# The Ultimate Guide to Building a Resilient Domestic Supply Chain: Strategy, Benefits, and a 5-Step Action Plan

Global disruptions have forced a fundamental rethink of how we move goods. The once-unquestioned model of sprawling international networks is giving way to a more strategic focus: the robust domestic supply chain. This is not just a trend; it is a critical business imperative for resilience, agility, and competitive advantage. This guide dives deep into what a modern domestic supply chain entails, its undeniable benefits, and provides a concrete action plan for implementation.

A domestic supply chain refers to the network of suppliers, manufacturers, warehouses, distributors, and transportation channels that are all located within a single country’s borders. While it may involve imported raw materials, its core value-adding activities and final assembly occur domestically. The goal is to shorten the physical and logistical distance between production and consumption.

UNDERSTANDING THE DRIVERS: WHY DOMESTIC IS STRATEGIC

The shift towards domestic sourcing and production is driven by more than just recent crises. Key factors include:

RISK MITIGATION: Long, complex international routes are vulnerable to geopolitical tensions, trade disputes, and pandemics. A domestic framework significantly reduces these exposure points.

CONSUMER DEMAND: A growing number of consumers prefer products made in their home country, associating them with higher quality, ethical labor standards, and lower carbon footprints. A 2022 survey by McKinsey & Company found that 66% of consumers consider sustainability when making a luxury purchase, with provenance being a key factor.

SPEED AND AGILITY: Shorter distances mean faster lead times. This allows companies to respond quickly to market changes, adopt on-demand manufacturing models, and reduce expensive inventory buffers.

GOVERNMENT INCENTIVES: Policies like the U.S. CHIPS and Science Act and various “reshoring” initiatives provide tax breaks, grants, and other incentives to build domestic capacity in critical sectors.

DOMESTIC VS. GLOBAL: A STRATEGIC COMPARISON

Choosing between a domestic and global supply chain is not an all-or-nothing decision. Most successful businesses operate a hybrid model. The key is strategically allocating which products or components belong to which network. The following table outlines the core trade-offs:

| Factor | Domestic Supply Chain | Global Supply Chain |

|---|---|---|

| Lead Time & Responsiveness | SHORT. Enables rapid fulfillment, just-in-time models, and quick adaptation to demand shifts. | LONG. Subject to shipping delays, port congestion, and complex customs clearance. |

| Cost Structure | Higher per-unit production cost often. Lower logistics and tariff costs. Reduced inventory carrying cost. | Lower per-unit production cost. Higher logistics, tariff, and inventory buffer costs. |

| Risk Profile | LOWER. Minimal geopolitical and long-distance transit risk. Easier to manage compliance. | HIGHER. Exposed to trade wars, currency fluctuation, and international instability. |

| Control & Visibility | HIGH. Easier to visit facilities, enforce standards, and track shipments in real-time. | LOWER. Complex oversight, potential for communication gaps, and less transparency. |

| Sustainability Impact | POTENTIALLY LOWER. Reduced transportation emissions. Easier to verify ethical practices. | POTENTIALLY HIGHER. Significant emissions from long-haul shipping and air freight. |

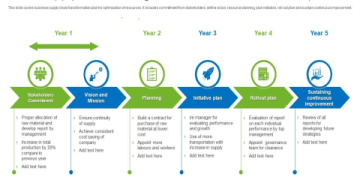

THE 5-STEP ACTION PLAN FOR BUILDING YOUR DOMESTIC CAPABILITY

Transitioning elements of your supply chain domestically requires careful planning. Here is a practical, step-by-step guide.

STEP 1: CONDUCT A PRODUCT-LEVEL VULNERABILITY ASSESSMENT

Not every product is a candidate for reshoring. Start by analyzing your portfolio. Identify items with high demand volatility, high import tariffs, or that are critical to your core business continuity. Use criteria like “pain point” severity and total cost of ownership, not just unit price.

STEP 2: MAP AND AUDIT POTENTIAL DOMESTIC PARTNERS

Research is key. Use industry databases, manufacturing alliances, and government export directories to find potential partners. Do not just look for a direct replacement for your overseas factory. Look for partners with modern capabilities like automation and digital connectivity. According to a report by the Reshoring Initiative, foreign direct investment and reshoring announcements created over 360,000 jobs in the U.S. in 2022, indicating a growing base of potential partners.

STEP 3: REDESIGN FOR EFFICIENCY AND AUTOMATION

Simply replicating an offshore process domestically will fail on cost. This step is about re-engineering. Can you simplify the product design for easier assembly? Can you invest in automation to offset higher labor costs? The goal is to improve productivity to close the cost gap.

STEP 4: DEVELOP A PHASED TRANSITION ROADMAP

Avoid a “big bang” switchover. Start with a pilot program for one product line or component. This de-risks the initiative, allows you to iron out kinks with your new domestic supply chain, and builds internal confidence. Phase the transition based on the priority list from Step 1.

STEP 5: INVEST IN VISIBILITY AND COLLABORATION TECHNOLOGY

A shorter supply chain still needs to be a smart one. Implement IoT sensors, cloud-based platforms, and shared data dashboards with your new partners. This digital thread ensures you realize the full visibility and responsiveness benefits that a domestic network promises.

COMMON PITFALLS TO AVOID

A warning for executives embarking on this journey: the biggest mistake is viewing this as a purely procurement-led, cost-centric project. It is a strategic operations and business continuity initiative. Do not underestimate the cultural and operational integration required with new domestic partners. Furthermore, do not neglect your remaining global network; the objective is a resilient hybrid, not an isolated fortress.

From my experience consulting with mid-sized manufacturers, the most successful transitions are led by a cross-functional team spanning operations, finance, and sales. We often find that the finance team’s initial total-cost model misses the “soft” benefits of reduced stock-outs and faster innovation cycles, which sales teams can immediately monetize.

FINAL CHECKLIST FOR DOMESTIC SUPPLY CHAIN RESILIENCE

Use this actionable checklist to evaluate your readiness and progress.

IDENTIFY: Have you identified specific products or components that are high-risk or high-priority for domestic sourcing?

RESEARCH: Have you compiled a vetted list of potential domestic suppliers and visited their facilities?

CALCULATE: Have you calculated a true Total Cost of Ownership (TCO) comparing offshore and domestic scenarios, including risk buffers?

AUTOMATE: Have you evaluated product redesign and process automation to improve domestic cost-effectiveness?

PARTNER: Have you established clear communication and data-sharing protocols with new domestic partners?

MEASURE: Do you have KPIs in place to measure the performance impact (lead time, agility, cost) of your domestic shift?

REVIEW: Do you have a quarterly review process to assess the hybrid model and adjust the strategy?

Building a robust domestic supply chain is a journey of strategic realignment. It demands investment, patience, and a shift in mindset from cost-minimization to value-optimization. The reward is a business that is not only safer from global shocks but also faster, more sustainable, and closer to its customers. The time to start mapping your path is now.