# The Ultimate Guide to Bio Pharma Supply Chain Risk: An Expert Framework for 2024

The modern bio pharma supply chain is a marvel of global coordination, but it is also a web of profound vulnerability. A single disruption can delay life-saving therapies, incur costs in the hundreds of millions, and erode public trust. Understanding and managing bio pharma supply chain risk is no longer a back-office function; it is a strategic imperative for resilience and patient care. This guide provides a comprehensive, actionable framework for navigating this complex landscape.

At its core, bio pharma supply chain risk refers to the potential for events or conditions to disrupt the flow of materials, information, and finances from raw biological ingredients to the delivered patient dose. Unlike traditional manufacturing, the stakes involve patient health, regulatory compliance, and products with extreme sensitivity to temperature, time, and handling.

## The Four Pillars of Bio Pharma Supply Chain Vulnerability

Bio pharma supply chains face unique pressures. We can categorize the primary risk domains into four interconnected pillars.

OPERATIONAL RISKS: These are the day-to-day threats to physical flow. They include manufacturing failures, quality deviations, equipment breakdowns, and logistical delays. For temperature-sensitive biologics, a minor excursion during transit can render an entire batch useless. A 2022 survey by the Pharmaceutical Supply Chain Initiative revealed that over 60% of companies experienced a significant temperature excursion in their cold chain in the prior year, highlighting the pervasive nature of this operational challenge.

REGULATORY AND COMPLIANCE RISKS: The bio pharma industry operates in the world’s most stringent regulatory environment. Changes in Good Manufacturing Practice (GMP) guidelines, import/export regulations, or customs procedures can halt shipments. Non-compliance, even at a single supplier, can lead to costly recalls, warning letters, and approval delays for new drugs.

GEO-POLITICAL AND THIRD-PARTY RISKS: Globalization means reliance on a network of suppliers often concentrated in specific regions. Trade wars, political instability, or export restrictions can sever critical links. Furthermore, over 80% of active pharmaceutical ingredients (APIs) for the U.S. market are sourced overseas, creating a concentrated dependency. (来源: U.S. Food and Drug Administration). Your risk is now the sum of your suppliers’ risks.

FINANCIAL AND MARKET RISKS: Demand volatility, currency fluctuations, and raw material price spikes (e.g., for specialty lipids used in mRNA vaccines) directly impact viability. A shortage of a single component, like glass vials or stoppers, can bottleneck production for multiple companies simultaneously.

## A Proactive Framework: From Assessment to Action

Reactive firefighting is a losing strategy. A proactive, structured framework is essential. Here is a five-step operational guide to build resilience.

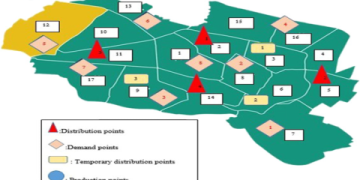

STEP 1: MAP AND VISUALIZE YOUR END-TO-END NETWORK. You cannot protect what you cannot see. Create a detailed map that goes beyond Tier 1 suppliers. Identify the origin of critical raw materials, single-source components, and alternative transportation routes. This map is your foundational risk assessment tool.

STEP 2: IDENTIFY AND CATEGORIZE CRITICAL NODES. Not all nodes are equal. Use a risk matrix to evaluate suppliers and processes based on their impact on patient safety and business continuity, and their probability of failure. Focus your resources on the high-impact, high-probability items.

STEP 3: DEVELOP QUANTITATIVE RISK METRICS. Move beyond qualitative “high/medium/low” ratings. Establish metrics like “Supplier Risk Score,” “Inventory Days of Coverage,” or “Network Recovery Time Objective.” This allows for data-driven prioritization and investment justification.

STEP 4: IMPLEMENT CONTINUOUS MONITORING. Static assessments are obsolete. Implement tools for real-time monitoring of shipments (temperature, location), geopolitical events, and supplier financial health. According to my experience, the teams that integrate these monitoring feeds into a central dashboard are the first to respond effectively to emerging threats.

STEP 5: BUILD RESPONSE AND RECOVERY PLAYBOOKS. For your top-tier risks, have pre-defined, actionable playbooks. What is the immediate action if a primary API plant has an earthquake? Who approves the switch to a secondary logistics provider? Regularly stress-test these plans through simulations.

## Technology Showdown: Digital Tools for Risk Mitigation

Adopting digital tools is non-negotiable for modern risk management. The table below contrasts two primary technological approaches: Integrated Platform Solutions and Best-of-Breed Point Solutions.

| Feature | Integrated Supply Chain Risk Platform | Best-of-Breed Point Solutions |

|---|---|---|

| Core Architecture | Single, unified platform (e.g., ERP/SCM modules, specialized risk suites) | Multiple standalone software tools (e.g., separate tools for logistics, supplier qual., monitoring) |

| Data Integration | HIGH. Native data flow between risk assessment, monitoring, and planning modules. | LOW to MODERATE. Requires complex APIs and manual effort to connect data silos. |

| Implementation & Cost | Higher initial cost and longer implementation time. | Lower initial, modular cost. Can lead to higher total cost of ownership from integration. |

| Analytical Insight | Strong. Enables predictive analytics and scenario modeling across the entire chain. | Limited. Insights are often confined to a single process (e.g., only logistics visibility). |

| Best For | Large enterprises seeking end-to-end control and predictive capability. | Mid-size firms or those needing to address a specific, acute vulnerability first. |

## Common Pitfalls and How to Avoid Them

Even with the best intentions, companies fall into predictable traps. Here is a critical warning section.

A MAJOR PITFALL IS OVER-RELIANCE ON FINANCIAL AUDITS ALONE. A supplier may be financially sound but have weak quality systems or be located in a geopolitically volatile zone. A holistic assessment covering operational, regulatory, and geographic factors is mandatory.

ANOTHER MISTAKE IS TREATING RISK MANAGEMENT AS A ONE-TIME PROJECT. Supply chain risk is dynamic. A supplier rated “low risk” today can be “high risk” tomorrow due to a merger, regulatory action, or natural disaster. Your process must be continuous and evergreen.

FINALLY, DO NOT NEGLECT THE HUMAN ELEMENT. The most advanced system fails without trained personnel and a culture that prioritizes speaking up about potential issues. Cross-functional risk committees are essential for breaking down silos.

## Your Bio Pharma Supply Chain Risk Resilience Checklist

Use this actionable checklist to evaluate and strengthen your program. Do not just check boxes; document evidence and action owners.

HAVE YOU mapped your supply network beyond Tier 1 for all critical materials?

HAVE YOU identified and documented all single-source suppliers and components?

HAVE YOU established quantitative risk metrics for key suppliers and logistics lanes?

HAVE YOU implemented real-time monitoring for shipment integrity (e.g., temperature, GPS)?

HAVE YOU developed and tested incident response playbooks for your top five scenario risks?

HAVE YOU integrated supply chain risk data into your corporate strategy and board reporting?

HAVE YOU conducted a scenario planning exercise in the last six months?

HAVE YOU diversified your supplier base for at least your most critical high-risk items?

Building a resilient bio pharma supply chain is a journey, not a destination. It requires sustained investment, cross-functional collaboration, and a mindset that views risk management as a source of competitive advantage. By systematically addressing bio pharma supply chain risk, you do more than protect your bottom line; you safeguard your ability to deliver on your promise to patients. Start with your map, prioritize with data, and build your resilience muscle one process at a time.