# The Ultimate Guide to Reading and Analyzing a Chrysler Stock Graph for Smart Investors

A Chrysler stock graph is more than just a line on a chart. It is a visual story of a company’s past, a snapshot of its present, and a puzzle piece for forecasting its future. For investors and market watchers, understanding how to interpret this graph is a fundamental skill. This guide will move beyond the basics, providing you with a deep, actionable framework for analyzing the Chrysler stock chart. We will explore its historical context, teach you to identify key patterns, and show you how to integrate this technical view with fundamental realities.

The journey of Chrysler as a publicly traded entity is unique. Today, the company is part of Stellantis N.V., a global automotive giant formed from the merger of Fiat Chrysler Automobiles and PSA Group. Therefore, when you look for a Chrysler stock graph, you are typically analyzing the historical performance of Fiat Chrysler Automobiles (FCAU) or the current trajectory of Stellantis (STLA). This context is critical for accurate analysis.

KEY QUESTION: WHAT DOES A STOCK GRAPH REALLY TELL YOU?

A stock price chart visualizes market sentiment. It aggregates the collective actions, fears, and expectations of every buyer and seller. For Chrysler, now Stellantis, this sentiment is influenced by auto sales figures, electric vehicle strategy, supply chain news, and broader economic cycles. The graph does not predict the future in isolation, but it provides the technical framework upon which probabilities can be assessed.

# Essential Components of a Chrysler Stock Chart

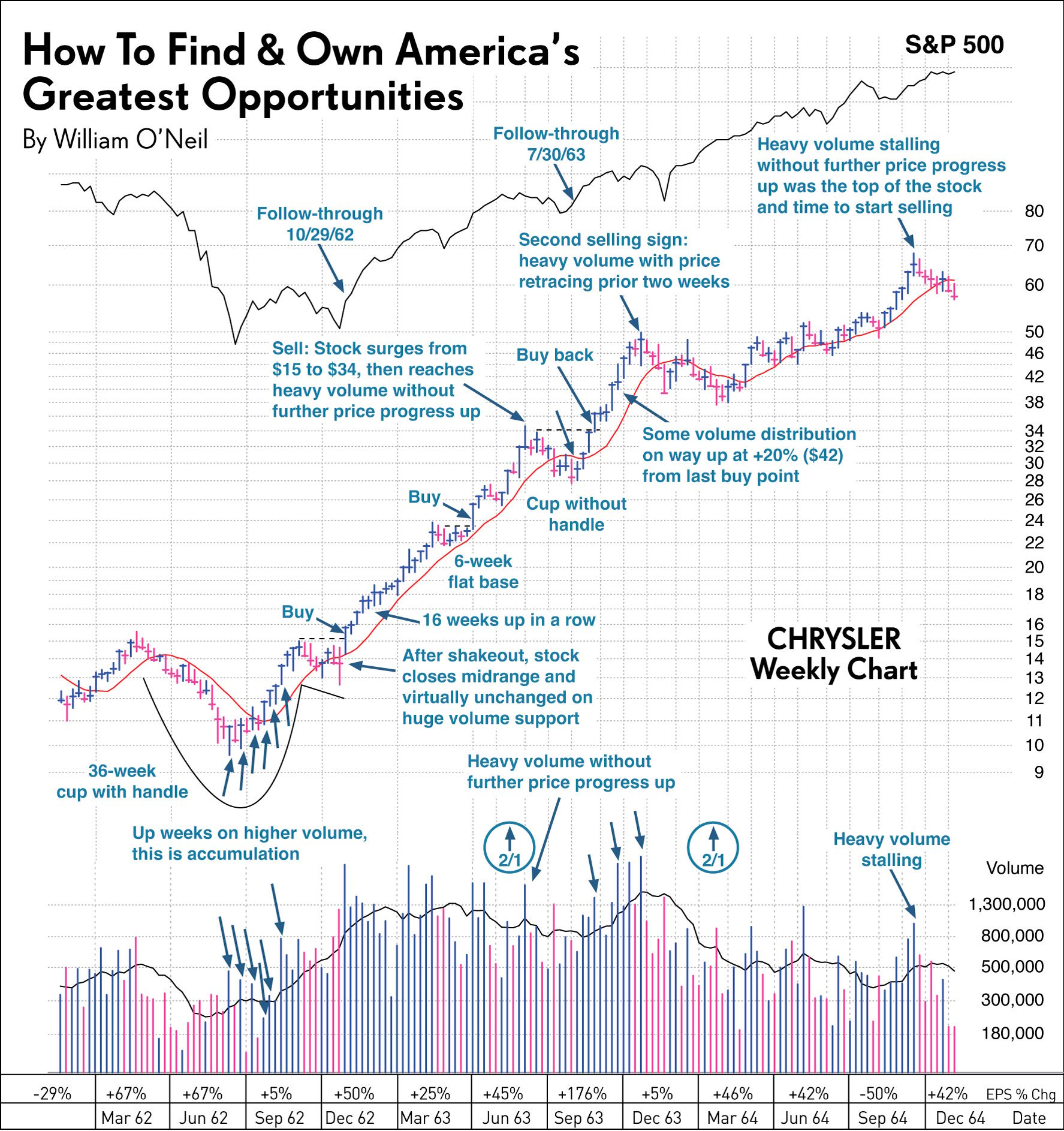

To analyze effectively, you must understand the tools. A basic line graph shows only the closing price over time. For serious analysis, you need a candlestick chart. Each candlestick shows the open, high, low, and close for a specific period a day, a week, or a month. The body of the candle is colored; typically, a green or white candle means the price closed higher than it opened (bullish), while a red or black candle indicates a lower close (bearish).

The next layer involves moving averages. These lines smooth out price data to reveal the underlying trend. The 50-day and 200-day simple moving averages are the most watched. When the 50-day crosses above the 200-day, it is called a Golden Cross, a potential bullish signal. The opposite is a Death Cross. For Stellantis stock, watching these averages on a weekly chart can filter out market noise.

Volume is the third critical component. It is the number of shares traded during a given period. A price move with high volume is considered more significant and sustainable than one with low volume. For instance, if STLA stock breaks above a key resistance level on unusually high volume, it confirms strong buyer interest.

# Historical Performance and Key Events on the Chart

A long-term Chrysler stock graph is a history book. You can see major events etched into the price action. The financial crisis of 2008-2009 is a dramatic example, where Chrysler faced bankruptcy. The stock of the former DaimlerChrysler and later Chrysler LLC became virtually worthless for common shareholders before the company’s restructuring.

Fast forward to the 2010s, after the alliance with Fiat. The Fiat Chrysler Automobiles stock chart shows a period of recovery and growth, driven by the success of brands like Jeep and RAM. A major spike can often be correlated with strong quarterly earnings reports or the announcement of strategic plans. For example, in mid-2021, Stellantis shares rose following ambitious electric vehicle investment plans outlined by CEO Carlos Tavares. According to a 2023 report by Reuters, Stellantis aimed to have over 75 all-electric models globally by 2030, a fundamental shift that long-term charts will reflect (source: Reuters).

Another crucial event is the Stellantis merger itself, completed in January 2021. On a chart, such mergers can create gaps where the price jumps from one level to another without trading in between, as the new entity begins trading.

# Technical Analysis: Identifying Patterns and Trends

This is where you become an active chart reader. Technical analysis assumes that history tends to repeat itself in terms of market psychology. Here are key patterns to look for on a Chrysler/Stellantis stock graph:

SUPPORT AND RESISTANCE: These are horizontal lines where the price has repeatedly reversed. Support is a floor where buying interest emerges. Resistance is a ceiling where selling pressure increases. Identifying these levels on the STLA chart helps define risk and reward.

TREND LINES: Drawing a line connecting successive higher lows defines an uptrend. A line connecting lower highs defines a downtrend. The slope and duration of the trend line offer clues about the trend’s strength.

COMMON CHART PATTERNS:

Head and Shoulders: A reversal pattern that often signals the end of an uptrend.

Cup and Handle: A continuation pattern that suggests a pause before the prior uptrend resumes.

Double Top/Bottom: Reversal patterns indicating a struggle to break through a key level.

Remember, no pattern is infallible. They are tools for assessing probabilities, not certainties.

# Fundamental Analysis: The Story Behind the Lines

A graph without context is dangerous. Technical analysis must be paired with fundamental analysis. For Stellantis, this means digging into the company’s financial health and strategic position.

KEY FUNDAMENTAL METRICS TO RESEARCH:

Earnings Per Share (EPS): The company’s profitability on a per-share basis.

Price-to-Earnings (P/E) Ratio: How much the market is willing to pay for $1 of earnings. Compare this to industry peers like Ford or GM.

Debt-to-Equity Ratio: A measure of financial leverage and risk.

Automotive Free Cash Flow: Crucial for understanding the company’s ability to fund investments, pay dividends, and reduce debt.

The fundamental story provides the “why” behind the price movements you see on the graph. A bullish chart pattern is far more convincing if it coincides with strong quarterly results and a positive outlook for electric vehicle sales in key markets.

# Comparison of Major Automotive Stocks: A Technical Perspective

To properly contextualize the Chrysler/Stellantis stock graph, it helps to compare its technical behavior with that of its main competitors. The table below contrasts key technical attributes over a recent one-year period. This is not financial advice but an analytical exercise.

| Company (Ticker) | Relative Trend Strength (vs. S&P 500) | Average Trading Volume (Shares) | Key Technical Support Level | Volatility Profile |

|---|---|---|---|---|

| Stellantis N.V. (STLA) | Mixed/Neutral | ~5-10 million | $20.00 | Moderate |

| Ford Motor Co. (F) | Weak | ~40-60 million | $11.00 | Moderate to High |

| General Motors (GM) | Weak | ~15-20 million | $32.00 | Moderate |

| Tesla, Inc. (TSLA) | Weak | ~80-120 million | $150.00 | Very High |

This comparison highlights that STLA often exhibits different technical characteristics than its Detroit peers, sometimes showing more resilience in certain market conditions, likely due to its strong European market presence and diverse brand portfolio.

# A 5-Step Guide to Analyzing the Chrysler/Stellantis Graph Today

Follow this actionable process to conduct your own analysis.

STEP 1: SET THE TIME FRAME. Start with the long-term view a weekly or monthly chart covering 3-5 years. This establishes the primary trend. Then zoom into a daily chart for entry or exit timing.

STEP 2: IDENTIFY THE TREND. Draw the major trend lines. Is Stellantis stock in a clear uptrend, downtrend, or a range-bound consolidation? Use the 50-day and 200-day moving averages for confirmation.

STEP 3: MARK KEY LEVELS. Draw horizontal lines at obvious support and resistance levels. Note where the price has reacted multiple times in the past.

STEP 4: CHECK THE VOLUME. Observe volume bars during recent price moves. Is volume confirming the trend? For example, is volume higher on up days during an uptrend?

STEP 5: LOOK FOR PATTERNS. Scan for the common chart patterns mentioned earlier, like a cup and handle forming near a resistance level.

Based on my experience, the most common mistake retail investors make is performing Step 5 in isolation. They see a pattern and act without considering the trend, volume, or fundamental backdrop. This leads to low-probability trades.

WARNING: COMMON PITFALLS IN CHART ANALYSIS

Be acutely aware of these traps when looking at any stock graph, including Chrysler’s:

CONFIRMATION BIAS: Seeing only the signals that support your existing opinion. Always actively look for evidence that contradicts your thesis.

OVER-RELIANCE ON INDICATORS: Do not clutter your chart with dozens of technical indicators. They will often conflict and cause paralysis. Master a few key ones like moving averages and RSI.

IGNORING FUNDAMENTALS: A beautiful bullish pattern can completely fall apart if the company misses earnings or cuts its guidance. The graph is not a crystal ball.

SHORT-TERM NOISE: Intraday or daily fluctuations can be random. Do not over-interpret every small wiggle on the chart. Focus on the higher-timeframe structure.

# Integrating Your Analysis into an Investment Decision

A chart should inform your decision, not make it for you. Use your technical analysis of the Chrysler stock graph to answer strategic questions: Is the long-term trend favorable? Is the current price at a high-probability support zone for a potential investment? Does the technical picture align with the positive or negative fundamental story?

For instance, if Stellantis reports strong EV sales growth (fundamental positive) and the stock chart is consolidating in a bullish flag pattern near its 200-day moving average on low volume (technical positive), the setup has a stronger thesis than either factor alone.

Ultimately, successful investing with charts requires patience and discipline. Wait for your predefined criteria to align. According to a classic study often cited in trading psychology, a major reason for investor underperformance is emotional decision-making and a lack of a systematic plan (source: “Trading in the Zone” by Mark Douglas). Your analysis of the graph is the foundation of that plan.

CHECKLIST FOR ANALYZING A CHRYSLER/STELLANTIS STOCK GRAPH

Before making any decision based on a stock chart, ensure you have completed this checklist. Use it as a final review.

IDENTIFY THE CORRECT TICKER: Are you analyzing historical FCAU data or current STLA data?

CONFIRM THE PRIMARY TREND: Use weekly charts and major moving averages.

NOTE KEY SUPPORT AND RESISTANCE: Mark at least two levels in each direction.

ANALYZE RECENT VOLUME: Does it confirm price action during breakouts or breakdowns?

SCAN FOR PATTERNS: Document any recognizable chart formations.

CHECK FUNDAMENTAL CATALYSTS: Are earnings, news, or sector trends aligned?

DEFINE YOUR RISK: Based on support levels, where would you be wrong?

SET A TIME HORIZON: Is your analysis for a short-term trade or long-term investment?

REVIEW THE CHECKLIST: Have you addressed each point objectively?

By methodically working through this guide and checklist, you transform a simple Chrysler stock graph from a mysterious image into a powerful, multi-dimensional tool for informed market participation.