# The Ultimate Guide to 13 Hourly to Salary: Calculate Your True Annual Earnings

You have a job offer or a current wage of 13 dollars per hour. The immediate question is, what does 13 hourly to salary look like over a year? This is a crucial calculation for budgeting, planning, and understanding your true earning potential. Many people make simple assumptions that lead to financial surprises. This guide will not only give you the basic math but will dive deep into the factors that change your actual take-home pay. We will explore tax implications, unpaid time off, and benefits. By the end, you will have a complete picture of your annual income from an hourly wage.

Understanding your annual salary from an hourly rate is foundational for financial health. It affects your ability to rent an apartment, secure a loan, and save for the future. A superficial calculation can be misleading. We are going to move beyond the basic multiplication. This article provides a detailed, step-by-step approach to converting 13 hourly to salary. You will learn about gross pay versus net pay. We will also discuss how overtime and different work schedules impact your total earnings. Let us begin with the fundamental calculation.

## The Basic 13 Hourly to Salary Calculation

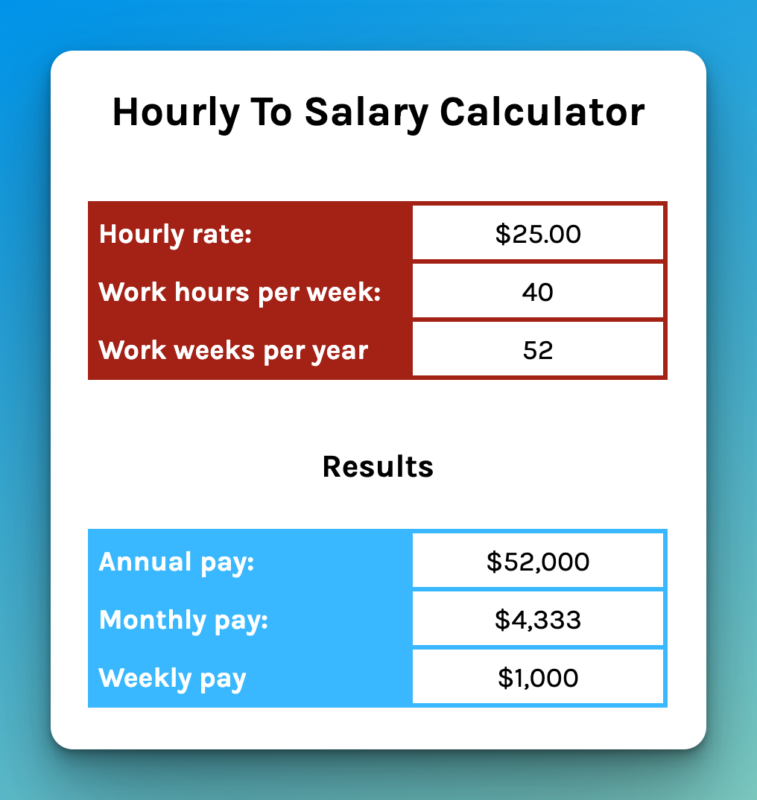

The starting point is straightforward. To find your gross annual salary, you multiply your hourly wage by the number of hours you work in a week. Then, you multiply that by the number of weeks you work in a year. The standard full-time work schedule in the United States is 40 hours per week for 52 weeks per year.

Here is the formula: Hourly Wage x Hours per Week x Weeks per Year = Gross Annual Salary.

For a 13 dollar per hour wage at 40 hours per week for 52 weeks, the math is: 13 x 40 x 52 = 27,040 dollars.

Therefore, a gross annual salary for a 13 hourly wage is 27,040 dollars. This is your earnings before any deductions like taxes or retirement contributions. It is the number you would see on an annual offer letter. However, this is rarely the amount that lands in your bank account. This basic figure serves as a benchmark. It is essential for comparing job offers and understanding your market rate.

## Key Factors That Change Your Actual Take-Home Pay

The gross salary of 27,040 dollars is just the beginning. Several critical factors will reduce this amount to your net pay, or take-home pay. Ignoring these factors is the most common mistake people make when planning their budget.

FEDERAL AND STATE TAXES: This is the largest deduction. Your employer withholds money for federal income tax, Social Security, and Medicare. The amount depends on your filing status and allowances claimed on your W-4 form. State income tax varies, with some states having none. According to the Tax Foundation, the average combined state and local sales tax rate is around 6-7%, but income tax can be higher (来源: Tax Foundation).

PRE-TAX DEDUCTIONS: These are benefits you pay for with dollars that have not been taxed yet. Common examples include health insurance premiums, dental plans, and contributions to a traditional 401(k) retirement account. While these reduce your taxable income, they also reduce your immediate cash flow.

POST-TAX DEDUCTIONS AND UNPAID TIME OFF: Other deductions come out after taxes are calculated. These might be union dues or wage garnishments. Furthermore, the standard 52-week model assumes no unpaid time off. Most workers take vacation, sick days, or holidays that may be unpaid. Even a single unpaid week per year reduces your gross pay by 520 dollars (13 x 40).

To visualize how different scenarios affect your annual earnings from a 13 hourly wage, consider the following comparison.

| Earnings Scenario | Weekly Hours | Weeks Worked | Gross Annual Salary | Key Consideration |

|---|---|---|---|---|

| Standard Full-Time | 40 | 52 | $27,040 | Base calculation, assumes no unpaid leave. |

| With 2 Weeks Unpaid Leave | 40 | 50 | $26,000 | A loss of $1,040 from the base salary. |

| Part-Time (30 hrs/week) | 30 | 52 | $20,280 | Common for students or second jobs. |

| With Overtime (5 hrs OT/week) | 45 | 52 | $31,330 | Overtime at time-and-a-half (19.50/hr) boosts income. |

## A Step-by-Step Guide to Calculate Your Personal Net Salary

To move from the gross 13 hourly to salary figure to your actual take-home pay, follow this five-step guide. You will need your most recent pay stub or your benefits enrollment information.

STEP 1: DETERMINE YOUR EXACT GROSS PAY PERIOD. Is your pay weekly, bi-weekly, or semi-monthly? Calculate your gross pay for one period. For weekly at 40 hours: 13 x 40 = 520 dollars.

STEP 2: IDENTIFY PRE-TAX DEDUCTIONS. List every deduction taken from your pay before taxes are calculated. Sum these amounts. For example, if health insurance is 50 dollars per week and your 401(k) contribution is 20 dollars, your total pre-tax deductions are 70 dollars.

STEP 3: CALCULATE TAXABLE INCOME FOR THE PERIOD. Subtract your pre-tax deductions from your gross pay. Using our example: 520 – 70 = 450 dollars. This is the amount subject to income and payroll taxes.

STEP 4: ESTIMATE TAX WITHHOLDINGS. This is the most complex step. Federal income tax depends on your taxable income and W-4 settings. Social Security tax is 6.2% and Medicare is 1.45%. For simplicity, a common effective tax rate for this income bracket might be 15-20%. Applying a 17% rate to 450 dollars gives about 76.50 dollars in taxes.

STEP 5: SUBTRACT POST-TAX DEDUCTIONS. Any remaining deductions (like union dues) come out now. Subtract them from the amount after taxes. From our 450 dollars minus 76.50 in taxes, we have 373.50. A 10 dollar post-tax deduction leaves a net weekly pay of approximately 363.50 dollars. Multiply this by your number of pay periods per year to find your net annual salary.

## Common Mistakes and Misconceptions to Avoid

When converting 13 hourly to salary, people often stumble on the same pitfalls. Being aware of these can prevent financial shortfalls.

MISTAKE 1: ASSUMING 40 HOURS A WEEK IS GUARANTEED. Many hourly positions, especially in retail or hospitality, offer variable schedules. Your hours may fluctuate week-to-week based on business needs. Basing your annual budget on a perfect 40-hour week can be risky if your average is only 35 hours.

MISTAKE 2: FORGETTING ABOUT SEASONAL OR CYCLICAL WORK. Some jobs are busier during certain seasons. You might work 50 hours a week in the summer but only 20 in the winter. Your annual 13 hourly to salary calculation must account for these averages, not the peak season income alone.

MISTAKE 3: IGNORING THE COST OF COMMUTING AND WORK ATTIRE. These are indirect deductions. Gas, public transit fares, and purchasing uniforms or professional clothing come out of your net pay. They do not show up on your pay stub but significantly impact your disposable income. A Bureau of Labor Statistics report shows transportation costs can consume a significant portion of a household budget (来源: Bureau of Labor Statistics Consumer Expenditure Survey).

MISTAKE 4: OVERLOOKING OPPORTUNITIES FOR INCREASE. Focusing solely on the conversion of 13 hourly to salary might make you passive. The real question should be, how can I increase my hourly rate? According to my experience in career coaching, hourly workers who proactively seek skill certifications or take on additional responsibilities often see faster wage growth than those who do not.

## Practical Checklist for Managing Your 13 Dollar an Hour Salary

After understanding your true 13 hourly to salary conversion, use this actionable checklist to manage your finances effectively. This list is designed for immediate use.

TRACK YOUR HOURS RELIGIOUSLY. Use a timesheet app or a simple notebook. Ensure you are paid for every minute worked, especially if overtime is involved.

CREATE A BUDGET BASED ON NET PAY, NOT GROSS. Build your monthly budget using your average take-home pay, not the 27,040 dollar gross figure. This prevents overspending.

INQUIRE ABOUT BENEFITS AND TAX ADVANTAGES. Ask your employer about available pre-tax benefits like Flexible Spending Accounts for health or dependent care. These can lower your taxable income.

PLAN FOR UNPAID TIME. If you do not have paid time off, actively save a portion of each paycheck to create an income buffer for vacations or sick days.

EVALUATE OVERTIME AND SIDE HUSTLE TRADEOFFS. Calculate the net pay from overtime after taxes. Sometimes, a side gig with deductible expenses can be more financially efficient than overtime taxed at a higher rate.

REVIEW YOUR TAX WITHHOLDING ANNUALLY. Use the IRS Tax Withholding Estimator to see if you are having too much or too little tax withheld. A large tax refund means you overpaid and gave the government an interest-free loan.

CONVERT YOUR HOURLY WAGE TO A MONTHLY NET FIGURE. Divide your estimated net annual salary by 12. This number is critical for managing rent, car payments, and other monthly bills. It makes the 13 hourly to salary figure tangible for daily financial decisions.