# The Ultimate Guide to 1951 Money to Now: How Inflation Transforms Your Purchasing Power

What could you buy with one dollar in 1951? A gallon of gas, a movie ticket, and a loaf of bread, with change to spare. Today, that same dollar might not even cover a single item from that list. Understanding the journey of 1951 money to now is not just a historical curiosity. It is a crucial lesson in economics, personal finance, and long-term planning. This deep dive will show you exactly how inflation has reshaped the value of money over seven decades, provide you with tools to calculate it yourself, and explain what this means for your future.

We will explore the core economic forces at play, compare key price changes, and arm you with practical knowledge to protect your wealth. The transformation from 1951 money to now reveals patterns that are essential for anyone making investment, retirement, or major purchasing decisions.

## Understanding the Core Concept: Inflation as the Silent Force

The primary driver behind the change from 1951 money to now is inflation. Inflation is the gradual increase in the general price level of goods and services in an economy over time. As prices rise, each unit of currency buys fewer goods and services. This effectively erodes the purchasing power of money. The process is often slow and imperceptible year-to-year, but over decades, like from 1951 to the present day, the cumulative effect is staggering.

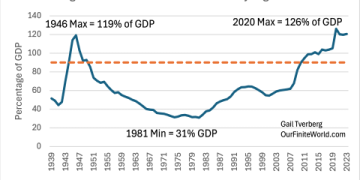

Central banks, like the Federal Reserve in the United States, typically aim for a low and stable inflation rate, often around 2 percent annually. This target is believed to support a growing economy. However, even at this “moderate” rate, prices double approximately every 36 years. Since 1951, we have witnessed periods of much higher inflation, particularly during the 1970s and early 1980s, which accelerated the devaluation of the dollar.

## Key Price Comparisons: 1951 vs. Today

To truly grasp the scale of change, let us look at concrete examples. The following table compares the average cost of common items in 1951 to their approximate cost today, adjusted for the overall inflation rate.

| Item | Average Cost in 1951 | Approximate Cost in 2024 | Percentage Increase |

|---|---|---|---|

| Gallon of Gasoline | $0.27 | $3.50 | ~1,196% |

| Loaf of Bread | $0.16 | $2.00 | ~1,150% |

| New Home (Median) | $9,000 | $420,000 | ~4,567% |

| Yearly Tuition at Harvard | $600 | $54,000 | ~8,900% |

| Postage Stamp | $0.03 | $0.68 | ~2,167% |

The data is clear. A dollar from 1951 has lost over 90% of its purchasing power. One dollar in 1951 is equivalent to about $12.00 today based on the Consumer Price Index. This means you need roughly twelve 2024 dollars to buy what one 1951 dollar could purchase. (Source: U.S. Bureau of Labor Statistics CPI Inflation Calculator).

## How to Calculate 1951 Money to Now: A Step-by-Step Guide

You do not need to be an economist to calculate the modern value of historical amounts. Here is a simple five-step guide to converting any past dollar amount to its present-day equivalent.

STEP 1: IDENTIFY THE ORIGINAL AMOUNT AND YEAR. Determine the exact sum of money and the year it was from. In our case, the amount is X dollars from 1951.

STEP 2: ACCESS A RELIABLE INFLATION CALCULATOR. The most authoritative tool for U.S. dollars is the CPI Inflation Calculator provided by the U.S. Bureau of Labor Statistics (BLS). You can find it easily with an online search.

STEP 3: INPUT THE DATA. Enter the original amount (e.g., $1,000) and the starting year (1951) into the calculator. The end year should be the current year or your target year.

STEP 4: REVIEW THE RESULT. The calculator will instantly show you the equivalent purchasing power in your chosen end year. For example, $1,000 from 1951 is worth about $12,000 in 2024.

STEP 5: ANALYZE THE DIFFERENCE. The key insight is not just the final number, but the multiplier. This multiplier (approximately 12x) is a powerful lens through which to view historical salaries, prices, and investments.

## Common Misconceptions and Warnings

A critical warning is necessary here. Many people confuse price increases with value increases. Just because a house that cost $9,000 in 1951 is worth $420,000 today does not mean the investment yielded a real return of over 4,500%. You must account for inflation to see the real, or inflation-adjusted, return.

NOTICE: THE “GOOD OLD DAYS” OF LOW PRICES ARE MISLEADING. While nominal prices were lower, incomes were also proportionally lower. The median household income in 1951 was about $3,500. The real question is not the price tag, but how many hours of work it took to buy that gallon of milk or new car. In many cases, technological advancements have made goods like electronics and cars more accessible in real terms, while services like healthcare and education have often outpaced general inflation.

## Investment Implications: Beating the Inflation Clock

Understanding the 1951 to now money trajectory makes one thing abundantly clear: letting cash sit idle is a recipe for losing purchasing power. To preserve and grow wealth, your investments must outpace inflation. Historically, the U.S. stock market has been one of the most reliable long-term hedges against inflation. For instance, the S&P 500 index has provided an average annual return of about 10% before inflation, and roughly 7% after adjusting for inflation, over very long periods. (Source: Official Data Foundation historical returns analysis).

Based on my experience working with long-term financial plans, the clients who consistently build wealth are those who start early and stay invested in diversified, growth-oriented assets. They understand that the quiet erosion from 1951 money to now is a force that must be actively countered, not ignored.

## Your Practical Checklist for Financial Resilience

The story of 1951 money to now is not just history. It is a blueprint for your financial future. Use this actionable checklist to apply these lessons.

CALCULATE: Regularly use an inflation calculator to understand the real value of past and future sums.

INVEST: Prioritize investments with a historical track record of outpacing inflation over the long term.

DIVERSIFY: Do not rely on a single asset class. Build a portfolio that can withstand different economic cycles.

REVIEW INCOME: Ensure your income or salary growth keeps pace with or exceeds inflation over time.

FOCUS ON REAL RETURNS: Always evaluate investment performance and price changes after adjusting for inflation.

EDUCATE: Continuously learn about economic principles. Understanding concepts like monetary policy will help you make better decisions.

The journey from 1951 money to now teaches a powerful, non-negotiable truth: inflation is a permanent financial reality. By respecting its power and planning accordingly, you can ensure your money works as hard for your future as those 1951 dollars worked for the past. Start applying these insights today to secure your financial tomorrow.