# Can a Trust Buy Property? The Ultimate Guide to Ownership, Benefits, and Process

The question “can a trust buy property” is a powerful one, opening the door to sophisticated estate and asset protection planning. The direct answer is YES, a trust can absolutely buy, hold, and sell real estate. But the real value lies in understanding the HOW and the profound WHY behind this strategy. This comprehensive guide will move beyond the simple yes or no, diving deep into the mechanics, advantages, and critical steps involved when a trust becomes a property owner. We will explore the different types of trusts used for this purpose, the process of acquisition, and the common pitfalls to avoid.

For many individuals and families, holding property in a trust is not just an option; it is a strategic cornerstone for preserving wealth and ensuring a smooth transition for future generations. According to a 2023 report by the American College of Trust and Estate Counsel, utilizing trusts for real estate holdings has seen a steady increase, particularly for properties valued over one million dollars, due to the clarity and control they provide beyond a simple will.

## Understanding the Trust as a Legal Property Owner

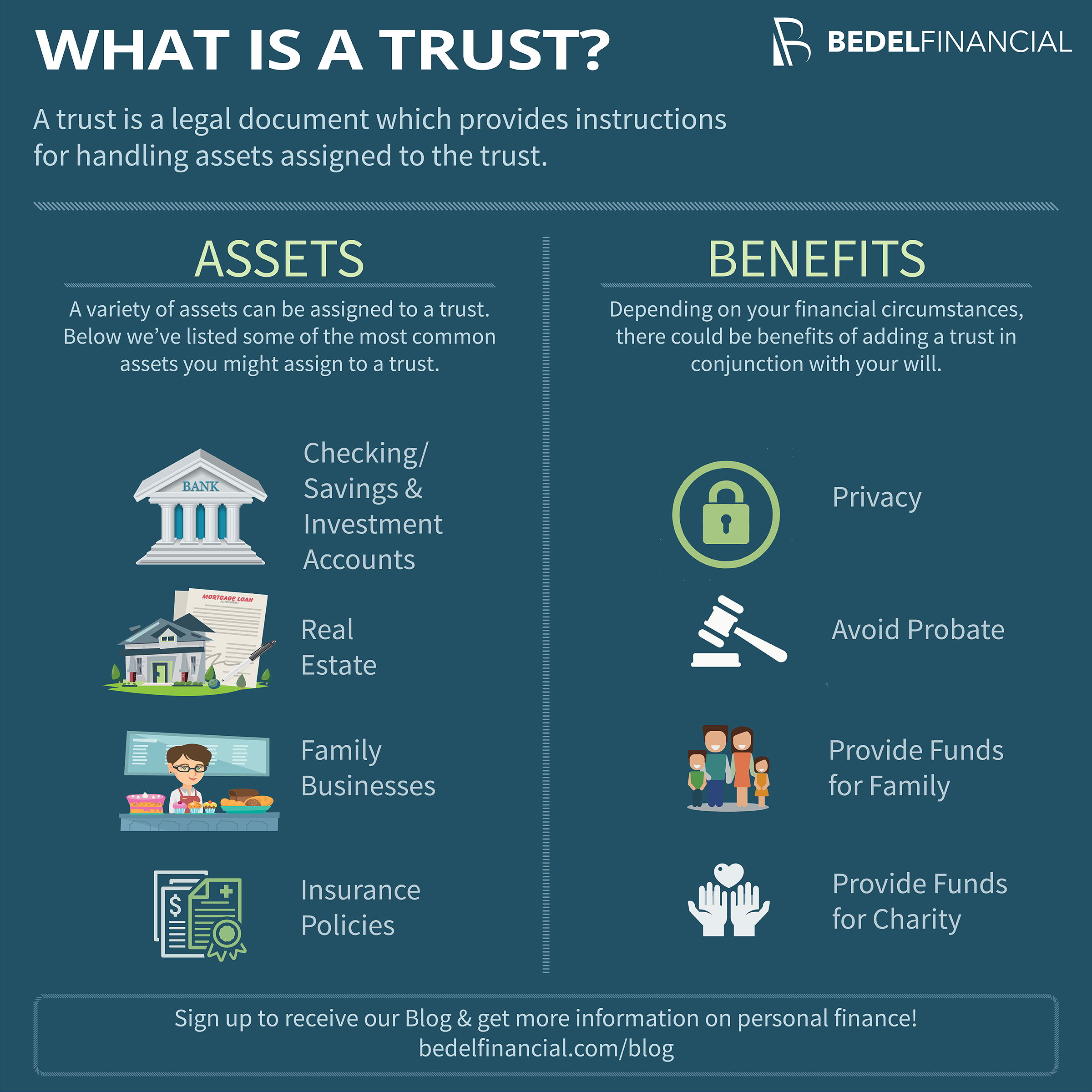

A trust is not a ghost or a vague concept. It is a formal legal arrangement where one party, the trustee, holds legal title to assets for the benefit of another party, the beneficiary. When you ask “can a trust buy property,” you are essentially asking if this legal arrangement can enter into a contract, which it can through its trustee.

The trustee acts on behalf of the trust. So, when a property is purchased, the deed will read something like: “John Doe, as Trustee of the Doe Family Trust dated January 1, 2024.” This means John Doe is signing the documents and managing the asset, but he is doing so in his capacity as a fiduciary for the trust, not for his personal benefit. The trust agreement itself is the governing document that outlines all the rules for how that property is to be managed, used, and eventually distributed.

## Key Reasons Why You Would Have a Trust Buy Property

The decision to have a trust purchase real estate is driven by specific, often compelling goals. It is far more than a technicality.

PROBATE AVOIDANCE is perhaps the most common driver. Property held in a revocable living trust bypasses the probate court process entirely. This means upon the grantor’s passing, the property can be transferred to beneficiaries privately, quickly, and with significantly lower costs and no public court records. A study from LegalShield noted that probate can often consume 3-7% of an estate’s value and take 12-18 months, making avoidance a key financial benefit.

ASSET PROTECTION is crucial, especially with irrevocable trusts. By placing property in certain types of irrevocable trusts, you can potentially shield it from future personal creditors, lawsuits, or even certain divorce proceedings. The property is no longer considered your personal asset.

PRIVACY AND CONTROL are paramount. A trust agreement is a private document. Unlike a will, which becomes a public record during probate, the terms of who inherits the property and under what conditions remain confidential. Furthermore, you can set precise terms, like allowing a spouse to live in the home for life before it passes to children from a prior marriage.

ESTATE TAX PLANNING can be optimized. For larger estates, certain irrevocable trust structures can help minimize or even eliminate state and federal estate taxes, preserving more wealth for your heirs.

## The Step-by-Step Process: How a Trust Buys Property

The process is methodical and requires attention to detail. Here is a practical, five-step guide.

STEP 1: ESTABLISH THE TRUST. The trust must be properly created and funded before any transaction. This involves working with an attorney to draft the trust agreement, which names the grantor, trustee(s), and beneficiaries, and outlines all terms. The trust then receives a formal Tax Identification Number (EIN) from the IRS if it is irrevocable, or may use the grantor’s Social Security Number if it is a revocable living trust.

STEP 2: SECURE FINANCING. If the trust needs a mortgage, this step is critical. Lenders will scrutinize the trust agreement. They need to confirm the trustee has the authority to borrow money and pledge the property as collateral. The loan will be in the name of the trust, and the trustee will personally sign the loan documents. This process can be more complex than a standard individual mortgage.

STEP 3: EXECUTE THE PURCHASE CONTRACT. The offer and purchase agreement should be made in the name of the trust. The buyer line would read: “The Smith Family Revocable Living Trust, dated June 10, 2023, John Smith, Trustee.” The trustee signs all contracts.

STEP 4: CONDUCT DUE DILIGENCE AND CLOSE. Title and escrow companies will need a copy of the trust agreement, specifically the signature page and the pages granting the trustee power over real estate. They ensure the trustee is acting within their authority. At closing, the deed is prepared showing the trust as the new legal owner.

STEP 5: MANAGE THE PROPERTY POST-CLOSING. All ongoing matters—insurance, property taxes, maintenance—must be handled in the name of the trust. Insurance policies should list the trust as the insured owner. Rental income, if any, is paid to the trust.

## Revocable vs. Irrevocable Trusts for Property: A Critical Comparison

Choosing the right type of trust is the most important decision. The table below clarifies the fundamental differences in the context of buying property.

| Aspect | Revocable Living Trust | Irrevocable Trust |

|---|---|---|

| Control | The grantor (creator) typically remains the trustee and retains full control. They can sell, refinance, or revoke the trust at any time. | The grantor gives up control. An independent trustee manages the asset. The grantor cannot easily revoke or alter the terms. |

| Asset Protection | NO. Assets are still considered part of the grantor’s estate and are vulnerable to creditors. | YES. Properly structured, it can provide a strong shield against creditors and lawsuits. |

| Tax Treatment | Grantor trust rules apply. All income and deductions flow to the grantor’s personal tax return. | The trust files its own tax return using its EIN. It may be subject to different tax brackets. |

| Primary Goal | Avoid probate, maintain privacy, and ensure seamless inheritance. | Asset protection, Medicaid planning, and advanced estate tax reduction. |

## Common Pitfalls and Essential Warnings

Navigating trust-owned real estate is not without its hazards. Being aware of these common mistakes can save you significant legal and financial headache.

WARNING: IMPROPER TITLE HOLDING. The single biggest error is failing to properly title the property in the trust’s name after purchase. If you buy as an individual and later try to transfer it, you might trigger a due-on-sale clause in your mortgage or create unnecessary complications. Always buy in the name of the trust from the outset.

WARNING: IGNORING FINANCING COMPLEXITIES. Not all lenders are comfortable with trust mortgages. Start conversations with lenders early and ensure your trust document has clear language authorizing the trustee to obtain financing. Be prepared for additional paperwork.

WARNING: MIXING PERSONAL AND TRUST ASSETS. The trustee must keep trust affairs completely separate. Paying for a trust property’s repair with a personal check, or depositing rental income into a personal account, can “pierce the trust veil,” potentially negating its legal protections. All transactions must flow through dedicated trust accounts.

WARNING: USING A GENERIC, “BOILERPLATE” TRUST AGREEMENT. Real estate is a major asset. Your trust agreement must be custom-drafted to address specific scenarios: Can the trustee sell the property? Under what conditions? How are expenses and income allocated among multiple beneficiaries? A one-size-fits-all document is a recipe for future conflict.

From my experience consulting with clients, the most successful outcomes arise when the trust is integrated into a holistic plan. We recently worked with a family who used an irrevocable trust to purchase a vacation property. The primary goal was asset protection for their family business, but they nearly derailed the process by trying to use a standard online form. A customized agreement addressed their unique concerns about usage rights among siblings, saving them from potential litigation down the road.

## Your Action Checklist for Having a Trust Buy Property

Before you proceed, use this practical checklist to ensure you are on the right path.

CONSULT WITH A QUALIFIED ESTATE PLANNING ATTORNEY. This is non-negotiable. Do not rely on generic advice or documents.

DECIDE ON THE TRUST TYPE. With your attorney, determine if a revocable or irrevocable trust aligns with your goals of probate avoidance, control, and asset protection.

DRAFT AND EXECUTE A COMPREHENSIVE TRUST AGREEMENT. Ensure it includes explicit powers for the trustee to buy, sell, lease, and mortgage real estate.

OBTAIN AN EIN FOR THE TRUST. If it is irrevocable, get this number from the IRS immediately. For revocable trusts, confirm with your attorney and CPA whether to use an EIN or your SSN.

PRE-QUALIFY FINANCING WITH LENDER. Approach lenders who have experience with trust-based mortgages and get pre-approval in the trust’s name.

INSTRUCT YOUR REAL ESTATE AGENT AND TITLE COMPANY. Clearly communicate that the buyer is the trust, and provide them with the necessary trust documentation upfront.

MAINTAIN IMMACULATE FINANCIAL RECORDS. Open a dedicated bank account for the trust and use it for all property-related income and expenses.

So, can a trust buy property? Absolutely. It is a proven, powerful tool for savvy investors and families looking to protect their legacy. However, its effectiveness hinges on precise execution and professional guidance. By understanding the reasons, following the correct process, and diligently avoiding the common pitfalls, you can leverage this strategy to achieve greater security, privacy, and peace of mind for your real estate holdings.