# Understanding Price Elasticity of Luxury Goods

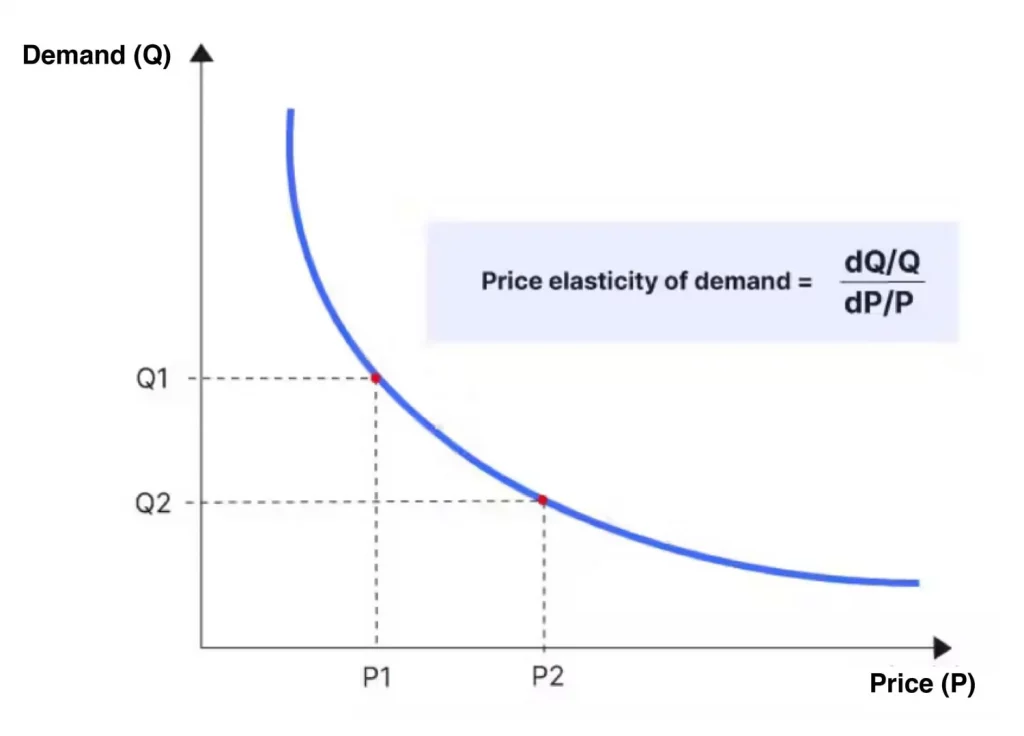

Price elasticity is a fundamental economic concept. It measures how sensitive the quantity demanded of a product is to a change in its price. For most everyday items, this relationship is straightforward: a price increase typically leads to lower demand. However, the world of luxury goods operates by a different, often counterintuitive, set of rules. The price elasticity of luxury goods is a fascinating and complex topic that challenges conventional economic wisdom. This guide will explore why luxury goods often defy standard demand curves, how brands strategically manipulate this phenomenon, and what it means for your marketing and pricing strategy.

At its core, the price elasticity of luxury goods is frequently inelastic or even exhibits a Veblen effect. Inelastic demand means that price changes have a relatively small impact on the quantity sold. The Veblen effect takes this further, suggesting that for certain conspicuous luxury items, higher prices can actually increase their desirability and demand because they serve as a stronger signal of status and exclusivity. Understanding this dynamic is not just academic; it is crucial for anyone involved in the marketing, branding, or financial planning of high-end products.

## The Counterintuitive Nature of Luxury Demand

Why do luxury goods behave this way? The answer lies in the psychological and social drivers behind luxury purchases. These products are not merely bought for their functional utility. They are acquired for the emotional value, identity expression, and social signaling they provide. A handbag is not just for carrying items; it is a symbol of taste, success, and belonging to an exclusive group.

This shifts the demand curve. For a true luxury item, the perceived value is intrinsically tied to its high price point. Lowering the price can dangerously dilute the brand’s aura of exclusivity, potentially alienating core customers who derive status from the purchase. Conversely, a strategic price increase can enhance the product’s allure, making it more aspirational. This creates a unique scenario where the traditional law of demand is suspended, or even reversed, within a specific price band.

## Key Factors Influencing Luxury Price Elasticity

Several interconnected factors determine how elastic or inelastic a luxury good’s price will be. Not all luxury items are created equal, and their sensitivity to price changes varies significantly.

BRAND EQUITY AND HERITAGE: A brand with a long, storied history and unwavering commitment to craftsmanship (like Hermès or Rolex) cultivates immense brand equity. This deep reservoir of perceived value makes its products highly inelastic. Customers are paying for a legacy, not just an object.

LEVEL OF EXCLUSIVITY AND SCARCITY: Artificial or natural scarcity is a powerful tool. Limited edition releases, waitlists, and controlled production runs create a perception of exclusivity that makes demand highly insensitive to price. The product’s availability becomes a bigger constraint than its cost.

PRODUCT CATEGORY AND CONSPICUOUSNESS: A product meant to be seen and recognized (a luxury car, a designer logo handbag) is more likely to exhibit Veblen characteristics than a private luxury (high-end bedding, bespoke tailoring). The more a product is used for public display of status, the more its high price becomes a feature, not a bug.

CONSUMER SEGMENT: The ultra-wealthy segment has a vastly different perception of price. For them, the cost is often a secondary consideration to the experience, quality, and status conferred. Their demand is far more inelastic compared to aspirational buyers who are stretching their budget to enter the luxury sphere.

## A Comparative View: Luxury vs. Mass-Market Elasticity

To truly grasp the uniqueness of luxury, it helps to contrast it with mass-market goods. The following table highlights the fundamental differences in how price changes affect demand across these two worlds.

| Factor | Mass-Market / Necessity Goods | True Luxury Goods |

|---|---|---|

| Primary Purchase Driver | Functional utility, convenience, price. | Emotional value, status, exclusivity, brand story. |

| Typical Price Elasticity | Elastic. Small price hikes can lead to significant drops in demand as consumers switch to substitutes. | Inelastic or Veblen. Demand may remain stable or even increase with price within the brand’s “luxury band.” |

| Role of Price | A barrier to purchase. Lower is generally better. | A signal of quality and exclusivity. Too low can damage perception. |

| Impact of Discounting | Effective for clearing inventory and boosting short-term volume. | Extremely risky. Can permanently erode brand equity and alienate core customers. |

| Consumer Relationship | Transactional. | Aspirational and emotional. |

## The Strategic Implications for Luxury Brands

Understanding inelastic demand provides a powerful toolkit for luxury brand managers. It informs critical decisions beyond simple pricing.

PREMIUM PRICING AS A CORNERSTONE: Luxury brands can and should command premium prices that far exceed the cost of materials and production. This margin is not just profit; it funds the marketing, retail experience, and craftsmanship that sustain the brand myth. A study by Bain & Company consistently shows that the personal luxury goods market grows even amid global economic uncertainty, underscoring the resilience of well-managed brands (来源: Bain & Company Luxury Study).

CONTROLLING DISTRIBUTION AND AVOIDING DISCOUNTS: To protect price integrity, luxury brands must maintain ironclad control over their distribution channels. Selling through unauthorized discounters or outlet malls can shatter the illusion of exclusivity. The primary sales channel should be owned boutiques or carefully vetted high-end partners.

COMMUNICATING VALUE BEYOND THE PRODUCT: Marketing must focus on the intangible: the heritage, the artisan’s touch, the unique experience. Price is rarely the headline. Instead, storytelling builds the emotional justification for the price point. As one Harvard Business Review article noted, “Luxury is the systematic manipulation of dreams.”

INNOVATING WITHIN THE BRAND CODE: Even when introducing new products or lines, innovation must happen within the boundaries of the brand’s established codes of luxury. Radical departures that make the product seem “cheap” or “common” can trigger negative elasticity.

## A 5-Step Framework for Analyzing Your Brand’s Price Elasticity

How can you apply this knowledge? Here is a practical, step-by-step guide to assess and leverage price elasticity for a luxury or premium brand.

STEP 1: DEFINE YOUR “LUXURY BAND.” Identify the price range within which your target customer perceives your product as authentically luxurious. This is not a single point but a zone. Pricing below this band makes you “premium”; pricing too far above it may make you unattainable even to your target market.

STEP 2: SEGMENT YOUR CUSTOMERS. Clearly distinguish between your core, high-net-worth clients and your aspirational buyers. Their elasticity will differ dramatically. Your pricing and communication strategy should primarily cater to the inelastic core segment.

STEP 3: AUDIT YOUR DISTRIBUTION AND PRICE CONSISTENCY. Map every point of sale, both physical and digital. Ensure there are no leaks where your product is sold at a discount without your explicit strategic consent (e.g., a seasonal private sale for loyal clients is very different from a perpetual discount on a marketplace).

STEP 4: CONDUCT DISCREET PRICE SENSITIVITY TESTING. This must be done carefully to avoid brand damage. Methods can include A/B testing on discreet online channels, limited regional adjustments, or introducing a new, slightly higher-priced variant to gauge reaction before adjusting the core line.

STEP 5: MONITOR COMPETITIVE POSITIONING AND BRAND PERCEPTION. Use social listening, customer surveys, and net promoter scores (NPS) to track how price changes or competitor actions affect your brand’s perceived exclusivity and desirability. Perception is your most valuable asset.

## Common Pitfalls and Warnings

A critical misunderstanding of price elasticity leads to catastrophic mistakes in the luxury sector.

WARNING: DO NOT CONFUSE LUXURY WITH PREMIUM. Many “premium” brands (e.g., some high-end electronics or kitchen appliances) have elastic demand. They compete on features and quality at a price. Applying true luxury inelastic pricing strategies to a premium product can lead to rapid loss of market share to competitors. The key differentiator is whether the primary purchase driver is emotional status or enhanced functional utility.

Another major pitfall is knee-jerk discounting during economic downturns. While tempting to maintain volume, it can permanently reset consumer expectations for your brand’s value. Based on my experience consulting for heritage brands, we have seen that brands which maintained price integrity and doubled down on client experience during recessions recovered their market position much faster and stronger than those who engaged in widespread promotion.

## Real-World Data and the Pandemic Test

The COVID-19 pandemic served as a real-world stress test for the price elasticity of luxury goods. Initially, sales plummeted due to store closures. However, the rebound was telling. According to data from McKinsey, the global luxury market showed remarkable resilience, with a swift V-shaped recovery driven by robust demand in China and sustained spending by local consumers in other regions (来源: McKinsey State of Fashion 2022 Report). This period also accelerated the shift to online channels, forcing brands to recreate digital exclusivity—a challenge that further separated brands with strong inelastic equity from those without.

## Final Checklist for Managing Luxury Price Elasticity

To ensure your strategy aligns with the principles of luxury price elasticity, use this actionable checklist. Answer YES or NO to each point.

– Our brand story and heritage are central to our marketing communications, not just product features.

– We have a clear definition of our core, high-net-worth customer segment and tailor strategies to them first.

– Our distribution channels are tightly controlled to prevent unauthorized discounting.

– We view our price as a key component of our brand’s exclusive image.

– We avoid public, widespread discounting and instead use selective, client-centric offers.

– We continuously monitor brand perception metrics, not just sales volume.

– We understand the difference between our inelastic iconic products and our more elastic entry-point or extension products.

– Our leadership team understands that protecting long-term brand equity is more important than short-term volume gains.

Mastering the price elasticity of luxury goods is about understanding psychology as much as economics. It requires the discipline to resist short-term volume tactics in favor of long-term brand building. By strategically leveraging inelastic demand, luxury brands can create enduring value, foster unwavering customer loyalty, and build enterprises that transcend generations.