# The Ultimate Guide to Grain Prices in Alberta: 2024 Market Analysis and Strategies

Understanding grain prices in Alberta is not just about checking a daily number. It is about navigating a complex web of global markets, local logistics, and agricultural economics. For farmers, buyers, and industry stakeholders, mastering this landscape is crucial for profitability and planning. This comprehensive guide dives deep into the factors influencing grain prices in Alberta, provides actionable strategies, and offers a clear roadmap for making informed decisions.

We will explore the key drivers, from Chicago Board of Trade correlations to local basis levels, and examine the primary crops that define Alberta’s agricultural output. Furthermore, we will compare major price reporting platforms and outline a step-by-step process for developing your own price monitoring system.

## What Drives Grain Prices in Alberta?

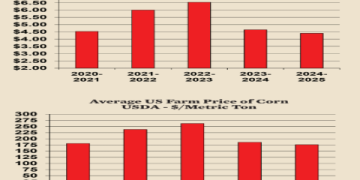

Grain prices in Alberta are not set in a vacuum. They are primarily derived from major futures markets, with adjustments made for local conditions. The single largest influence is the price established on exchanges like the Chicago Board of Trade (CBOT) for crops like wheat and corn, or the ICE Futures Canada for canola. These futures prices reflect global supply and demand, geopolitical events, and macroeconomic trends.

However, the price a farmer in Peace River or Lethbridge actually receives is the “cash price.” This is calculated as: Futures Price + Local Basis. The “basis” is the difference between the local cash price and the futures price. It can be positive or negative and is influenced by local factors such as transportation costs (distance to port or processor), elevator handling charges, local supply and demand imbalances, and crop quality. A strong understanding of basis movement is often more critical for Alberta producers than predicting the futures market itself.

## Key Alberta Grain Crops and Market Dynamics

Alberta’s climate and geography make it a powerhouse for specific grains. The pricing dynamics for each can vary significantly.

CANOLA: Alberta is a leading producer of canola. Its prices are heavily tied to global vegetable oil demand, biofuel policies, and export markets, particularly China. Crush plant capacity within the province also plays a massive role in setting local basis.

WHEAT: Different classes of wheat are grown. High-protein milling wheat like Canada Western Red Spring (CWRS) commands a premium and is sensitive to global quality shortages. Feed wheat prices correlate more closely with corn and barley markets for livestock use.

BARLEY: A major crop for both feed and malt. Malt barley prices are subject to strict quality specifications and contract terms with breweries. Feed barley prices are closely linked to the provincial and continental livestock herd sizes.

PEAS AND LENTILS: These pulses have seen volatile prices driven by export demand from India and other regions. Local processing and transportation logistics significantly impact the final price received by growers.

## How to Track and Analyze Grain Prices in Alberta

Passively watching prices is not a strategy. Active monitoring and analysis are key. Here is a five-step operational guide to building your price intelligence system.

STEP 1: IDENTIFY YOUR BENCHMARKS. Determine which futures contract (e.g., CBOT December Wheat, ICE January Canola) is most relevant for your crop and marketing window.

STEP 2: SELECT PRIMARY DATA SOURCES. Bookmark and regularly check reputable sources for Alberta-specific cash prices. We will compare major platforms in the next section.

STEP 3: CALCULATE YOUR LOCAL BASIS. Regularly subtract the futures price from your local elevator or bid price. Chart this over time to understand seasonal and historical patterns.

STEP 4: MONITOR FUNDAMENTAL DRIVERS. Follow weekly crop progress reports from Alberta Agriculture, Statistics Canada production estimates, and global supply-and-demand reports from the USDA.

STEP 5: SET PRICE ALERTS. Use the alert functions on price platforms or brokerage apps to notify you when your target futures price or local cash price is reached.

## Comparison of Major Grain Price Information Platforms

Not all price sources are created equal. Some offer real-time data for a fee, while others provide delayed information for free. The following table compares two of the most prominent platforms used by Alberta growers.

| Platform Feature | Alberta Agriculture (Crop Market Prices) | DTN/Progressive Farmer |

|---|---|---|

| Primary Coverage | Focus on Alberta and Western Canada; reports from various delivery points. | Global futures and North American cash markets, including Alberta. |

| Data Frequency & Timeliness | Daily updates, but often with a 1-day delay. A reliable free resource. | Real-time and delayed quotes available. Subscription-based for real-time data. |

| Basis Information | Provides actual cash bids, allowing you to calculate basis manually. | Offers sophisticated basis charts and historical tracking tools. |

| Best For | Farmers seeking a trustworthy, free snapshot of local Alberta prices. | Serious marketers needing integrated futures, cash, and analysis tools. |

## Common Pitfalls in Interpreting Grain Prices

A WARNING ON MARKET NOISE: One of the biggest mistakes is reacting to short-term price fluctuations driven by speculative trading or headline news. The daily volatility of the futures market can be extreme, but the local cash price, through basis adjustment, is often more stable. Do not let a sharp one-day drop on the CBOT cause panic if your local basis has simultaneously strengthened.

Another critical error is ignoring basis and focusing solely on the futures price. A rising futures market does not guarantee a better local price if your basis is weakening dramatically due to a local glut or railcar shortage. According to a 2023 report by Alberta Grains, understanding basis trends accounted for a significant portion of successful marketing outcomes among their member surveys (来源: Alberta Grains Annual Market Review). Always analyze the complete cash price equation.

## Advanced Marketing Strategies for Alberta Growers

Beyond tracking, successful farmers employ proactive strategies. This includes using forward contracts to lock in prices for a portion of expected production during favorable pricing windows. Pooling options, through the Canadian Wheat Board legacy or other pools, offer an alternative by averaging prices over a period.

Hedging with futures and options is a more advanced technique, typically executed with a brokerage. It allows you to manage price risk without necessarily delivering grain against the futures contract. Interestingly, many Alberta producers now use a hybrid approach, marketing grain in increments throughout the year rather than all at harvest to average their price risk.

From my experience consulting with farm operations, the most successful managers are those who dedicate specific time each week to market analysis, separate from their operational duties. They treat marketing as a core business function, not an afterthought.

## The Future of Grain Prices in Alberta: Key Trends

Looking ahead, several macro-trends will shape grain prices in Alberta. Climate volatility poses both a risk to consistent yields and a potential premium for reliable Canadian production. Global demand for plant-based proteins and sustainable biofuels continues to grow, supporting long-term demand for canola and pulses.

Furthermore, supply chain infrastructure investments, like port expansions and inland processing, could alter traditional basis patterns. A 2024 study from the University of Calgary’s School of Public Policy suggested that increased value-added processing within Alberta could lead to a structural strengthening of basis levels for certain grains over the next decade (来源: U of C School of Public Policy Report). Monitoring these structural shifts is as important as watching daily price ticks.

## Your Grain Price Management Checklist

To ensure you are covering all bases in managing grain prices in Alberta, use this actionable checklist. Review it at the start of each crop season and marketing year.

IDENTIFY YOUR COST OF PRODUCTION per bushel/tonne for each crop. This is your baseline price target.

ESTABLISH PRIMARY AND SECONDARY PRICE SOURCES for futures and local cash bids.

SET CLEAR MARKETING GOALS AND TRIGGERS, such as percentage of crop to forward contract at specific price levels.

CALENDAR KEY REPORT DATES from Statistics Canada, USDA, and Alberta Agriculture.

DEVELOP A RECORD-KEEPING SYSTEM for your sales, basis calculations, and market notes.

CONSULT WITH A MARKETING ADVISOR OR AGRONOMIST to align your crop plans with market opportunities.

REVIEW AND ADAPT YOUR STRATEGY quarterly, considering new information and changing conditions.

By systematically understanding the forces at play and implementing a disciplined approach, you can transform the challenge of volatile grain prices in Alberta into a managed component of your business success. The market will always have uncertainty, but your response to it can be certain and strategic.