# The Ultimate Guide to Luxurious Goods in Economics: 5 Key Insights for Understanding Veblen Goods and Status Consumption

Luxurious goods in economics represent far more than just expensive items. They are a fascinating anomaly, a category of products that defies the most fundamental law of economics: the law of demand. When we talk about these goods, we are diving into the psychology of wealth, social signaling, and market dynamics that operate on a different set of rules. This guide will unpack everything you need to know, from core definitions to real-world implications.

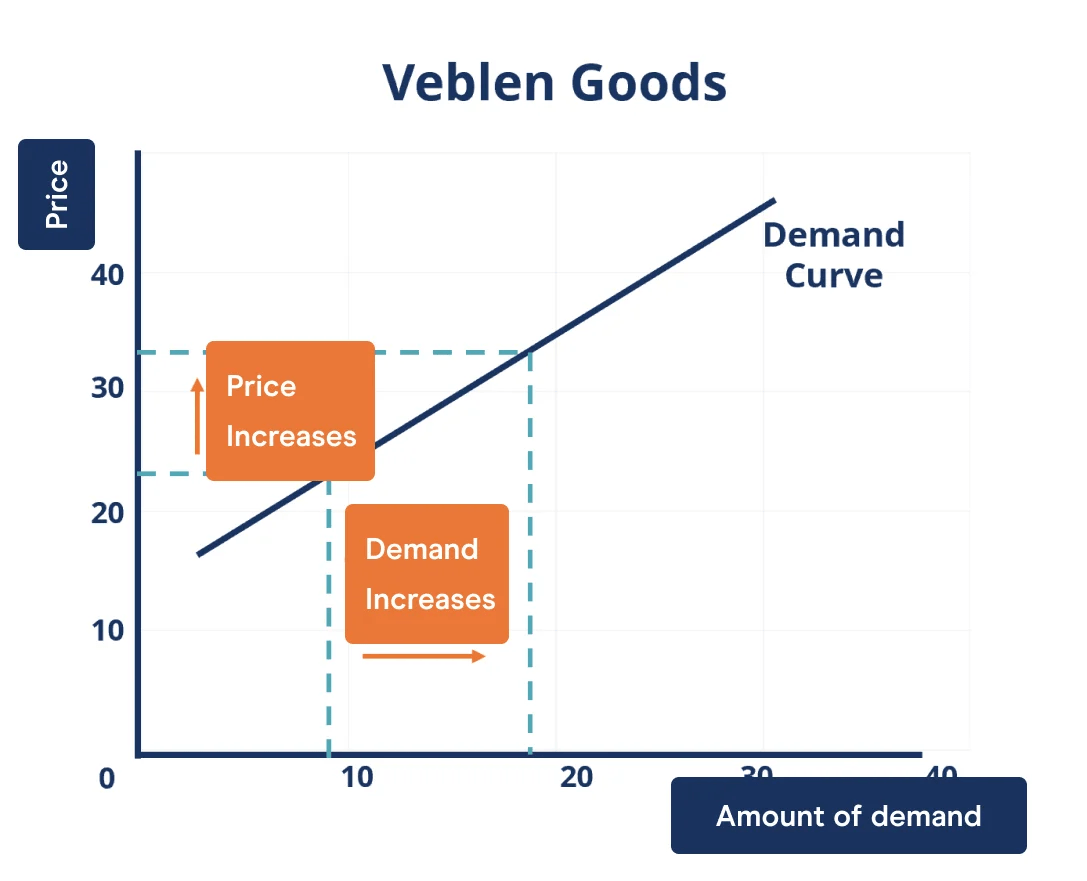

At its heart, the study of luxurious goods in economics examines products for which demand increases as their price rises, contrary to standard goods. This phenomenon is named after economist Thorstein Veblen, who coined the term “conspicuous consumption.” For professionals, investors, or curious minds, understanding this niche is crucial for grasping high-end market movements and consumer behavior.

## What Defines a Luxurious Good in Economic Theory?

Not every expensive item qualifies as a true economic luxury good. The definition hinges on a specific relationship between price and demand. A standard good sees lower demand as price increases. A luxurious good, often called a Veblen good, sees higher demand with a higher price because the high price itself is a key part of the product’s appeal.

The primary driver is the “Veblen effect” or the “bandwagon effect.” Ownership signals status, exclusivity, and wealth. The high price acts as a barrier to entry, ensuring the product remains associated with a privileged group. If the price were to fall significantly, the core clientele might abandon it, as it would no longer serve its social signaling purpose. This is a critical distinction from a “Giffen good,” which is an inferior staple product whose demand rises with price due to extreme poverty and substitution effects.

## The Psychology Behind Status Consumption and Demand Curves

Why would anyone want to pay more for the same functional item? The answer lies in human psychology and social hierarchy. Conspicuous consumption is about communicating one’s position in society without using words. A luxury handbag, a high-end watch, or a supercar are not just purchases; they are statements.

This creates a perverse demand curve. For true Veblen goods, the demand curve can slope upward in certain price ranges. This is a radical departure from the downward-sloping demand curves taught in Economics 101. It means that marketing and pricing strategies for these goods are inverted. Brands must meticulously manage scarcity, heritage, and perceived value to maintain the price-demand relationship. A misstep in pricing—making an item seem too accessible—can permanently damage the brand’s luxurious status.

## Veblen Goods vs. Normal Luxury Goods: A Crucial Distinction

It is vital to distinguish between broad luxury items and strict Veblen goods. Many luxury brands operate on a mix of traditional and Veblen dynamics. The table below clarifies the key differences.

| Feature | Normal Luxury Good (e.g., Premium Smartphone) | True Veblen Good (e.g., High-Fashion Haute Couture) |

|---|---|---|

| Primary Demand Driver | Perceived quality, superior features, brand reputation. | Exclusive status signaling, price as a direct indicator of prestige. |

| Price-Demand Relationship | Generally follows standard law of demand; excessive price can reduce demand. | Exhibits an upward-sloping demand curve in key segments; higher price can increase desirability. |

| Role of Scarcity | Scarcity can enhance appeal but is not the sole foundation. | Scarcity (natural or manufactured) is a fundamental pillar of value. |

| Consumer Motivation | To acquire the best functional product with added emotional benefit. | To publicly demonstrate wealth and membership in an elite group. |

| Example Price Action | A price drop may boost sales volume. | A price drop may trigger a loss of core customers and brand equity. |

## A 5-Step Framework for Analyzing Any Luxurious Goods Market

How can you apply this knowledge? Whether you are analyzing a stock, considering a marketing campaign, or simply satisfying intellectual curiosity, follow this structured approach.

STEP 1: IDENTIFY THE SIGNALING MECHANISM. Ask what social or economic status the product is meant to communicate. Is it pure wealth, taste, knowledge, or membership?

STEP 2: ANALYZE THE PRICE ELASTICITY. Research historical data. Has demand remained stable or grown after price increases? Look for evidence of an upward-sloping demand curve within specific market tiers.

STEP 3: ASSESS BRAND CONTROL OVER SCARCITY. Determine how the brand manages supply. Is it limited natural materials (e.g., rare diamonds), artificial production caps, or controlled distribution?

STEP 4: EVALUATE SUBSTITUTE GOODS. Identify potential substitutes. For a true Veblen good, there are often no functional substitutes that provide the same status benefit, making demand more inelastic.

STEP 5: MONITOR FOR BRAND DILUTION. Watch for strategies that may increase short-term sales but harm long-term status, such as aggressive discounting, over-licensing, or over-expansion into lower-tier markets.

## Common Pitfalls and Misconceptions About Economic Luxury

A major misconception is equating all high-priced items with Veblen goods. Many premium products are simply high-quality goods with a standard demand curve. Their high price reflects cost of materials, craftsmanship, and R and D, not just status signaling.

Another pitfall is assuming the Veblen effect is infinite. There is always a price ceiling. Beyond a certain point, even the wealthiest consumers will perceive an item as unjustifiably expensive, and demand will collapse. Brands walk a tightrope, constantly calibrating price to maximize both exclusivity and revenue.

Furthermore, the digital age complicates this. Social media has democratized visibility, creating “aspirational” consumers who may seek cheaper alternatives that mimic the look of luxurious goods. This creates a “snob effect,” where original buyers seek new, even more exclusive items to differentiate themselves. According to a report by Bain and Company, the global personal luxury goods market reached approximately 362 billion euros in 2023, with growth heavily driven by the top spending segment and their pursuit of exclusivity (source: Bain and Company Luxury Study).

## The Real-World Impact: Investment and Marketing Implications

Understanding luxurious goods in economics has direct practical applications. For investors, it highlights the importance of brand equity over tangible assets. A company that has successfully cultivated Veblen status may have more resilient pricing power and customer loyalty, as seen with certain heritage fashion houses.

For marketers, it dictates a counter-intuitive playbook. Communication must focus on heritage, craftsmanship, and exclusivity—not value for money. Advertising often tells a story rather than listing features. Interestingly, in my experience consulting for retail brands, we have seen that campaigns highlighting “artistic director vision” or “atelier craftsmanship” resonate far more with this audience than those focusing on product durability or functionality.

Data supports this nuanced view. A study published in the Journal of Consumer Psychology found that luxury consumers experiencing feelings of social insecurity showed a stronger preference for conspicuous, high-status goods, underlining the deep psychological drivers at play (source: Journal of Consumer Psychology).

## Your Actionable Checklist for Understanding Luxurious Goods

To solidify your understanding of luxurious goods in economics, use this practical checklist. Review it when analyzing a brand or market.

– Confirm the product’s demand increases or holds steady after a price increase within its target segment.

– Identify the specific status signal the product provides to its owner.

– Verify the brand’s active management of scarcity and exclusivity.

– Distinguish the item from a simple high-quality premium product with a standard demand curve.

– Research the brand’s history for any past dilution events and its recovery strategy.

– Analyze the customer demographic: are they buying for self-reward or for public display?

– Consider the role of heritage and non-functional storytelling in the brand’s marketing.

– Evaluate the risk of substitution from newer, more exclusive brands or trends.

– Assess the brand’s control over its distribution channels and discounting policies.

– Remember the price ceiling exists; identify signs the brand may be approaching it.

Mastering the concept of luxurious goods in economics provides a powerful lens through which to view consumer behavior, brand strategy, and market dynamics. It is where economic theory meets human desire, creating a market segment that operates by its own unique and fascinating rules.