# The Ultimate Guide to Price Elasticity of Demand for Luxury Goods: Strategies and Secrets

Understanding the price elasticity of demand for luxury goods is not just an academic exercise. It is a critical business tool for anyone operating in the high-end market. This concept explains how sensitive customer demand is to changes in price. For luxury brands, getting this wrong can damage prestige and profits. Getting it right can unlock unprecedented growth and brand strength.

This guide will break down the unique economics of luxury, provide actionable strategies, and reveal how top brands master their pricing power.

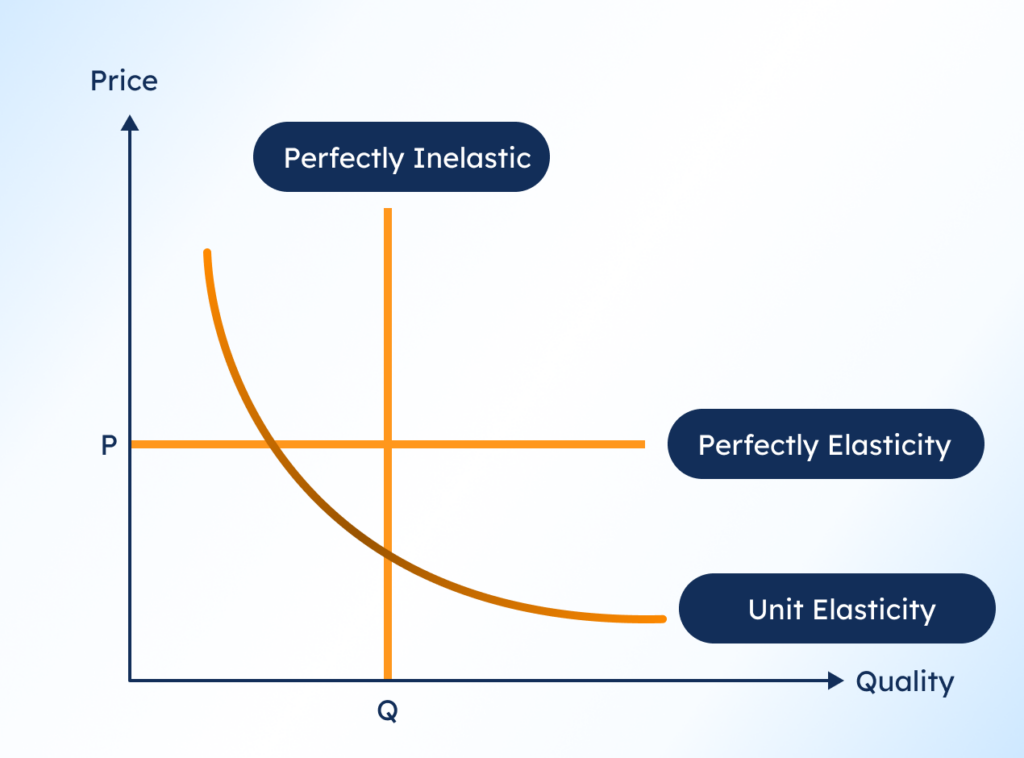

## What Is Price Elasticity of Demand? A Quick Refresher

Price elasticity of demand measures the percentage change in quantity demanded divided by the percentage change in price. In simple terms, it tells you how much sales volume goes up or down when you change your price.

If a product is elastic, a small price increase causes a large drop in sales. Think of generic grocery items. If a product is inelastic, demand remains relatively stable even after significant price hikes. This is where luxury goods often reside, but with fascinating twists.

## The Paradox of Luxury: Why Veblen Goods Defy Economics

Luxury goods frequently behave as Veblen goods. Named after economist Thorstein Veblen, these items possess a perverse characteristic: demand can actually increase as the price rises. This contradicts the basic law of demand.

Why does this happen? High price itself becomes a key feature of the product. It signals exclusivity, status, and quality. For a luxury handbag or Swiss watch, the high price is part of its allure. Lowering the price could make it less desirable to the target consumer, as it would dilute the brand’s exclusive image.

Therefore, the price elasticity of demand for luxury goods is often, but not always, inelastic. The relationship is complex and carefully managed.

## Key Factors Influencing Elasticity in the Luxury Sector

Several unique factors shape demand sensitivity in this market:

EXCLUSIVITY AND BRAND STORY: A strong, authentic narrative and perceived scarcity make demand less sensitive to price. A limited edition item has near-zero elasticity.

BRAND HERITAGE AND PERCEIVED VALUE: Centuries-old houses like Cartier or Louis Vuitton have built such immense perceived value that price becomes a secondary concern for their core clientele.

CONSUMER INCOME LEVEL: The target demographic for true luxury has high disposable income. Price changes within a range have minimal impact on their purchasing decisions.

SUBSTITUTE AVAILABILITY: A specific luxury item often has few true substitutes in the mind of the consumer. You cannot replace a Rolex with a similar-looking watch and receive the same social utility.

Interestingly, a 2023 report by Bain & Company highlighted that the personal luxury goods market has shown remarkable resilience to macroeconomic pressures, growing globally despite inflation, a sign of relative inelasticity for the sector as a whole (source: Bain & Company Luxury Study).

## A Critical Comparison: Luxury Goods vs. Necessities

To fully grasp the concept, it is helpful to contrast luxury goods with everyday necessities. The following table illustrates the fundamental differences in their demand dynamics.

| Feature | Luxury Goods (e.g., Designer Handbag) | Necessities (e.g., Bread, Basic Utilities) |

|---|---|---|

| PRICE ELASTICITY OF DEMAND | Generally Inelastic (can be Veblen-effect) | Highly Inelastic |

| PRIMARY DRIVER OF DEMAND | Status, Emotion, Identity, Exclusivity | Basic Need, Functionality |

| IMPACT OF PRICE INCREASE | May increase or maintain demand; filters non-target customers | Minimal change in quantity demanded |

| ROLE OF BRANDING | Central to value proposition; commands premium | Minimal; often commoditized |

| CONSUMER INCOME EFFECT | Strong; purchased with discretionary income | Weak; purchased regardless of income fluctuation |

## A 5-Step Framework to Analyze Your Brand’s Price Elasticity

How can you apply this knowledge? Follow this actionable framework to assess and leverage your pricing power.

STEP 1: SEGMENT YOUR PRODUCT PORTFOLIO. Not all items have the same elasticity. Entry-level products (like a perfume from a fashion house) are more elastic than flagship, iconic items. Categorize your offerings.

STEP 2: ANALYZE HISTORICAL SALES DATA. Look at past price changes and corresponding sales volumes. Did a 10% price increase on a classic item lead to a 2% or a 20% drop in units sold? Use this data to calculate approximate elasticity.

STEP 3: CONDUCT CUSTOMER AND MARKET RESEARCH. Use surveys, focus groups, and conjoint analysis to understand perceived value and price thresholds. Ask what other brands they would consider if your price rose by 15%.

STEP 4: MONITOR COMPETITIVE POSITIONING. Your elasticity is relative. If a direct competitor holds price while you increase, you may lose share. Understand your position in the competitive set.

STEP 5: TEST AND ITERATE CAREFULLY. Implement price changes in controlled markets or on select online channels. Measure the impact not just on volume, but on overall profit margin and brand perception metrics.

Based on my experience consulting for premium brands, the most common mistake is assuming all products are equally immune to price sensitivity. We once worked with a heritage brand that almost eroded its entry-tier customer base by applying the same aggressive price hike across its entire line. The data showed a stark difference in elasticity between its signature items and its accessories.

## Common Pitfalls and Warning for Luxury Brands

WARNING: DO NOT CONFUSE INELASTICITY WITH INFINITE PRICING POWER.

This is the critical error. While luxury demand is often inelastic, there is always a breaking point. Pushing prices too far, too fast, without corresponding increases in perceived value, can trigger a sharp negative response. It can alienate loyal customers, attract the wrong kind of scrutiny, and ultimately damage the brand’s long-term equity. The collapse of some “affordable luxury” brands has been linked to over-inflation of prices without a solid value foundation.

Furthermore, in economic downturns, even luxury elasticity can change. During the 2008 financial crisis, demand for some luxury goods became more elastic as consumer confidence plummeted (source: Journal of Consumer Research).

## Practical Pricing Strategies Based on Elasticity

Knowing your elasticity informs strategy:

FOR HIGHLY INELASTIC ICON PRODUCTS: Use price increases strategically to enhance exclusivity and fund brand-building. Communicate the heritage and craftsmanship story relentlessly.

FOR MORE ELASTIC ENTRY-LEVEL PRODUCTS: Be cautious with price hikes. Consider value-adding bundles or limited-time offerings instead. These products are gateways to the brand.

DYNAMIC AND PERSONALIZED PRICING: For e-commerce, use customer data to offer personalized promotions without publicly devaluing the brand. A private offer maintains public price integrity.

## The Future: Sustainability and Digital Goods

New factors are influencing elasticity. The rise of conscious consumerism means sustainability credentials can make demand less elastic. Conversely, digital luxury items like NFTs or high-end digital fashion present a new frontier where traditional rules of scarcity and price are being rewritten in real-time.

## Your Action Checklist for Mastering Price Elasticity

To implement the insights from this guide on the price elasticity of demand for luxury goods, use this practical checklist.

IDENTIFY which of your products are true Veblen goods versus aspirational luxury items.

CALCULATE the historical price elasticity for at least your top three product categories.

DEFINE the perceived value narrative for each product tier before any price change.

ANALYZE your closest competitor’s pricing strategy and market positioning.

ESTABLISH key metrics to monitor beyond sales volume, such as profit margin, customer acquisition cost, and brand sentiment.

CREATE a controlled testing plan for any proposed price adjustment.

REVIEW the price-value equation continuously, especially in volatile economic times.

EDUCATE your marketing and sales teams on the principles of luxury demand elasticity to ensure consistent messaging.

Mastering the price elasticity of demand for luxury goods is an ongoing process of analysis, storytelling, and strategic courage. By respecting the unique psychology of your clientele and backing decisions with data, you can price not just for profit, but for lasting prestige.