Supply chain M and A is a powerful but complex strategy. Companies do not just buy factories or logistics firms. They acquire capabilities, networks, and competitive moats. This guide provides an expert breakdown of the entire process. We will explore the driving forces, the hidden pitfalls, and a step-by-step framework for success. Whether you are a CEO, an investor, or a supply chain leader, understanding supply chain M and A is now a business imperative.

The landscape is active. A report from PwC noted that industrial manufacturing and automotive deal values remained robust, driven by strategic moves to secure supply chain resilience (source: PwC Global M and A Industry Trends). This is not just about growth. It is about survival and transformation in a volatile world.

# Why Companies Pursue Supply Chain M and A

The motivations extend far beyond simple financial consolidation. Strategic supply chain acquisitions are often defensive and offensive moves rolled into one.

First, vertical integration is a primary driver. A manufacturer might acquire a key supplier to secure access to critical raw materials or components. This shields the company from market shortages and price volatility. Conversely, a brand might buy a logistics provider to gain direct control over delivery speed and customer experience. The goal is to own more links in the value chain.

Second, companies seek capability and technology acquisition. It is often faster to buy innovation than to build it internally. A traditional retailer might acquire an e-commerce fulfillment startup for its advanced warehouse robotics and software. A pharmaceutical company might buy a specialized cold-chain logistics firm. This leapfrogs years of development.

Third, geographic expansion is accelerated through acquisition. Entering a new continent requires local knowledge, infrastructure, and relationships. Buying an established local player provides an instant, operational network. This is a common tactic in global supply chain strategy.

Finally, resilience and redundancy have become non-negotiable. The pandemic exposed fatal single points of failure. Acquiring additional manufacturing sites in different regions or adding backup logistics partners diversifies risk. This strategic move builds a more shock-proof supply chain.

# The 5 Major Risks and How to Mitigate Them

Mergers and acquisitions in the supply chain space carry unique dangers that can destroy expected value. Ignoring them is the single biggest mistake.

RISK 1: CULTURAL AND PROCESS MISALIGNMENT

Two companies may use completely different software, planning cycles, and performance metrics. Their teams might have opposing philosophies: one prioritizes cost above all, while the other competes on service speed. This clash can paralyze integrated operations.

RISK 2: HIDDEN SUPPLIER CONCENTRATION

The target company might appear healthy but could rely on a single supplier for a crucial part. Acquiring them means inheriting that vulnerability. You must conduct deep-tier supply chain mapping during due diligence.

RISK 3: TECHNOLOGY INTEGRATION NIGHTMARES

Legacy warehouse management systems, incompatible ERP platforms, and disjointed data standards can make integration a multi-year, budget-busting project. The synergy savings evaporate if IT integration fails.

RISK 4: KEY TALENT FLIGHT

The real value often lies in the expertise of the target’s supply chain planners, logistics managers, and procurement specialists. If they leave post-acquisition, you may have bought empty buildings and contracts.

RISK 5: REGULATORY AND COMPLIANCE SURPRISES

This includes everything from environmental regulations at a newly acquired warehouse to international trade compliance issues. Unexpected liabilities can emerge long after the deal closes.

Mitigation requires exhaustive due diligence that goes beyond financials. You must audit operational processes, technology stacks, and human capital with the same rigor as the balance sheet.

# Supply Chain Due Diligence: The Operational Deep Dive

Financial due diligence asks, “Is the price right?” Operational supply chain due diligence asks, “Can we actually run this together?” This phase is where deals succeed or fail.

You must analyze these four pillars:

1. NETWORK AND ASSETS: Map all facilities (plants, warehouses), transportation lanes, and owned assets (fleets, equipment). Assess their condition, capacity, and strategic fit with your existing network.

2. PROCESSES AND PERFORMANCE: Review planning, procurement, manufacturing, and fulfillment processes. Scrutinize KPIs like on-time-in-full delivery, inventory turnover, and cost per unit. Look for process maturity.

3. TECHNOLOGY LANDSCAPE: Catalog every software system in use. Understand licensing agreements, customization levels, and integration points. Create a realistic integration roadmap and cost estimate.

4. TALENT AND ORGANIZATION: Evaluate the structure and skills of the supply chain team. Identify key personnel and assess retention risk. Understand the prevailing culture and management style.

According to a study by KPMG, over half of merger integrations fail to capture anticipated supply chain synergies, often due to inadequate operational due diligence (source: KPMG Global M and A Insights). Do not become a statistic.

# Integration Playbook: A 5-Step Framework for Success

Post-merger integration is the real work. Here is a practical, phased approach to merging supply chain operations.

STEP 1: FORM THE INTEGRATION MANAGEMENT OFFICE (IMO)

Immediately establish a dedicated team with leaders from both companies. This IMO must have clear authority to make decisions on process, technology, and organizational design. It is the central nervous system for the integration.

STEP 2: STABILIZE AND COMMUNICATE

Day one is about no regression. Ensure all customer shipments go out on time. Guarantee suppliers get paid. Over-communicate with employees, customers, and suppliers to reduce uncertainty. This phase is about maintaining business continuity.

STEP 3: DESIGN THE FUTURE OPERATING MODEL

This is the strategic core. Will you fully integrate networks, run them independently, or adopt a hybrid? Decide which ERP system will be the standard, which warehouses to consolidate, and which transportation contracts to renegotiate. Create a detailed blueprint.

STEP 4: EXECUTE SYNERGY CAPTURE

Now, implement the blueprint. This involves physically consolidating facilities, migrating data to new systems, re-bidding logistics contracts, and implementing new, unified processes. Track synergy capture rigorously against the deal model.

STEP 5: OPTIMIZE AND INNOVATE

Once the new, unified supply chain is operating, shift focus from integration to optimization. Leverage the combined scale and data to drive continuous improvement, explore new technologies, and find growth opportunities that were not possible before.

Throughout this, change management is critical. People need to understand the “why” behind every change.

# Technology Integration: ERP vs. Best-of-Breed Approach

A pivotal decision is how to handle technology. The choice often comes down to two paths: forcing one company’s monolithic ERP system onto the other, or creating a hybrid “best-of-breed” architecture. The table below contrasts the two common approaches.

| Factor | ERP-Centric Integration | Best-of-Breed Hybrid |

|---|---|---|

| DATA UNIFORMITY | HIGH. Single source of truth for all transactions and master data. | MEDIUM. Requires robust middleware and data lakes to synchronize disparate systems. |

| IMPLEMENTATION SPEED & COST | SLOW and VERY HIGH. ERP migrations are complex, lengthy, and expensive. | MODERATE. Can be faster initially by connecting systems, but middleware adds cost. |

| FLEXIBILITY & INNOVATION | LOW. Tied to the ERP vendor’s roadmap and module limitations. | HIGH. Allows selection of specialized, cutting-edge solutions for warehousing, transport, etc. |

| OPERATIONAL RISK | HIGH during cut-over. A big-bang switch carries significant disruption risk. | MANAGEABLE. Phased integration allows systems to run in parallel, reducing go-live risk. |

| LONG-TERM TCO | POTENTIALLY LOWER. Reduced software licensing and integration maintenance. | POTENTIALLY HIGHER. Multiple vendor licenses, middleware, and specialized IT skills needed. |

There is no universally correct answer. The right path depends on the strategic goal of the merger and the relative maturity of each company’s systems.

# Common Pitfalls and Warning Signs

WARNING: DO NOT TREAT SUPPLY CHAIN AS A BACK-OFFICE FUNCTION

The biggest error is leaving supply chain integration as a late-phase, tactical cleanup task. From our team’s experience advising on post-merger integrations, the most successful deals involve supply chain leadership at the strategy table from the very first discussions. When supply chain is an afterthought, synergy targets are almost always missed.

Other critical mistakes include:

– Overestimating synergy savings without a detailed plan.

– Underestimating the cost and time of technology integration.

– Failing to identify and retain critical operational talent.

– Neglecting to communicate with the frontline teams who will execute the new processes.

– Assuming processes are compatible without a process-level audit.

Watch for red flags during due diligence: an over-reliance on manual spreadsheets for planning, a lack of clear performance metrics, or high turnover in key logistics roles. These signal deeper operational issues.

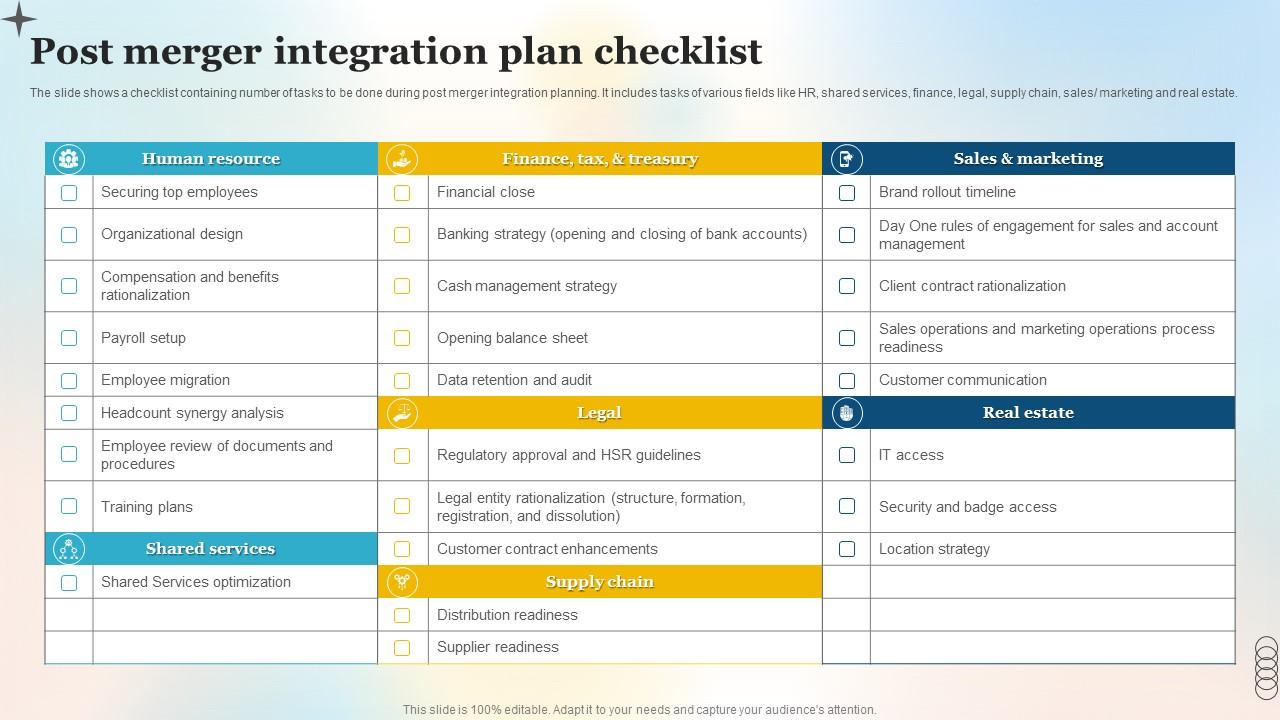

# Your Post-M and A Supply Chain Integration Checklist

Use this actionable checklist to guide your next supply chain merger or acquisition.

PHASE 1: DUE DILIGENCE

– Conduct deep-tier mapping of the target’s supplier network.

– Perform a complete audit of all supply chain software and IT infrastructure.

– Analyze key operational KPIs and compare them to your own benchmarks.

– Interview key supply chain personnel to assess culture and retention risk.

– Model integration costs for network, systems, and processes realistically.

PHASE 2: INTEGRATION PLANNING

– Establish a joint Integration Management Office with clear governance.

– Choose the future operating model: full integration, standalone, or hybrid.

– Make the final decision on technology architecture (ERP vs. Hybrid).

– Develop a 100-day communication plan for all stakeholders.

– Create detailed project plans for each workstream (logistics, procurement, etc.).

PHASE 3: EXECUTION AND MONITORING

– Prioritize day-one business continuity above all else.

– Begin synergy capture initiatives according to the plan.

– Execute system integrations or migrations in controlled phases.

– Track progress against synergy targets and operational KPIs weekly.

– Implement a structured program for change management and training.

PHASE 4: OPTIMIZATION

– Conduct a post-integration review to capture lessons learned.

– Launch continuous improvement initiatives leveraging the new combined scale.

– Explore strategic opportunities enabled by the merged entity (new markets, services).

Supply chain M and A is a marathon, not a sprint. Success demands equal parts strategic vision, operational grit, and meticulous planning. By treating the supply chain as the strategic asset it is, you can transform a complex acquisition into a durable competitive advantage.