# The Ultimate Guide to Diesel Prices in Mexico: Trends, Taxes, and How to Save

Understanding diesel prices in Mexico is crucial for businesses, truckers, and travelers. The cost at the pump is more than just a number. It is a complex result of global markets, national policies, and local taxes. This guide provides a deep dive into everything affecting diesel prices in Mexico. We will explore the pricing structure, historical trends, and practical strategies for managing fuel costs.

If you operate a fleet or plan a long-distance drive, this knowledge is power. Let us begin by breaking down what makes up the price you pay.

## How Diesel Prices Are Set in Mexico

Unlike many countries, Mexico has a hybrid system for fuel pricing. The government fully liberalized gasoline and diesel prices in 2017. This means prices are now tied to international market benchmarks. However, the state-owned company Pemex remains the dominant supplier.

The final retail price you see consists of several key components:

– International Benchmark Price: This is the base cost, linked to the U.S. Gulf Coast reference price.

– Logistics and Distribution: Costs for transportation, storage, and delivery to gas stations.

– Retailer Margin: The profit for the gas station owner.

– Taxes: This is the most significant and variable part. It includes the Special Tax on Production and Services (IEPS) and Value Added Tax (VAT).

The IEPS tax is designed as a stabilizer. When international prices are high, the government can reduce this tax to cushion the impact. When prices are low, the tax increases. This creates a complex and often unpredictable element in the final diesel prices in Mexico.

## Key Factors Influencing Diesel Costs in Mexico

Several forces push and pull on diesel costs. Knowing these helps predict trends.

GLOBAL CRUDE OIL MARKETS: As a derivative of crude oil, diesel prices follow its volatility. Events in major oil-producing regions directly impact costs in Mexico.

EXCHANGE RATE (PESO/USD): Since oil is traded in U.S. dollars, a weaker Mexican peso makes importing fuel more expensive. This exchange rate effect is a constant factor in pricing models.

DOMESTIC PRODUCTION AND IMPORTS: Pemex refineries have struggled with low output. Mexico imports a significant portion of its refined diesel, primarily from the United States. This reliance on imports adds logistical costs and exposure to foreign market shifts.

GOVERNMENT TAX POLICY: The IEPS tax rate is the government’s primary tool for price control. Changes in this policy can lead to sudden price hikes or subsidies at the pump.

## Current Trends and Historical Data for Mexican Diesel

Following the liberalization, diesel prices in Mexico have shown greater volatility, aligning more closely with international movements. For instance, the global price shocks of 2022 led to record highs. The average price for diesel in Mexico City exceeded 25 pesos per liter that year.

However, the government has occasionally intervened with subsidies to limit increases. Tracking these trends requires looking at reliable sources. The Mexican government’s Energy Regulatory Commission (CRE) and Pemex publish official average prices. Independent platforms like PetroIntelligence also offer detailed charts and regional breakdowns.

According to data from the Bank of Mexico, the average annual price for diesel has seen significant fluctuations over the past five years, reflecting the complex interplay of global markets and local tax adjustments (来源: Bank of Mexico Statistical Reports).

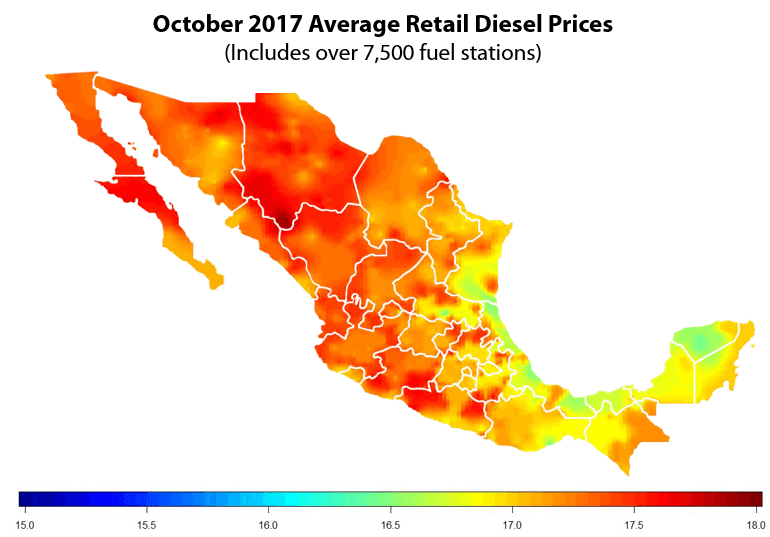

## Regional Variations in Diesel Prices Across Mexico

A critical point often missed is that diesel prices in Mexico are not uniform nationwide. Prices can vary significantly from one state to another, and even between cities. This is due to several factors:

– Distance from Refineries and Ports: States closer to Pemex refineries or major import terminals (like Veracruz or Altamira) typically have lower distribution costs.

– Local Competition: Areas with more gas station brands (including international brands) often see more competitive pricing.

– State and Municipal Taxes: While the federal IEPS and VAT are standard, some local jurisdictions may add minor fees or have different enforcement schedules.

For accurate, location-specific planning, always check real-time price apps or websites before fueling up on a long route.

## Comparison of Diesel Price Factors: Mexico vs. United States

To better understand the Mexican market, it is useful to compare it with its northern neighbor, a major fuel trading partner. The table below highlights key differences.

| Factor | Mexico | United States |

|---|---|---|

| Pricing Model | Liberalized, but with a variable tax (IEPS) as a stabilizer. | Fully liberalized and market-driven, with relatively fixed tax rates. |

| Major Tax Component | Special Tax on Production and Services (IEPS) – variable rate. | Federal and State Excise Taxes – mostly fixed rates. |

| Main Supplier | Pemex (state-owned) dominates the market. | Highly competitive market with multiple major oil companies. |

| Price Uniformity | High regional variation due to logistics and local factors. | Less variation, though state taxes cause differences. |

| Link to International Price | Direct link to U.S. Gulf Coast benchmark, plus exchange rate. | Direct link to domestic and global benchmarks. |

## A 5-Step Guide to Tracking and Forecasting Diesel Prices

Proactive management beats reactive spending. Here is a practical guide to staying ahead of price changes.

STEP 1: BOOKMARK OFFICIAL SOURCES. Make the CRE website and Pemex’s official price page your primary references for confirmed national averages.

STEP 2: USE REAL-TIME MOBILE APPS. Applications like ‘GasoApp’ or ‘Mi Gasolina’ provide crowd-sourced, station-by-station price updates across Mexico.

STEP 3: MONITOR THE MACRO INDICATORS. Set up news alerts for “West Texas Intermediate (WTI) crude prices” and “USD/MXN exchange rate.” Significant moves in these are leading indicators.

STEP 4: UNDERSTAND THE TAX CYCLE. Note that IEPS adjustments are often announced on Fridays for the following week. Follow financial news outlets for previews.

STEP 5: ANALYZE HISTORICAL SEASONALITY. Diesel demand often rises during certain harvest seasons or holiday transport periods. Review past years’ data to anticipate these bumps.

## Common Mistakes and Misconceptions About Diesel in Mexico

AVOID THESE COSTLY ERRORS:

ASSUMING PRICES ARE THE SAME EVERYWHERE. This is the biggest mistake. Failing to compare prices between stations, especially near state borders, can waste significant money.

IGNORING THE EXCHANGE RATE. Businesses that budget in pesos must factor in potential peso weakness against the dollar, as it directly inflates fuel costs.

THINKING LIBERALIZATION MEANS NO CONTROL. While the market is free, the government’s IEPS tax is a powerful and active tool. A sudden change in this tax can alter your cost forecast overnight.

CONFUSING GASOLINE AND DIESEL SUBSIDIES. Government support measures sometimes target only gasoline (Magna). Do not assume diesel is included in every subsidy announcement.

## Practical Tips for Reducing Your Diesel Fuel Costs

Based on my experience consulting for logistics companies, the biggest savings come from behavior and planning, not just chasing the cheapest liter.

First, focus on fleet efficiency. Regular engine maintenance and proper tire inflation can improve mileage by a notable percentage. Second, optimize routes. Use modern GPS logistics software to avoid traffic and reduce idle time. Third, consider bulk purchasing or fuel card programs if you have a large fleet. These can offer small but consistent discounts and simplify accounting.

Interestingly, driver training is a highly effective yet overlooked strategy. Training drivers in eco-driving techniques—smooth acceleration, anticipating stops—can lead to double-digit percentage savings in fuel consumption over time.

## The Future of Diesel Prices in Mexico

Looking ahead, several trends will shape diesel prices in Mexico. The government’s commitment to maintaining the liberalized price framework will keep prices tied to global volatility. Investments in Pemex’s refining capacity, like the Dos Bocas refinery, aim to reduce import dependency. However, this is a long-term project.

Furthermore, the global energy transition towards electrification will eventually impact diesel demand. For now, diesel remains the lifeblood of Mexican cargo transport. Staying informed and agile is the best strategy for anyone whose bottom line depends on understanding diesel prices in Mexico.

## Your Diesel Price Management Checklist

Use this actionable checklist to take control of your fuel expenses:

– Identify and follow two official price sources (e.g., CRE, Pemex).

– Install and configure at least one real-time fuel price app on your primary device.

– Set up weekly alerts for WTI crude oil prices and USD/MXN exchange rate news.

– Perform a monthly review of your fuel receipts to identify consumption patterns and regional price differences.

– Schedule quarterly vehicle maintenance checks focused on fuel efficiency (air filters, injectors, tire pressure).

– Conduct annual driver training or refreshers on fuel-efficient driving techniques.

– Develop a simple forecasting model that includes base price, exchange rate, and seasonal trends for your annual budget.

By systematically working through this guide and checklist, you transform from a passive observer of diesel prices in Mexico into an informed, cost-conscious manager. The market may be complex, but with the right knowledge, you can navigate it confidently.