# The Pharmaceutical Industry Value Chain Explained: A 7-Step Guide to Understanding Drug Development

The journey of a pill from a scientific concept to a patient’s medicine cabinet is one of the most complex and regulated processes in the modern world. This journey is mapped by the pharmaceutical industry value chain, a critical framework that outlines every step of drug discovery, development, and delivery. For professionals, investors, and anyone seeking to understand this vital sector, grasping the value chain is not just academic, it is essential. This guide will break down the pharmaceutical value chain into its core components, revealing how value is created, where costs accumulate, and what the future holds for this dynamic industry.

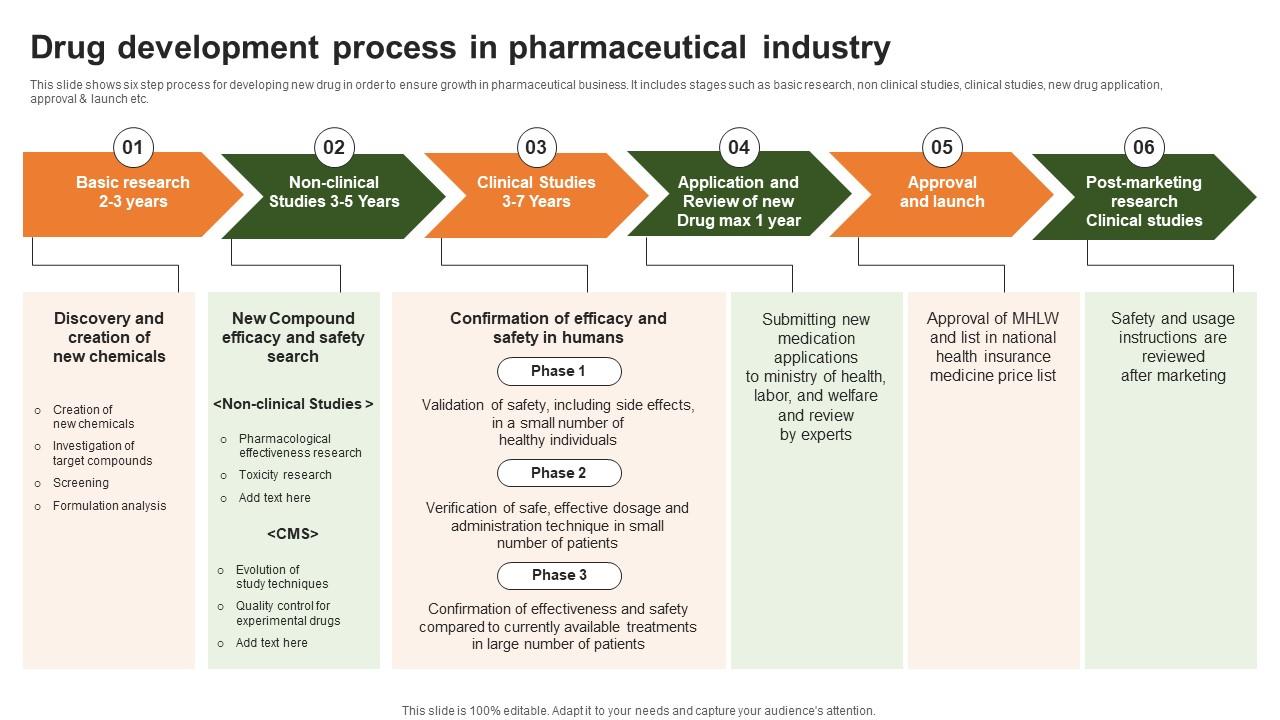

At its heart, the pharmaceutical value chain is a sequence of interconnected activities that transform basic research into therapeutic products. Each link in this chain adds value but also introduces significant cost, risk, and time. The entire process can take over a decade and cost billions, with no guarantee of success. Understanding this flow is key to appreciating the price of innovation and the challenges of global health.

## The 7 Core Stages of the Pharmaceutical Value Chain

We can deconstruct the pharmaceutical industry value chain into seven distinct, yet overlapping, stages. Each stage has its own set of players, technologies, and regulatory considerations.

### 1. Research and Discovery

This is the genesis of everything. Scientists explore disease biology to identify a “target,” such as a protein or gene involved in a disease. They then screen thousands, even millions, of compounds to find ones that might interact with that target. This stage is highly speculative and relies on advanced technologies like high-throughput screening and artificial intelligence. According to a 2023 report by the Congressional Budget Office, large pharmaceutical companies invest over 20 percent of their annual revenues in research and development, a figure that far exceeds the average for other knowledge-based industries (来源: Congressional Budget Office).

### 2. Preclinical Development

Once a promising compound is identified, it enters preclinical testing. Researchers conduct laboratory and animal studies to assess the compound’s safety, biological activity, and formulation. The goal is to gather enough data to justify testing the drug in humans. This stage is a major filter; many compounds fail due to toxicity or poor efficacy profiles.

### 3. Clinical Development

This is the most costly and time-consuming phase. It involves three sequential phases of human trials:

– PHASE 1: Tests safety and dosage in a small group of healthy volunteers.

– PHASE 2: Evaluates efficacy and side effects in a larger group of patients with the target disease.

– PHASE 3: Confirms efficacy, monitors adverse reactions, and compares the drug to standard treatments in large patient populations, often across multiple countries.

### 4. Regulatory Review and Approval

After successful Phase 3 trials, the company compiles all data into a massive application submitted to regulatory agencies like the U.S. FDA or the European EMA. Agency scientists review the data to determine if the drug’s benefits outweigh its risks. The average review time for a standard FDA approval is around 10 months, though expedited pathways exist for critical therapies.

### 5. Manufacturing and Production

Once approved, the drug must be produced at scale under strict Good Manufacturing Practice (GMP) regulations. This involves sourcing raw materials, chemical synthesis or biological fermentation, purification, formulation into a final product (like a tablet or injectable), and packaging. Manufacturing for global supply is a monumental logistical challenge that requires immense capital investment.

### 6. Marketing, Sales, and Distribution

Here, the product is introduced to healthcare providers and, in some markets, directly to consumers. Sales teams educate doctors, while marketing campaigns raise awareness. The drug then moves through a complex distribution network of wholesalers and pharmacies to reach hospitals and patients. This stage is heavily regulated to ensure promotional practices are truthful and not misleading.

### 7. Pharmacovigilance and Post-Market Surveillance

The chain does not end at the pharmacy. Companies must continuously monitor the drug’s safety in the real-world population, reporting any adverse events to regulators. This phase can lead to updated labeling, new restrictions, or, in rare cases, withdrawal from the market.

## Key Players and Their Roles in the Value Chain

The pharmaceutical ecosystem is not monolithic. Different organizations specialize in different links of the chain.

| Player Type | Primary Role in the Value Chain | Typical Focus |

|---|---|---|

| Big Pharma (e.g., Pfizer, Roche) | Often integrated across the chain, with strengths in late-stage development, regulatory affairs, global marketing, and sales. | Blockbuster drugs, large-scale trials, commercial execution. |

| Biotech Startups | Typically focus on early-stage research and discovery, leveraging novel platforms (e.g., gene therapy). | Innovative targets, preclinical and early clinical proof-of-concept. |

| Contract Research Organizations (CROs) | Provide outsourced services, primarily for clinical trial management and execution. | Patient recruitment, data management, site monitoring. |

| Contract Manufacturing Organizations (CMOs) | Handle production on behalf of drug developers, offering scale and expertise. | API synthesis, drug formulation, fill-finish services. |

## A 5-Step Guide to Analyzing a Company’s Position in the Value Chain

If you are evaluating a pharmaceutical company, follow this practical guide to understand its strategic place in the value chain.

STEP 1: IDENTIFY THE CORE ACTIVITIES. Examine the company’s pipeline and revenue sources. Are most assets in preclinical Phase 1, or are they marketed products?

STEP 2: ASSESS VERTICAL INTEGRATION. Determine which stages the company performs in-house versus outsourcing. In-house control can mean higher margins but also higher fixed costs.

STEP 3: ANALYZE THE PARTNER NETWORK. Look at licensing deals, research collaborations, and manufacturing contracts. A robust partner network can de-risk and accelerate development.

STEP 4: EVALUATE REGULATORY CAPABILITIES. For companies in late-stage development, a strong regulatory affairs team is a critical asset for navigating approvals.

STEP 5: SCRUTINIZE COMMERCIAL INFRASTRUCTURE. For commercial-stage firms, assess the strength and reach of their sales and marketing teams in key geographic markets.

## Common Misconceptions and Critical Warnings

A major point of confusion lies in the cost structure. While manufacturing the physical pill is often inexpensive, the price must recoup the astronomical costs and failures from the earlier research and development stages. Another misconception is that this is a linear process. In reality, there is constant feedback. A safety signal in Phase 3 trials might send researchers back to the discovery phase for a new compound.

WARNING: DO NOT UNDERESTIMATE THE ROLE OF INTELLECTUAL PROPERTY. Patents are the lifeblood of the pharmaceutical value chain. They provide a temporary monopoly to allow companies to recoup R and D investment. The looming “patent cliff,” when key drugs lose exclusivity, is a defining moment for any pharma company’s valuation and strategy.

## The Future: How Technology is Reshaping the Chain

The traditional pharmaceutical value chain is being disrupted. Artificial intelligence is accelerating drug discovery, identifying candidates in months instead of years. Real-world evidence from digital health tools is supplementing clinical trial data. Advanced therapies like CAR-T cells are blurring the lines between treatment and manufacturing, creating highly personalized “living drugs.” Furthermore, the rise of telemedicine is changing the final link of distribution and patient access.

Based on my experience consulting for biotech firms, the most successful companies are those that view the value chain not as a rigid pipeline, but as a dynamic, interconnected network. They build flexibility to pivot when data demands it and form strategic partnerships to fill capability gaps. For instance, our team worked with a startup that leveraged AI for discovery but partnered with a top-tier CRO for its first clinical trial, dramatically increasing its chances of success without building an expensive internal infrastructure.

## Your Pharmaceutical Value Chain Action Checklist

To solidify your understanding and apply this knowledge, use the following checklist.

IDENTIFY THE STAGE OF A DRUG CANDIDATE. Can you place any currently headline-making therapy into its correct phase in the value chain?

DIFFERENTIATE BETWEEN R AND D AND COMMERCIAL ACTIVITIES. When reading a company report, separate the sections discussing pipeline progress from those discussing product sales.

RECOGNIZE THE SOURCES OF COST. When you see a drug’s price, mentally allocate portions of it to discovery risk, clinical trial expenses, and ongoing safety monitoring.

MAP THE KEY PLAYERS. For any pharmaceutical news story, identify which type of organization (Big Pharma, Biotech, CRO) is the main actor and what part of the chain it affects.

TRACK A REGULATORY MILESTONE. Follow the FDA or EMA announcement of a drug approval, understanding it as the crucial gateway between development and commercialization.

By mastering the framework of the pharmaceutical industry value chain, you gain a powerful lens through which to view medical innovation, business strategy, and healthcare policy. It is the ultimate blueprint for how modern medicines are born.