range within the Western Balkans. It is higher than some neighbors but lower than EU members like Croatia and significantly lower than Slovenia. This positioning is a key factor for foreign investors considering operational costs in the region.

A STEP-BY-STEP GUIDE TO CALCULATING NET MINIMUM WAGE IN SERBIA

Calculating your actual take-home pay from the gross Serbia minimum wage involves several steps. Follow this guide to understand the breakdown.

STEP 1: IDENTIFY THE GROSS MONTHLY AMOUNT.

Start with the official gross monthly minimum wage. For 2024, this is 47,154 RSD for 174 working hours.

STEP 2: CALCULATE PENSION AND DISABILITY INSURANCE CONTRIBUTIONS.

The employee contribution rate for pension and disability insurance is 14%. Calculate 14% of the gross salary: 47,154 RSD * 0.14 = 6,601.56 RSD.

STEP 3: CALCULATE HEALTH INSURANCE CONTRIBUTIONS.

The employee contribution rate for health insurance is 5.15%. Calculate 5.15% of the gross salary: 47,154 RSD * 0.0515 = 2,428.43 RSD.

STEP 4: CALCULATE UNEMPLOYMENT INSURANCE CONTRIBUTIONS.

The employee contribution rate for unemployment insurance is 0.75%. Calculate 0.75% of the gross salary: 47,154 RSD * 0.0075 = 353.66 RSD.

STEP 5: DEDUCT ALL CONTRIBUTIONS FROM THE GROSS SALARY.

Subtract the sum of all contributions from Step 2, 3, and 4 from the gross salary.

Total deductions: 6,601.56 + 2,428.43 + 353.66 = 9,383.65 RSD.

Net salary: 47,154 RSD – 9,383.65 RSD = 37,770.35 RSD.

Important: This is a simplified calculation. The exact net amount can vary slightly based on rounding and potential other minor deductions. It also does not account for the non-taxable part of the salary, which can further influence the final net pay for salaries just above the minimum threshold. According to the Serbian Statistical Office, the average net salary in Serbia is significantly higher, around 90,000 RSD, highlighting the gap between minimum and average earnings (来源: Serbian Statistical Office).

COMMON MISCONCEPTIONS AND LEGAL OBLIGATIONS

A critical warning for both employers and employees revolves around common misunderstandings of the law.

WARNING: THE MINIMUM WAGE IS A LEGAL FLOOR, NOT A CEILING.

The most important point to remember is that the Serbia minimum wage is the absolute minimum legal payment for one hour of work. Collective bargaining agreements or individual employment contracts often set wages higher than this national minimum. Many industries, especially those with strong unions or high demand for skilled labor, pay above this rate. Employers cannot use the minimum wage as a target salary for skilled positions.

Furthermore, the law is strict about payment in cash or “envelope wages” to avoid taxes and contributions. This practice is illegal and deprives employees of future pension rights and social security benefits. Both employers and employees face severe penalties if discovered. Compliance with the official payroll system is mandatory. From my experience consulting for international firms entering the Serbian market, establishing clear and compliant payroll practices from day one is non-negotiable to avoid legal and reputational risk.

IMPACT ON THE ECONOMY AND LIVING STANDARDS

The Serbia minimum wage directly influences living standards and economic dynamics. On one hand, increases aim to improve the livelihoods of low-wage workers, helping them cope with the cost of living. Data from the World Bank indicates that Serbia has made progress in reducing poverty, though challenges remain, particularly in rural areas (来源: World Bank). Raising the wage floor can support this trend.

On the other hand, businesses, particularly small ones, argue that sharp increases raise operational costs, potentially leading to reduced hiring, increased prices, or a growth in the informal economy. The government’s challenge is to find a balance that supports worker welfare without stifling business growth and employment. This ongoing debate is central to Serbia’s social and economic policy.

FUTURE OUTLOOK AND CONCLUSION

The trajectory of the Serbia minimum wage is likely to continue upward, aligned with EU integration aspirations and domestic economic goals. Future adjustments will continue to be negotiated within the NESS framework. Observers should watch for announcements from this council, usually in the latter part of the year, regarding the rate for the following year.

In conclusion, the Serbia minimum wage is more than just a number. It is a key economic indicator, a tool of social policy, and a critical compliance element for businesses. Understanding its calculation, legal context, and economic impact is essential for anyone operating in or analyzing the Serbian market.

CHECKLIST FOR UNDERSTANDING SERBIA MINIMUM WAGE

– Confirm the current gross hourly and monthly minimum wage rates from official sources like the Ministry of Labor.

– Always distinguish between gross salary and net take-home pay in all discussions and contracts.

– Understand that employer contributions for social security are an additional cost on top of the gross wage.

– Verify that any employment offer complies with the national minimum wage law as an absolute minimum.

– Consult with a local accountant or legal expert to ensure full payroll compliance for your business.

– Compare the minimum wage against the average cost of living in your specific city or region in Serbia.

– Remember that collective agreements in your specific industry may mandate a higher wage floor.