# The Ultimate Guide to the Price Elasticity of Demand of Luxury Goods: What Every Marketer Needs to Know

Understanding the price elasticity of demand of luxury goods is not just an academic exercise. It is a fundamental principle that dictates the success or failure of billion-dollar brands. In simple terms, price elasticity measures how sensitive the quantity demanded of a product is to a change in its price. For most goods, the rule is straightforward: higher prices lead to lower sales. But luxury goods play by a different set of rules. This guide will dissect this fascinating economic concept, providing you with actionable insights for strategy and marketing.

## What Is Price Elasticity? The Core Concept Explained

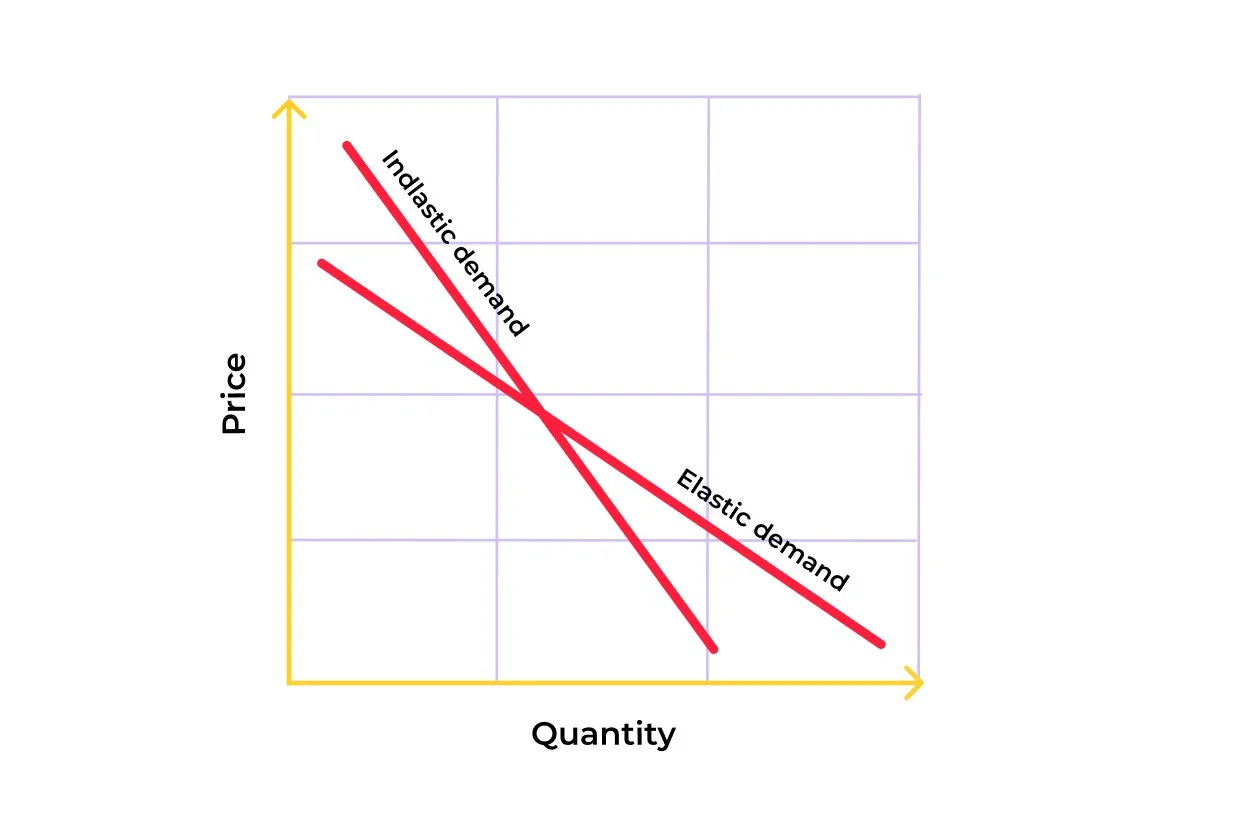

Price elasticity of demand (PED) is calculated as the percentage change in quantity demanded divided by the percentage change in price. A PED greater than 1 means demand is elastic, sensitive to price changes. A PED less than 1 means demand is inelastic, relatively insensitive to price. Everyday necessities like bread or medicine tend to be inelastic. Luxury goods, however, occupy a unique and often counterintuitive space on this spectrum.

## Why Luxury Goods Defy Conventional Economics

The demand for luxury items is frequently inelastic, but not for the reasons you might think. It is not about the product’s inherent utility. Instead, it is driven by powerful psychological and social factors. The Veblen Effect, named after economist Thorstein Veblen, is key here. For certain high-status goods, a higher price can actually increase their desirability because the price itself becomes a signal of exclusivity, quality, and prestige. This creates a perverse relationship where raising prices does not deter, but attracts, a specific clientele.

## Key Factors Influencing Luxury Demand Elasticity

Several interconnected factors determine the specific price elasticity of demand for a luxury item.

BRAND POWER AND HERITAGE: Established brands like Hermes or Rolex possess immense brand equity. Their history and perceived timeless value make their products less sensitive to price hikes compared to a newer, less prestigious brand.

PERCEIVED EXCLUSIVITY AND SCARCITY: Artificial scarcity, limited editions, and long waiting lists (like for a Birkin bag) deliberately restrict supply. This enhances the item’s exclusive appeal, making demand highly inelastic, as consumers are willing to pay a premium to access the inaccessible.

SUBSTITUTABILITY: A true luxury good has no close substitutes. If a consumer wants the status conferred by a specific Patek Philippe watch, a different brand simply will not do. This lack of alternatives makes demand more inelastic.

INCOME LEVEL OF TARGET CONSUMERS: For the ultra-wealthy, the price of a luxury handbag or sports car constitutes a tiny fraction of their wealth. Their demand is therefore far less sensitive to price changes than it would be for an aspirational buyer stretching their budget.

## Inelastic vs. Elastic Luxury: A Crucial Distinction

Not all items within the luxury sector behave the same. The market is stratified. Understanding this hierarchy is critical for pricing strategy. The table below contrasts typical characteristics of inelastic “absolute luxury” with more elastic “aspirational” or “accessible luxury” goods.

| Feature | Inelastic Absolute Luxury (e.g., High-End Watch, Couture) | More Elastic Accessible Luxury (e.g., Premium Handbag, Designer Fragrance) |

|---|---|---|

| Core Driver | Veblen Effect, Status, Investment | Brand Affiliation, Perceived Quality |

| Price Sensitivity | Very Low (PED < 1) | Moderate to High (PED often >=1) |

| Consumer Base | Ultra-High-Net-Worth Individuals | Affluent and Aspirational Middle Class |

| Substitutability | Extremely Low | Moderate (competition within segment) |

| Marketing Focus | Heritage, Craftsmanship, Rarity | Lifestyle, Trends, Accessibility |

## Real-World Data and Case Studies

The theory is compelling, but what does the data say? A study by researchers at Boston University and Harvard Business School analyzed data from a luxury retailer. They found that for the most exclusive product lines, a 1% price increase led to a less than 1% drop in sales volume, confirming inelastic demand. In some cases, sales volume even remained stable. (来源: Journal of Consumer Research).

Conversely, during economic downturns, the more accessible segments of luxury often see significant demand drops, revealing a higher elasticity. For instance, while sales of ultra-luxury cars may hold steady, sales of entry-level luxury sedans can plummet, showing how elasticity varies within the same broad category.

From my experience consulting with premium brands, I have seen this firsthand. We worked with a heritage leather goods company that was considering a price cut to boost market share. Our analysis of their customer data and brand positioning strongly advised against it. We argued it would dilute their exclusive appeal and could actually alienate their core, high-net-worth customers. They maintained their pricing and instead focused on enhancing the client experience. The result was sustained demand and increased brand equity.

## A 5-Step Framework to Analyze Elasticity for Your Brand

How can you apply this? Follow this actionable framework to assess the price elasticity of demand for your product or service.

STEP 1: DEFINE YOUR PRODUCT’S POSITION. Is it absolute luxury or accessible luxury? Use the table above as a guide. Be brutally honest about where you sit in the market hierarchy.

STEP 2: ANALYZE YOUR CUSTOMER SEGMENTS. Map your primary buyers. Are they price-insensitive connoisseurs or price-conscious aspirants? Survey data and purchase history are invaluable here.

STEP 3: EVALUATE COMPETITIVE SUBSTITUTES. List direct and indirect competitors. Can your customer easily find a similar status signal elsewhere? If yes, your elasticity is higher.

STEP 4: ASSESS BRAND EQUITY METRICS. Look at brand loyalty rates, social media sentiment, and willingness-to-pay studies. Strong, positive equity correlates with lower elasticity.

STEP 5: CONDUCT CONTROLLED TESTING. If possible, run limited, regional price tests. Measure the volume impact carefully. This is the most direct way to gauge real-world elasticity.

## Common Pitfalls and Strategic Warnings

A critical mistake is assuming your luxury brand is immune to elasticity forever. Context matters enormously.

WARNING: DO NOT CONFUSE INELASTIC DEMAND WITH INFINITE PRICING POWER. Even the most prestigious brands have a limit. There is a threshold where a price becomes absurd even for Veblen goods, breaking the spell of exclusivity and triggering backlash.

WARNING: ECONOMIC AND SOCIAL SHIFTS CAN CHANGE ELASTICITY. A recession, a change in social attitudes toward overt displays of wealth, or a brand scandal can make demand for a once-inelastic product suddenly become elastic. Constant market sensing is essential.

WARNING: OVER-EXPANSION AND DISCOUNTING ARE THE ARCH-ENEMIES OF INELASTICITY. Making a product too widely available or frequently discounting it erodes the perception of scarcity and exclusivity. This can permanently increase price sensitivity, a very difficult trend to reverse.

## The Future of Luxury and Price Elasticity

The landscape is evolving. Digitalization, the rise of the resale market, and growing consumer focus on sustainability are new variables in the elasticity equation. A limited-edition digital asset (NFT) might exhibit Veblen characteristics. Conversely, a younger generation may value experiential luxury over physical goods, altering traditional demand curves. The core principles, however, remain: value perception, exclusivity, and brand narrative are the ultimate drivers of inelastic demand.

To conclude, mastering the price elasticity of demand of luxury goods requires a blend of economic understanding and psychological insight. It is about managing perception as much as it is about managing price.

IMPLEMENTATION CHECKLIST FOR LUXURY BRANDS:

– Clearly define your market position as either absolute or accessible luxury.

– Conduct regular analysis of your core customer segments and their price sensitivity.

– Vigilantly protect brand equity through narrative, quality, and controlled distribution.

– Use competitive analysis to understand your product’s true substitutability.

– Test price changes cautiously in controlled environments before full rollout.

– Continuously monitor social and economic trends that could impact consumer perception.

– Never compromise long-term exclusivity for short-term sales volume via discounting.

– Integrate elasticity considerations into all strategic marketing and product development plans.