# The Ultimate Guide to AMG Debt Collection: 5 Expert Strategies for Businesses in 2024

Dealing with unpaid invoices and delinquent accounts is a universal challenge for businesses. It drains resources, impacts cash flow, and distracts from core operations. This is where a specialized service like AMG debt collection becomes a critical partner. But what exactly does AMG debt collection entail, and how can it be leveraged effectively? This comprehensive guide will explore the intricacies of professional debt recovery, with a focus on the strategies and considerations surrounding AMG debt collection services.

We will move beyond a simple definition to provide actionable insights. You will learn how professional collection agencies operate, the legal framework they navigate, and how to choose the right partner for your business. Our goal is to equip you with the knowledge to turn a financial headache into a recoverable asset.

## Understanding AMG Debt Collection and the Modern Recovery Landscape

At its core, AMG debt collection refers to the services provided by a professional agency operating under that name to recover overdue payments on behalf of creditor clients. These agencies act as an intermediary between a business (the creditor) and the individual or company that owes money (the debtor). The modern landscape of debt collection is heavily regulated, requiring agencies to adhere strictly to laws like the Fair Debt Collection Practices Act (FDCPA) in the United States.

The primary value proposition of engaging with an AMG debt collection firm is expertise and efficiency. These agencies employ trained specialists who understand negotiation tactics, skip-tracing techniques to locate debtors, and the legal nuances of the collection process. For a business, this means outsourcing a time-consuming and often uncomfortable task to professionals, freeing up internal staff to focus on revenue-generating activities. According to data from the Association of Credit and Collection Professionals, third-party collection agencies recovered over $55.2 billion in otherwise uncollectible debt for the U.S. economy in a recent year (source: ACA International).

## How Professional Debt Collection Agencies Operate: A Step-by-Step Process

The process followed by a reputable agency like an AMG debt collection service is methodical and designed to maximize recovery while maintaining compliance. Here is a typical step-by-step operation guide.

STEP 1: ACCOUNT PLACEMENT AND DATA TRANSFER. The creditor client provides the agency with detailed information on the delinquent account, including the debtor’s contact information, the original contract, a history of payments, and all previous communication records.

STEP 2: INITIAL NOTIFICATION AND VERIFICATION. The agency sends a formal first notice to the debtor, often via mail and phone. This notice validates the debt and informs the debtor of their rights under the FDCPA. It also provides a clear window for the debtor to dispute the debt’s validity.

STEP 3: SKIP-TRACING AND INVESTIGATION. If the debtor cannot be reached at the provided contacts, the agency employs skip-tracing methods. This involves using specialized databases and investigative techniques to find updated phone numbers, addresses, or employment information.

STEP 4: NEGOTIATION AND RESOLUTION PLANNING. Once contact is established, trained collectors negotiate a resolution. This could be payment in full, setting up a structured payment plan, or, in some cases, negotiating a settlement for less than the full amount owed.

STEP 5: REPORTING AND CLOSURE. The agency provides regular status reports to the creditor client. If payment is secured, funds are collected and remitted (minus a pre-agreed fee). If all ethical and legal collection efforts fail, the agency will recommend closing the account or proceeding to legal action, depending on the client’s instructions and the viability of the claim.

## Choosing the Right Partner: AMG vs. Other Collection Solutions

Not all collection agencies are created equal. Businesses must perform due diligence when selecting a partner for their accounts receivable recovery. The decision often comes down to using a dedicated firm like AMG debt collection or exploring alternative software solutions for in-house management. The following table contrasts the two primary approaches.

| Feature | Professional Agency (e.g., AMG Debt Collection) | In-House Collection Software |

|---|---|---|

| Expertise | HIGH. Staffed with trained specialists in negotiation, law, and skip-tracing. | MEDIUM. Relies on the training and time of your existing staff. |

| Cost Structure | Contingency Fee. You pay a percentage (typically 25-50%) only on the amount successfully recovered. | Subscription/License Fee. Fixed monthly or annual cost, regardless of recovery success. |

| Time & Resource Drain | LOW. The agency handles all aspects, freeing your team completely. | HIGH. Requires significant staff time for calling, documenting, and following up. |

| Legal Compliance Risk | LOW. Reputable agencies have compliance departments to ensure adherence to FDCPA and state laws. | HIGH. Your business bears full liability for any compliance missteps by your staff. |

| Best For | Older, more complex debts; large volumes; businesses without dedicated staff. | Early-stage delinquencies (30-90 days); businesses wanting full control over customer communication. |

## Critical Legal and Ethical Considerations in Debt Recovery

Engaging in debt collection, whether in-house or through an agency, is not a lawless endeavor. The FDCPA sets strict national standards, and many states have their own additional regulations. A common misconception is that once an account is with an agency, the creditor is no longer responsible for compliance. This is false. Creditors can be held vicariously liable for the actions of the agencies they hire.

WARNING: COMMON LEGAL PITFALLS TO AVOID

Businesses must ensure their chosen agency, such as an AMG debt collection service, follows ethical practices. Prohibited behaviors include calling debtors at unreasonable hours, using abusive or threatening language, misrepresenting the amount owed or the legal consequences, and discussing the debt with unauthorized third parties (like family or employers). Before signing a contract, verify the agency’s licensing, ask for their compliance policies, and check their rating with the Better Business Bureau.

## A 5-Point Action Plan for Implementing AMG Debt Collection Services

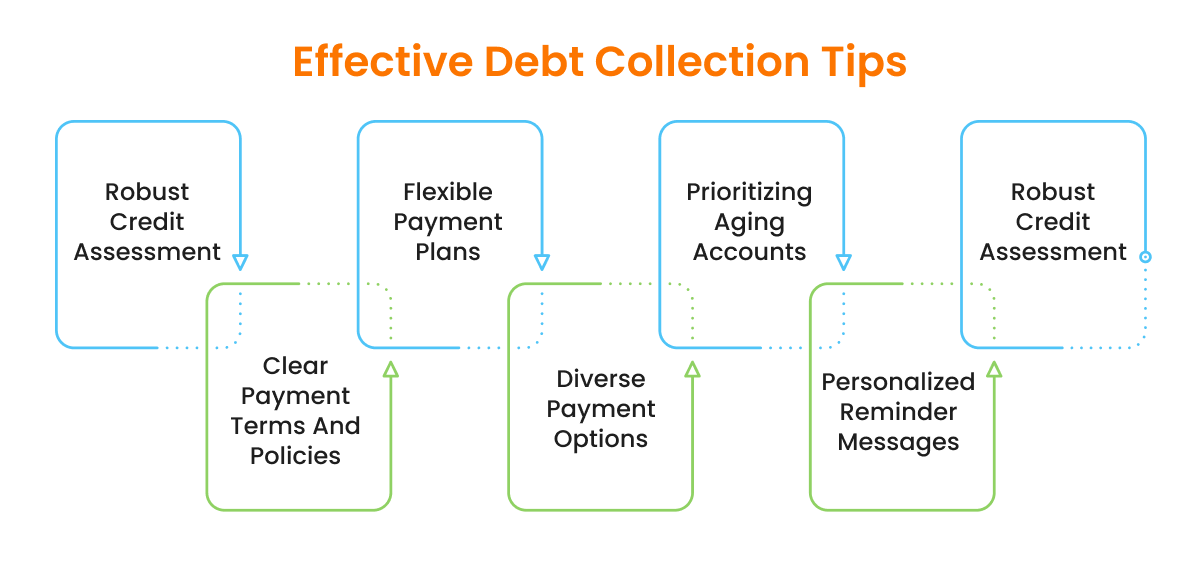

Based on my experience consulting with small and medium-sized businesses, a haphazard approach to placing accounts for collection leads to poor results and damaged customer relationships. Here is a strategic action plan.

First, segment your delinquent accounts by age and amount. Prioritize older, larger debts for agency placement, as they have the highest cost of carry and the lowest likelihood of in-house recovery.

Second, establish clear internal policies. Determine at what point (e.g., 90, 120 days past due) an account will be forwarded to a collection agency. Communicate this policy to customers in your terms of service.

Third, conduct thorough due diligence on potential agencies. Interview them, ask for client references, and understand their fee structure, reporting frequency, and communication style.

Fourth, prepare your accounts for transfer. Gather all supporting documentation—contracts, invoices, payment history, and communication logs—before sending them to the AMG debt collection partner. Clean data improves recovery rates.

Fifth, maintain a line of communication with the agency. While they handle the day-to-day, regular reporting and strategy sessions ensure the approach aligns with your company’s values and goals for customer relations where possible.

## The Future of Debt Collection: Technology and Trends

The industry is evolving rapidly. Forward-thinking agencies are integrating advanced technologies like artificial intelligence and machine learning to prioritize accounts, predict debtor behavior, and personalize communication strategies. Furthermore, there is a growing trend toward digital-first communication, using email and text messaging in compliant ways, as phone call answer rates continue to decline. A study by Experian found that using digital engagement strategies can improve right-party contact rates by up to 30% (source: Experian Collections Benchmark Report). This means a modern AMG debt collection service is likely leveraging data analytics and omnichannel outreach to improve efficiency and recovery rates for their clients.

In conclusion, partnering with a professional AMG debt collection agency can be a transformative decision for a business struggling with cash flow issues due to unpaid debts. It is a strategic move that converts a non-performing asset into recovered capital. The key lies in understanding the process, choosing an ethical and effective partner, and integrating collection strategy into your broader financial operations.

FINAL CHECKLIST FOR ENGAGING A DEBT COLLECTION AGENCY

Verify the agency is properly licensed and bonded in your state.

Review their fee structure and contract terms carefully.

Ask for detailed references from businesses in your industry.

Confirm their compliance procedures and insurance coverage.

Establish clear reporting protocols and a point of contact.

Define the process for recalling an account if needed.

Ensure they use modern, multi-channel communication strategies.

Discuss their policy on credit bureau reporting.

Clarify the remittance process for collected funds.

Align on the overall approach to maintain your brand’s reputation.