# The Ultimate Guide to the Luxury Wines and Spirits Market: Trends, Data, and Strategy

The luxury wines and spirits market is not just about expensive bottles. It is a complex ecosystem driven by heritage, scarcity, and evolving consumer desires. For investors, collectors, and industry professionals, understanding this market is crucial. This guide provides a deep dive into its current dynamics, key players, and future trajectory.

We will explore what defines luxury in this sector, analyze the major driving forces, and offer actionable strategies for engagement. Whether you are looking to invest, build a brand, or simply comprehend the high-end alcobev landscape, this resource is designed for you.

## What Defines the Luxury Wines and Spirits Segment?

Luxury in wines and spirits transcends high price tags. It is an amalgamation of several non-negotiable factors. First, provenance and terroir are paramount. A Champagne from a specific grand cru vineyard or a Scotch from a revered Islay distillery carries a story in every sip. Second, rarity plays a critical role. Limited production runs, single cask releases, or vintage-specific offerings create exclusivity.

Third, craftsmanship and heritage are the bedrock. Decades, sometimes centuries, of family ownership or master distiller/blender expertise command respect and premium pricing. Finally, brand narrative and presentation are essential. The packaging, the history, and the overall experience of ownership contribute significantly to the perceived value. This segment caters to consumers seeking not just a beverage, but an artifact and a statement.

## Key Drivers and Trends Shaping the Market

The luxury wines and spirits market is undergoing significant transformation. Several powerful trends are reshaping consumer behavior and industry strategies.

The rise of the experience economy is a major driver. Consumers, especially younger high-net-worth individuals, value experiences over mere possession. This has led to growth in luxury bar experiences, distillery tours at iconic estates, and curated tasting events. The digitalization of luxury is another key trend. While traditional brick-and-mortar retailers remain important, online platforms for rare spirits and fine wine auctions have democratized access to some extent.

Furthermore, sustainability and conscious consumption are no longer niche concerns. Luxury buyers increasingly inquire about organic viticulture, biodynamic practices, and the environmental footprint of production. A brand’s commitment to ethical sourcing and environmental stewardship can be a powerful differentiator. Interestingly, the growth of Asian markets, particularly China and India, continues to be a primary engine for expansion, with a growing appetite for both Western icons and local premium brands.

## Major Players and Market Segments Analysis

The market can be broadly segmented by product type and geography. In wines, the classic regions of Bordeaux, Burgundy, Champagne, and Tuscany dominate the luxury conversation, alongside cult producers from Napa Valley and emerging regions like Oregon and Argentina. For spirits, the landscape is led by prestige Cognac, single malt Scotch, Japanese whisky, and ultra-premium tequila and rum.

The competitive landscape features a mix of family-owned estates and giants of the global luxury wines and spirits market. Conglomerates like LVMH, Pernod Ricard, and Diageo hold portfolios of legendary brands, leveraging vast distribution networks. However, smaller, independent producers often set trends and command extreme loyalty for their artisanal offerings.

Here is a comparison of two dominant segments within the luxury spirits category:

| Feature | Super-Premium Single Malt Scotch | Prestige Cognac |

|---|---|---|

| Core Appeal | Terroir expression, aging process, distillery character. | Blending artistry, house style, consistency across decades. |

| Key Consumer Base | Global collectors, enthusiasts in Europe, North America, Asia. | Stronghold in East Asia, traditional gift market, luxury nightlife. |

| Price Driver | Age statement, cask type (sherry, bourbon), limited editions. | Vintage designation, cru (growth region), producer prestige (e.g., Grande Champagne). |

| Market Dynamics | High auction activity, secondary market for rare bottles. | Brand loyalty is paramount, often consumed in social settings. |

## A Five-Step Guide to Investing in Luxury Wines and Spirits

Investing in this market can be rewarding but requires knowledge and caution. It is not a shortcut to wealth. Follow this structured approach.

STEP 1: EDUCATE YOURSELF RELENTLESSLY. Before spending any money, immerse yourself in the category of interest. Read critic reviews, follow auction results, and understand the factors that influence quality and value. Knowledge is your primary asset.

STEP 2: DEFINE YOUR GOAL AND BUDGET. Are you building a collection for personal enjoyment with potential appreciation, or is this a purely financial investment? Your goal dictates strategy. Set a clear, realistic budget and stick to it.

STEP 3: START WITH BLUE-CHIP NAMES. For beginners, the safest entry point is with established, highly sought-after producers from renowned regions. First-growth Bordeaux, top Champagne houses, or iconic single malt distilleries have proven long-term market resilience.

STEP 4: SOURCE FROM REPUTABLE CHANNELS. Only buy from trusted merchants, official distributors, or reputable auction houses. Provenance and proper storage are everything. A certificate of authenticity is often crucial for high-value items.

STEP 5: ENSURE PROFESSIONAL STORAGE. This is non-negotiable. Wine and spirits are physical assets vulnerable to heat, light, and vibration. Use a professional, climate-controlled storage facility. This protects your investment and is required by most future buyers.

## Common Pitfalls and Warnings for New Entrants

The allure of the luxury wines and spirits market can lead to costly mistakes. Here are critical warnings.

WARNING: BEWARE OF COUNTERFEITS. The market for fake luxury bottles is sophisticated. If a deal seems too good to be true, it almost certainly is. Be extra cautious with ultra-rare bottles sold outside official channels.

WARNING: DO NOT CHASE HYPE EXCLUSIVELY. While limited editions can be profitable, buying based solely on marketing buzz is risky. Many “hot” releases lose value quickly once the hype fades. Focus on underlying quality and brand legacy.

WARNING: LIQUIDITY IS NOT GUARANTEED. Unlike stocks, selling a bottle of wine or whisky can take time. You need to find the right buyer at the right moment. Do not invest money you may need to access quickly.

WARNING: IGNORING STORAGE COSTS. Professional storage is an ongoing annual expense that eats into potential returns. Factor this into your investment calculations from day one.

From our team’s experience consulting for new collectors, the single biggest error is impatience. Building a valuable collection or portfolio takes years, not months. The desire for quick returns leads to poor decisions. Successful participation in this market requires a long-term perspective and genuine passion for the category.

## The Future Outlook: What Lies Ahead?

The future of the luxury wines and spirits market looks robust but increasingly nuanced. Personalization will become more important. Brands will leverage data to offer bespoke experiences, from custom blends to personalized bottle engravings. The “better-for-you” trend will infiltrate luxury, with demand for low-ABV premium cocktails and spirits with perceived functional benefits.

Technology, particularly blockchain, is poised to play a larger role in combating counterfeiting and proving provenance. Each bottle could have a verifiable digital history. Finally, the definition of “luxury” will continue to expand. Craft producers from non-traditional regions, offering exceptional quality and story, will capture market share from established players who fail to innovate.

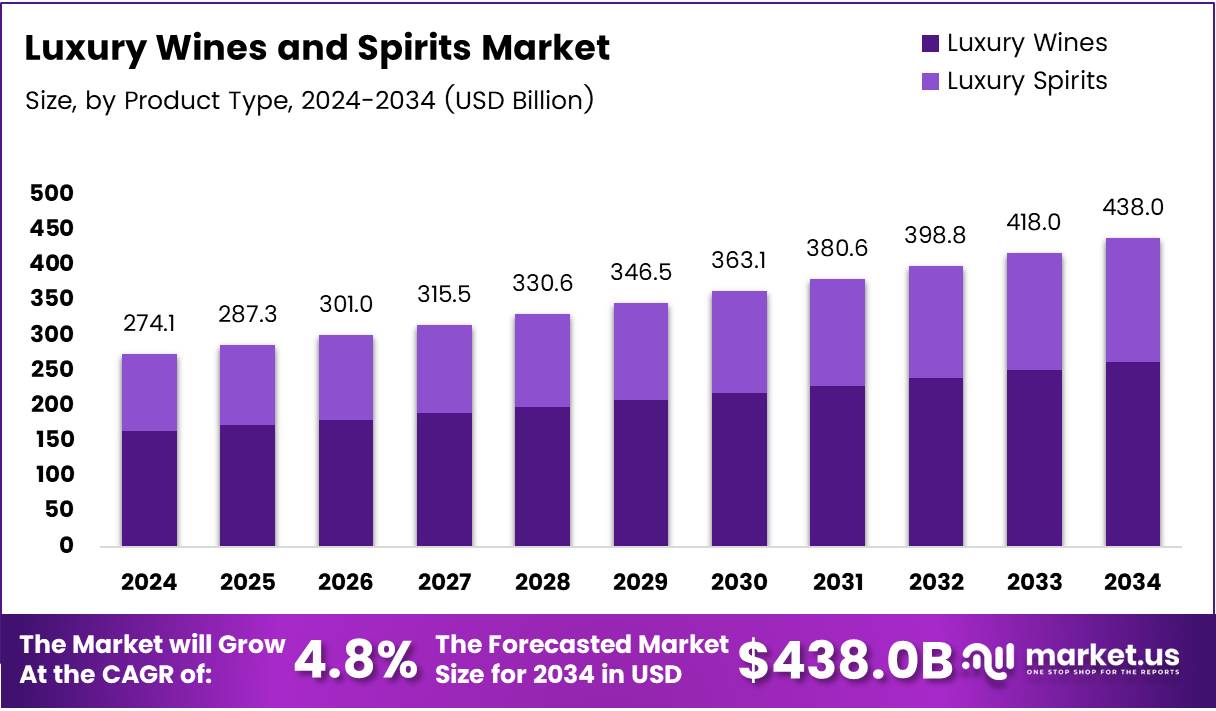

According to a report by Grand View Research, the global luxury spirits market size was valued at USD 22.34 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030 (source: Grand View Research). Another study highlights that online sales of fine wine and rare spirits are accelerating, a trend cemented during the pandemic and continuing its upward trajectory (source: Liv-ex Fine Wine Market Report).

The market’s fundamentals are strong, driven by global wealth creation and the enduring cultural cachet of fine drinks. However, the winners will be those who adapt to the new values of experience, authenticity, and responsibility.

## Your Actionable Checklist for the Luxury Market

To conclude, here is a practical checklist to guide your journey into the luxury wines and spirits market.

CONDUCT THOROUGH INITIAL RESEARCH ON YOUR TARGET SEGMENT.

SET A CLEAR FINANCIAL BUDGET AND INVESTMENT TIMEFRAME.

PRIORITIZE PURCHASES FROM REPUTABLE AND AUTHORIZED SOURCES ONLY.

ARRANGE PROFESSIONAL CLIMATE-CONTROLLED STORAGE IMMEDIATELY.

FOCUS ON ACQUIRING BLUE-CHIP AND PROVEN PRODUCERS FIRST.

CONTINUOUSLY MONITOR AUCTION RESULTS AND MARKET PUBLICATIONS.

BE PATIENT AND PREPARE FOR A LONG-TERM HOLDING PERIOD.

DIVERSIFY YOUR HOLDINGS ACROSS REGIONS AND PRODUCT TYPES OVER TIME.

VERIFY THE PROVENANCE OF EVERY HIGH-VALUE BOTTLE YOU ACQUIRE.

ENSURE YOU HAVE ADEQUATE INSURANCE COVERAGE FOR YOUR COLLECTION.