# The GEP Global Supply Chain Volatility Index: Your Ultimate Guide to Understanding and Using This Critical Metric

Supply chain professionals no longer operate in a world of predictable, linear flows. Today, volatility is the new normal. To navigate this chaos, leaders need more than gut feeling; they need precise, data-driven intelligence. This is where the GEP Global Supply Chain Volatility Index becomes an indispensable tool. But what exactly is it, and how can you leverage it to protect your business and seize competitive advantage? This definitive guide breaks down everything you need to know.

We will explore the indexs methodology, interpret its signals, and provide a practical framework for integrating its insights into your strategic planning. By the end, you will have a clear action plan to transform raw data into resilient operations.

UNDERSTANDING THE GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

At its core, the GEP Global Supply Chain Volatility Index is a leading indicator designed to track the overall health and stability of global supply chains. Published monthly by GEP, a leading provider of procurement and supply chain strategy software and services, the index aggregates real-world data from thousands of companies across North America, Europe, and Asia.

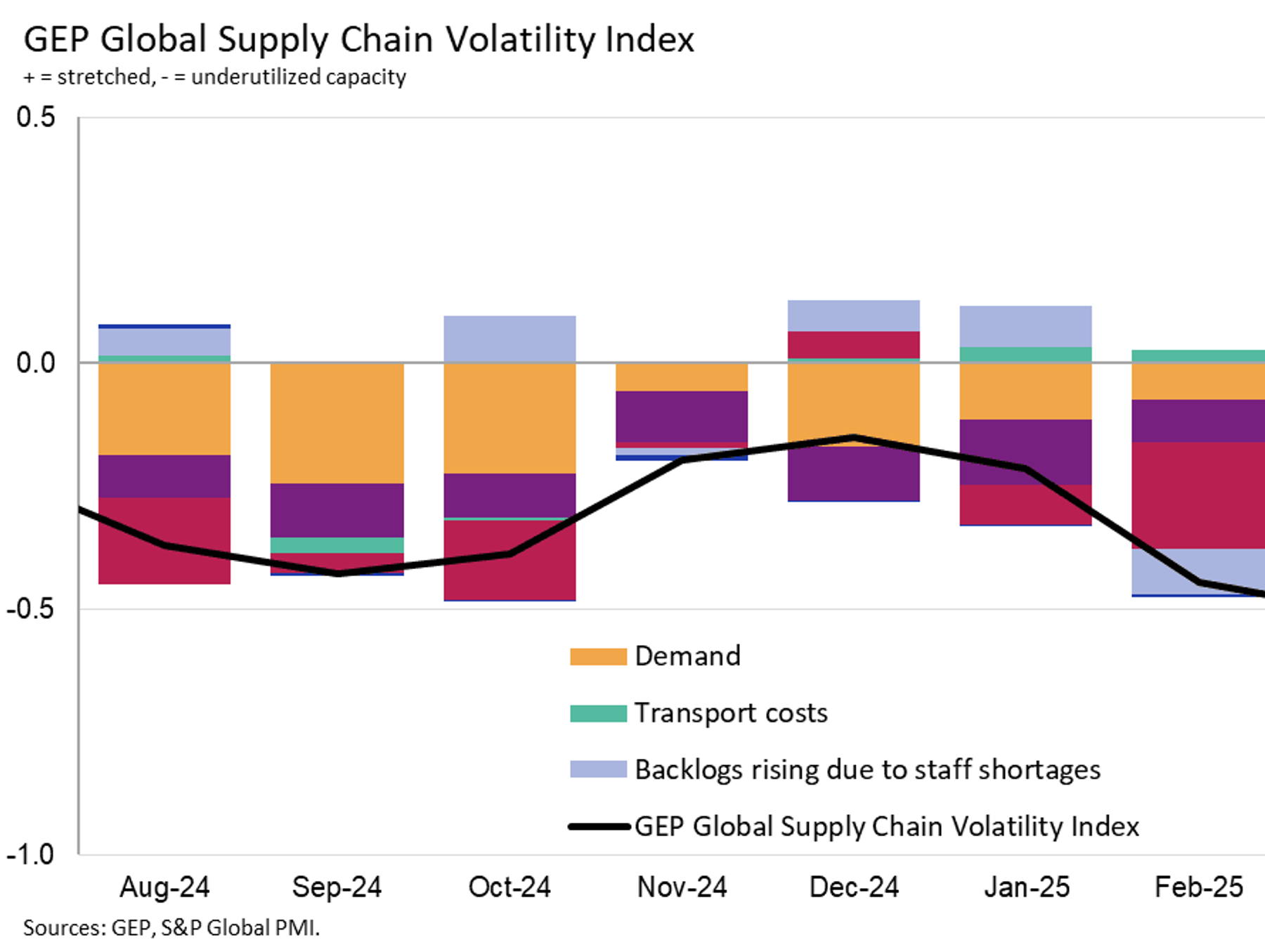

Unlike surveys based on sentiment, the GEP index is derived from actual purchasing behavior and operational data. It analyzes factors like demand, inventory levels, shortages, and transportation costs. A key component is tracking purchasing of raw materials, components, and capital goods. When the index rises above zero, it indicates supply chain capacity is being stretched, signaling rising volatility, inflationary pressures, and potential shortages. Conversely, a reading below zero suggests slack capacity, lower volatility, and deflationary trends.

The power of the GEP Global Supply Chain Volatility Index lies in its forward-looking nature. It often provides early warning signs of market shifts weeks or even months before they become apparent in traditional economic reports.

KEY DRIVERS AND WHAT THE INDEX MEASURES

To fully grasp the GEP index, you must understand the specific components it monitors. These drivers paint a comprehensive picture of global supply chain stress.

Demand Strength: This measures the volume of orders for raw materials and components. A sustained surge is a primary driver of volatility, as suppliers struggle to keep pace.

Inventory Buffering: Companies often build up safety stock in anticipation of disruptions. The index tracks this behavior, as excessive inventory building can itself become a source of volatility when demand shifts.

Material Shortages: The frequency and severity of shortages for key items are a direct input. This is a pure indicator of supply-side stress.

Transportation Capacity: Data on freight costs, backlogs, and availability is factored in. Congestion and high costs directly contribute to a higher volatility reading.

Labor Market Constraints: Shortages in key logistics and manufacturing roles impact the entire chain’s throughput and reliability.

By synthesizing these elements, the GEP Global Supply Chain Volatility Index provides a single, comprehensible number that reflects a complex, interconnected system. For instance, in early 2022, the index reached near-record highs, accurately reflecting the compounded pressures of post-pandemic demand, port congestion, and geopolitical uncertainty. According to GEPs own analysis, the index remained in significant expansion territory for much of 2021 and 2022, correlating with the global inflation surge (source: GEP Global Supply Chain Volatility Index reports).

HOW TO INTERPRET THE INDEX: A PRACTICAL GUIDE

Reading the monthly GEP Global Supply Chain Volatility Index report is one thing. Interpreting it for your specific business context is another. Follow this five-step guide to move from data to decision.

STEP 1: CHECK THE HEADLINE NUMBER AND TREND. Is the index positive or negative? More importantly, what is its direction over the last 3-6 months? A rising positive trend is a strong warning signal.

STEP 2: DRILL INTO THE REGIONAL DATA. The global headline masks regional differences. The index provides breakdowns for North America, Europe, and Asia. Your supply chain may be more exposed to one region. Focus your analysis there.

STEP 3: ANALYZE THE COMPONENT DRIVERS. Look at which specific drivers are contributing most to the volatility. Is it demand, shortages, or transportation? This tells you the nature of the risk.

STEP 4: CORRELATE WITH YOUR INTERNAL DATA. Compare the index trends with your own companys metrics: purchase order lead times, inbound shipping delays, and material costs. Does the external index foreshadow your internal pain points?

STEP 5: FORMULATE A RESPONSE STRATEGY. Based on the analysis, decide on actions. A high and rising index may trigger a review of safety stock policies or supplier diversification. A low and falling index might present an opportunity to negotiate longer-term contracts at favorable rates.

COMMON MISINTERPRETATIONS AND PITFALLS

A tool is only as good as the person using it. Avoid these common mistakes when applying the GEP Global Supply Chain Volatility Index.

MISTAKE: VIEWING IT AS A SHORT-TERM TRADING SIGNAL. The index is a strategic, not tactical, tool. Do not make weekly purchasing decisions based on a monthly index movement. It is designed to inform quarterly and annual strategy.

MISTAKE: IGNORING LAGGING EFFECTS. A shift in the index takes time to filter through complex supply chains. A downturn in the index does not mean your costs will drop tomorrow; it indicates easing pressure that may materialize in 60-90 days.

MISTAKE: RELYING ON IT IN ISOLATION. The GEP index is powerful, but it is one piece of the puzzle. Always combine it with other economic indicators, geopolitical analysis, and deep supplier intelligence.

COMPARING SUPPLY CHAIN RISK INDICATORS

The GEP Global Supply Chain Volatility Index is not the only metric available. How does it stack up against other well-known indicators? The table below provides a clear comparison.

| Indicator Name | Publisher | Primary Data Source | Key Focus | Frequency |

|---|---|---|---|---|

| GEP Global Supply Chain Volatility Index | GEP | Real purchasing & operational data from global enterprises | Overall capacity stress and volatility | Monthly |

| PMI Manufacturing Index | S&P Global / ISM | Survey of purchasing managers | General direction of manufacturing sector | Monthly |

| Baltic Dry Index (BDI) | Baltic Exchange | Shipping charter rates for dry bulk carriers | Demand for raw materials shipping | Daily |

| New York Fed Global Supply Chain Pressure Index | Federal Reserve Bank of New York | Transportation costs and regional PMI data | Cross-sectional pressure across multiple dimensions | Monthly |

As shown, the GEP indexs unique advantage is its foundation in actual transactional data, moving beyond sentiment to capture what companies are physically doing.

INTEGRATING THE INDEX INTO YOUR SUPPLY CHAIN STRATEGY

Knowledge without action is meaningless. The true value of monitoring the GEP Global Supply Chain Volatility Index comes from embedding it into your organizations rhythm of business.

Based on my experience consulting with procurement teams, the most successful ones treat the index as a formal agenda item in their monthly S&OP (Sales and Operations Planning) meetings. It provides the external context for internal debates about inventory targets and demand forecasts. For example, a persistently high index reading might justify the financial case for investing in a dual-sourcing strategy for a critical component, even if the upfront cost seems high.

Furthermore, the regional data can guide near-shoring or friend-shoring decisions. If volatility is consistently higher in one major sourcing region, it adds a quantitative risk premium to the total landed cost calculation from that region, potentially making alternative regions more attractive on a risk-adjusted basis.

Interestingly, the index can also be a valuable tool for communication with finance and executive leadership. It translates complex supply chain dynamics into an authoritative, third-party metric that can justify budget requests for resilience initiatives.

ACTIONABLE CHECKLIST FOR USING THE GEP VOLATILITY INDEX

To operationalize the insights from this guide, follow this concrete checklist.

SUBSCRIBE TO THE MONTHLY GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX REPORT. Ensure it is delivered to key stakeholders in supply chain, procurement, and finance.

ASSIGN OWNERSHIP FOR INTERPRETATION. Designate an analyst or planner to be responsible for summarizing the monthly report and its implications for your business.

CREATE A SIMPLE TRACKING DASHBOARD. Plot the headline index and relevant regional index against your companys key performance indicators, like purchase price variance and on-time delivery.

DEFINE TRIGGER THRESHOLDS. Establish clear rules. For example, IF the index is above +0.5 for three consecutive months, THEN we will convene a risk mitigation task force.

INTEGRATE FINDINGS INTO EXISTING PROCESSES. Present the index analysis in S&OP, supplier review meetings, and quarterly business reviews.

REVIEW AND REFINE YOUR STRATEGY QUARTERLY. Use the trend analysis to validate or challenge your current supply chain strategy and adjust as necessary.

By treating the GEP Global Supply Chain Volatility Index not as just another data point but as a strategic compass, you can proactively navigate uncertainty. In an era defined by disruption, this foresight is the ultimate competitive advantage. Start by monitoring the index, but aim to master it. Your supply chains resilience depends on it.