Understanding the landscape of the largest retailers worldwide is crucial for anyone in business, investing, or simply curious about global commerce. These corporate giants shape consumer trends, influence supply chains, and set the pace for the entire industry. This guide provides a deep dive into the titans of retail, exploring their strategies, the metrics that define their size, and the key trends they are driving.

# Who Are the Largest Retailers Worldwide?

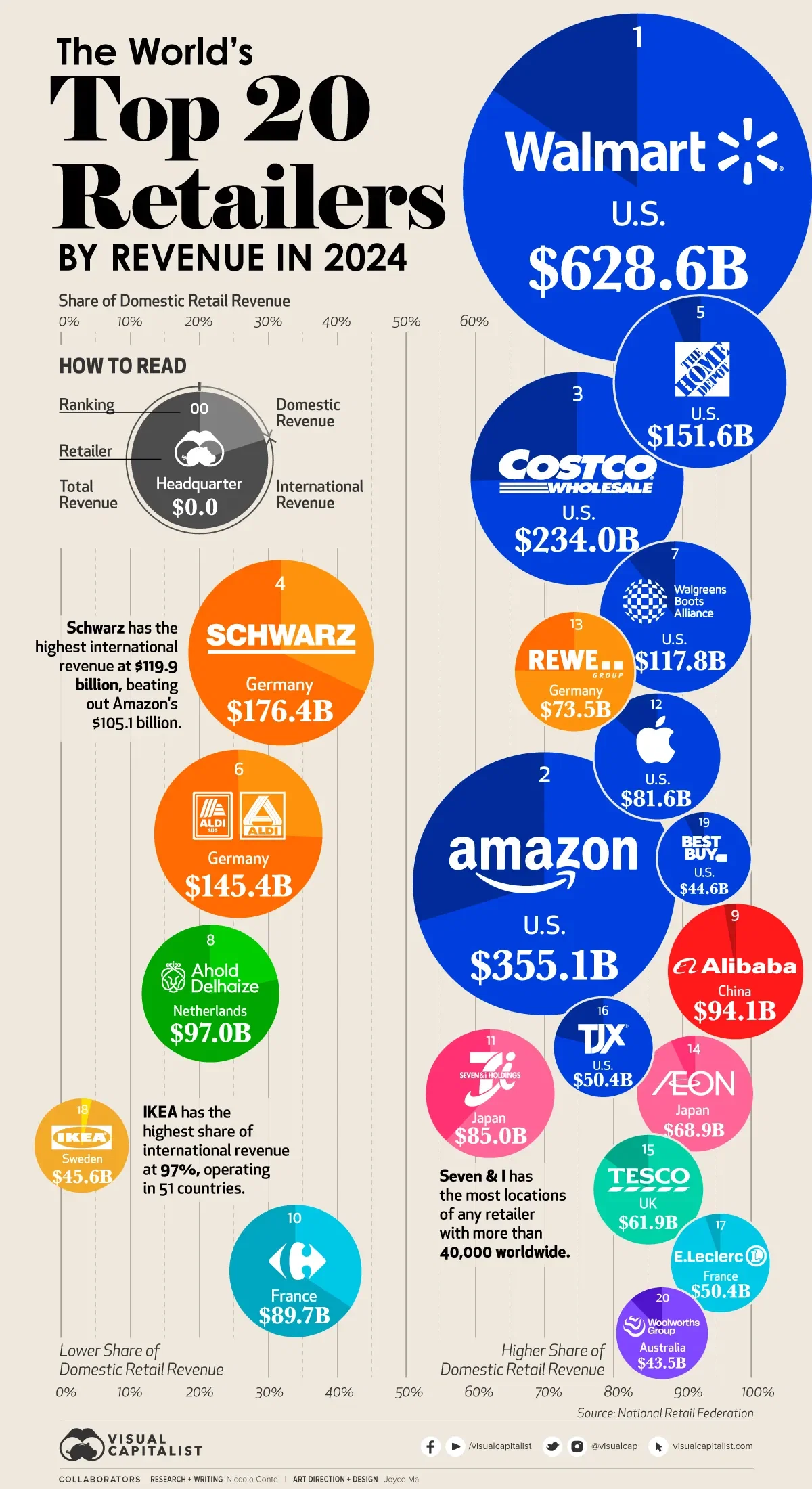

The title of “largest” can be measured in several ways, primarily by annual revenue and by market capitalization. Revenue reflects the sheer volume of sales a company generates, while market cap represents the total market value of its outstanding shares, indicating investor confidence and future growth potential. The most common and straightforward ranking is based on annual retail revenue. According to the National Retail Federation and Deloitte’s annual Global Powers of Retailing report, the list is consistently dominated by a mix of American hypermarket chains, e-commerce behemoths, and European discount giants. For instance, in the 2024 ranking, Walmart maintained its decades-long position at the top with over 600 billion U.S. dollars in revenue, a figure that surpasses the GDP of many countries (source: National Retail Federation).

# The Top Contenders and Their Dominant Models

The elite group of the largest retailers worldwide can be segmented by their core business models. This segmentation helps explain their success and market positioning.

E-COMMERCE AND OMNICHANNEL LEADERS: This category is defined by Amazon, the undisputed king of online retail. Its model is built on an unparalleled logistics network, a vast third-party marketplace, and subscription services like Prime. Chinese giant JD.com also fits here, with its emphasis on fast, reliable direct sales and logistics.

HYPERMARKET AND SUPERSTORE GIANTS: Walmart is the archetype. Its model leverages massive physical footprints, extreme supply chain efficiency for low costs, and a growing omnichannel presence with curbside pickup and delivery. Similar players include Costco, with its membership warehouse model, and France’s Carrefour.

DISCOUNT AND VALUE RETAILERS: This sector is led by European powerhouses like Aldi and Lidl. Their model focuses on a limited selection of private-label goods, operational frugality, and high volume to offer the lowest possible prices. They have seen explosive global growth by disrupting traditional grocery markets.

APPAREL AND SPECIALTY RETAILERS: While not always topping the overall revenue charts, companies like Inditex (Zara) and H&M are giants in their vertical. Their fast-fashion model, characterized by rapid design-to-store cycles and trend responsiveness, has revolutionized the industry.

Here is a comparison of two dominant but distinct models from the list of the largest retailers worldwide:

| Retailer (Model) | Core Strategy | Key Strength | Primary Customer Appeal |

|---|---|---|---|

| Amazon (E-commerce & Omnichannel) | Maximum selection, convenience, and speed via technology and logistics. | Network effect, data dominance, and fulfillment infrastructure. | Unbeatable convenience, vast product range, and fast delivery. |

| Aldi (Hard Discount) | Extreme cost-cutting on products, operations, and store experience. | Unmatched supply chain efficiency and private-label control. | The absolute lowest price on essential groceries and goods. |

# How Did They Get So Big? Key Growth Strategies

The ascent of the largest retailers worldwide is not accidental. It is the result of deliberate, scalable strategies. First, supply chain mastery is non-negotiable. Walmart’s cross-docking logistics and Amazon’s robotic fulfillment centers are legends in efficiency, minimizing costs and delivery times. Second, private label proliferation has been a massive profit driver. From Amazon Basics to Kirkland Signature at Costco, these high-margin brands build customer loyalty and insulate retailers from supplier pricing. Third, strategic acquisitions have fueled expansion. A prime example is Amazon’s purchase of Whole Foods, which instantly gave it a high-end physical grocery footprint. Fourth, the relentless pursuit of omnichannel integration is now standard. The goal is a seamless experience whether a customer shops on a phone, online, or in-store. Based on my experience analyzing retail trends, we often see that the most successful players treat their physical stores not just as sales floors but as localized fulfillment hubs for online orders.

# A Step-by-Step Guide to Analyzing Any Major Retailer

If you want to understand any company on the list of the largest retailers worldwide, follow this analytical framework.

STEP 1: IDENTIFY THE CORE BUSINESS MODEL. Determine if it is primarily e-commerce, discount, wholesale, specialty, or a hybrid. This is the foundation of all analysis.

STEP 2: EXAMINE THE FINANCIAL METRICS. Look beyond total revenue. Analyze growth rates, profit margins (gross and net), and same-store sales growth. Compare these to direct competitors.

STEP 3: ASSESS THE SUPPLY CHAIN AND LOGISTICS. Research how the company manages inventory, distributes goods, and handles last-mile delivery. This is a major source of competitive advantage or weakness.

STEP 4: EVALUATE THE CUSTOMER VALUE PROPOSITION. What is the main promise? Is it lowest price (Aldi), best convenience (Amazon), curated selection (Costco), or latest trends (Zara)?

STEP 5: SCRUTINIZE TECHNOLOGY AND DATA USAGE. How is the company using data analytics, AI, and mobile technology to personalize marketing, optimize inventory, and improve the customer journey?

STEP 6: MONITOR EXPANSION AND INTERNATIONAL STRATEGY. Is growth coming from new store openings, new markets, online channel growth, or acquisitions?

STEP 7: REVIEW SUSTAINABILITY AND ESG FACTORS. Increasingly, consumer and investor sentiment is influenced by a retailer’s environmental, social, and governance policies. This includes supply chain ethics and carbon footprint.

# Common Misconceptions and Pitfalls to Avoid

When discussing the largest retailers worldwide, several misconceptions are common. A major one is equating “largest by revenue” with “most profitable.” Some high-volume retailers operate on razor-thin net profit margins, while smaller, luxury-focused retailers can be far more profitable per sale. Another pitfall is overlooking regional champions. While the global list is dominated by U.S. and European names, massive retailers like Suning.com in China or E-mart in South Korea dominate their home markets and are critical to understand for a complete global picture. Finally, do not assume physical retail is dead. The narrative of “brick-and-mortar vs. online” is outdated. The true leaders are those mastering omnichannel, using stores as assets for returns, pickups, and experiences. For example, over 50% of Target’s digital sales in a recent quarter were fulfilled by stores (source: Target Corporate Earnings Report).

# The Future Trends Shaping Global Retail Giants

The future for the largest retailers worldwide will be defined by several converging trends. Artificial Intelligence is moving from recommendation engines to autonomous inventory management, dynamic pricing, and loss prevention. Sustainability is transitioning from a marketing slogan to a core operational requirement, affecting packaging, sourcing, and energy use. Furthermore, the rise of social commerce and live-stream shopping, particularly in Asia, is creating a new, direct-to-consumer sales channel that blends entertainment and instant purchasing. Anticipating and investing in these areas will separate the future leaders from the followers.

# Your Actionable Checklist for Understanding Retail Giants

To effectively research and comprehend the largest retailers worldwide, use this practical checklist.

IDENTIFY the primary metric for “size” in your analysis: revenue, market cap, or physical store count.

CLASSIFY the retailer’s core business model among the key types: e-commerce, discount, hypermarket, warehouse club, or specialty.

ANALYZE the annual financial reports, focusing on revenue growth trend and net profit margin.

MAP the omnichannel capabilities, noting how online and physical operations integrate.

INVESTIGATE the private label strategy and the percentage of sales it represents.

EVALUATE the international presence and identify which regions are growth engines.

RESEARCH the key technological investments in logistics, AI, and customer data.

ASSESS the public sustainability commitments and any related supply chain audits.

COMPARE the retailer against its two closest competitors using a side-by-side table.

MONITOR quarterly earnings calls and news for strategic shifts and executive commentary.