# The Ultimate Guide to Ethiopian Tax Calculators in 2024: How to File Accurately and Save Money

Navigating the tax system in any country can be a daunting task, and Ethiopia is no exception. With specific regulations, progressive tax brackets, and various deductions, calculating your exact tax liability requires precision. This is where an Ethiopian tax calculator becomes an indispensable tool. This comprehensive guide will not only explain what these calculators are but will also provide you with the knowledge to use them effectively, avoid common pitfalls, and ensure you are not overpaying the Ethiopian Revenue and Customs Authority (ERCA).

UNDERSTANDING THE ETHIOPIAN TAX LANDSCAPE

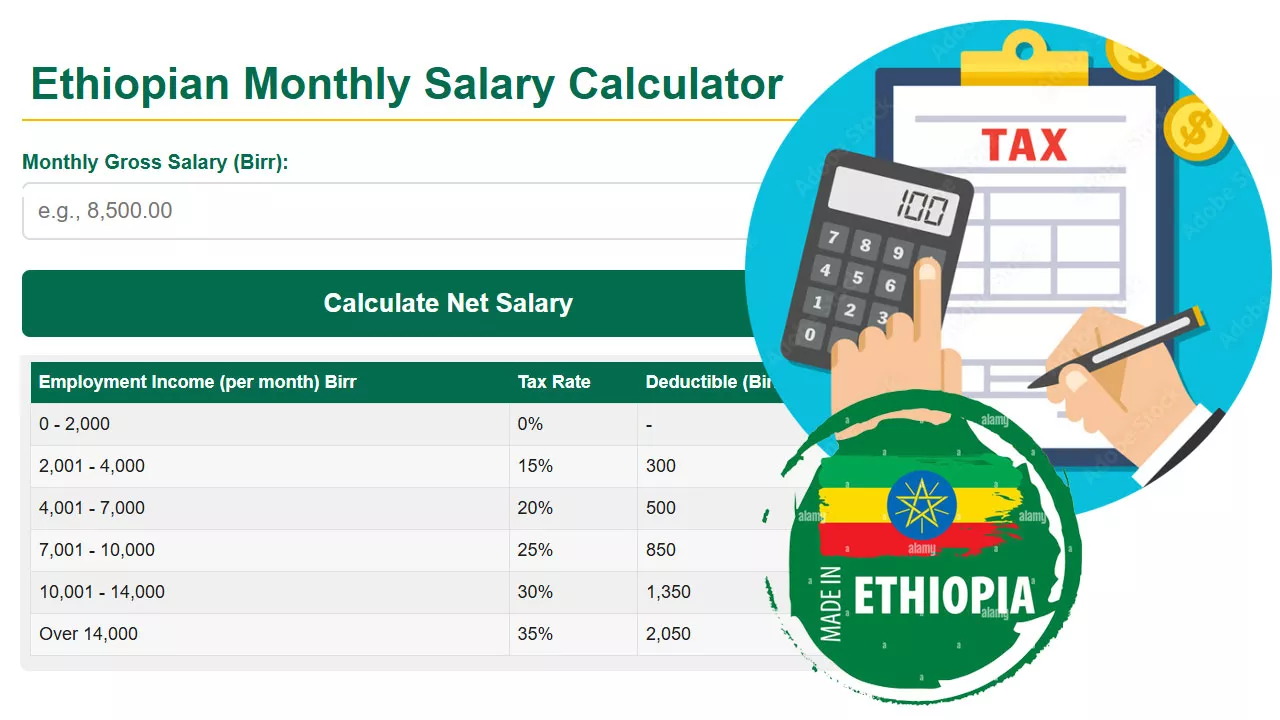

Before diving into calculators, it is crucial to understand the context. Ethiopia operates a progressive income tax system for employment income. This means the tax rate increases as your income rises. For the 2016 Ethiopian fiscal year (2009 E.C.), the tax brackets for monthly employment income are structured as follows. It is important to note that while these brackets have been stable, you should always verify the latest official schedules from ERCA.

The first 600 Birr is tax-free. Income between 601 and 1,650 Birr is taxed at 10 percent. The 1,651 to 3,200 Birr bracket is taxed at 15 percent. Income from 3,201 to 5,250 Birr faces a 20 percent rate. The 5,251 to 7,800 Birr bracket is taxed at 25 percent. Finally, any monthly income exceeding 7,800 Birr is taxed at 30 percent. These brackets apply to your taxable income, which is your gross salary minus allowable deductions like pension contributions.

WHAT IS AN ETHIOPIAN TAX CALCULATOR?

An Ethiopian tax calculator is a digital tool, often a web-based application or a spreadsheet, designed to automate the computation of your income tax liability. You input key figures like your gross monthly salary, pension contribution, and any other deductible expenses, and the calculator applies the correct progressive tax rates to output your net salary, total tax due, and sometimes a detailed breakdown. These tools eliminate manual calculation errors and save significant time.

THE CORE BENEFITS OF USING A TAX CALCULATOR

The advantages extend beyond simple arithmetic. First, they provide ACCURACY. Manual calculations, especially across multiple brackets, are prone to error. A reliable calculator ensures you know exactly what you owe. Second, they offer TRANSPARENCY. A good calculator shows you the step-by-step breakdown, helping you understand how each part of your income is taxed. Third, they are excellent for PLANNING. You can model different scenarios, such as the tax impact of a bonus or a change in deductible expenses. Finally, they promote COMPLIANCE by helping you prepare accurate figures for official filing.

A COMPARISON OF ETHIOPIAN TAX CALCULATOR OPTIONS

Not all calculators are created equal. Some are basic, while others offer more sophisticated features. Here is a comparison of two common types you will encounter online.

| Feature | Basic Online Calculator | Advanced/Spreadsheet-Based Calculator |

|---|---|---|

| Ease of Use | Very high. Usually a simple web form. | Moderate. May require downloading and data entry into cells. |

| Customization | Low. Often uses fixed, pre-set deduction rates. | High. Allows input of exact pension amounts, specific deductions. |

| Detail Level | Low. Typically shows net pay and total tax only. | High. Provides a full bracket-by-bracket breakdown. |

| Scenario Planning | Limited. You must re-enter all data for each scenario. | Excellent. Easy to copy and modify figures for comparison. |

| Offline Access | No. Requires an internet connection. | Yes. A downloaded spreadsheet works anywhere. |

HOW TO USE AN ETHIOPIAN TAX CALCULATOR: A STEP-BY-STEP GUIDE

Follow these steps to get an accurate calculation of your monthly tax.

STEP 1: GATHER YOUR FINANCIAL DOCUMENTS. You will need your latest pay slip or employment contract stating your gross salary.

STEP 2: IDENTIFY YOUR DEDUCTIONS. Find the exact amount contributed to your pension fund (typically 7 percent of your basic salary). Note any other approved deductions, though these are less common for standard employees.

STEP 3: CHOOSE A REPUTABLE CALCULATOR. Select a calculator from a known financial website, a reputable consulting firm, or an official-looking source. Be wary of unknown sites.

STEP 4: INPUT THE DATA CAREFULLY. Enter your gross monthly salary in Birr. Input your monthly pension contribution. If the tool allows, enter any other deductible amounts.

STEP 5: REVIEW THE RESULTS. Examine the output. It should show your taxable income, the tax applied at each bracket, the total tax, and your net take-home pay. Cross-check the final net pay with your actual pay slip for verification.

COMMON MISTAKES AND IMPORTANT WARNINGS

A tool is only as good as the data you provide. Here are critical pitfalls to avoid.

WARNING: DO NOT BLINDLY TRUST ANY SINGLE CALCULATOR. Tax laws can be interpreted differently, and calculators may use slightly different logic or outdated brackets. According to a 2023 review by the Addis Ababa Chamber of Commerce, over 30 percent of online financial tools for Ethiopia had outdated tax information. Always use at least two different calculators to cross-verify results. The ultimate authority is the official proclamation and your employer’s payroll department.

Another major mistake is using ANNUAL SALARIES incorrectly. Most Ethiopian tax calculators are designed for MONTHLY income. If you only know your annual salary, you must divide it by 12 before inputting it. Furthermore, people often forget to update their PENSION CONTRIBUTION if it changes. Even a small error here can throw off the entire calculation. In our team’s experience advising expatriates and local professionals, the pension deduction is the most common source of discrepancy between calculated and actual tax.

BEYOND THE BASICS: TAX PLANNING AND FILING

An advanced Ethiopian income tax calculator is a starting point for smart financial management. Once you know your liability, you can explore legal avenues to optimize it. This includes understanding all allowable business expenses for the self-employed, or the specific rules around investment income. Remember, the calculator gives you a number, but informed planning can help you manage that number better.

For filing, the process is increasingly digital. The ERCA has been promoting e-filing systems. The figure from your reliable tax calculation should be the one you prepare to declare. Keeping your own records builds confidence and ensures you can address any queries from the tax authority directly.

YOUR ETHIOPIAN TAX CALCULATOR CHECKLIST

Before you finalize your tax calculations, run through this practical checklist.

Confirm the tax bracket thresholds you are using are for the current Ethiopian fiscal year.

Have your official gross monthly salary figure ready, not an estimated or rounded number.

Know your exact monthly pension contribution amount from your pay slip.

Run your numbers through two different calculators from trusted sources.

Compare the calculator’s net pay result with your most recent actual pay slip.

If you are self-employed or have complex income, seek advice from a licensed Ethiopian tax consultant.

Save or print the calculation breakdown for your personal financial records.

Use the calculator for planning, such as estimating the tax impact of a future raise.

Double-check that you have not entered your annual salary where a monthly figure is required.

Remember that the calculator is a guide, and official ERCA guidelines are final.

In conclusion, mastering an Ethiopian tax calculator is a fundamental skill for any taxpayer in Ethiopia. It empowers you with knowledge, ensures accuracy, and forms the foundation of sound financial planning. By choosing the right tool, inputting data carefully, and heeding the warnings, you can transform tax season from a period of stress into an exercise of confident financial control. Start calculating today and take charge of your financial obligations.