# Amazon Stock Price Prediction 2050: An Expert Analysis of Long-Term Potential and Risks

The idea of an Amazon stock price prediction for 2050 might seem like pure science fiction. Predicting the market a few months out is hard enough, let alone peering nearly three decades into the future. However, long-term forecasting is not about pinpointing an exact number on a specific day. It is a structured exercise in understanding the mega-trends, potential disruptions, and fundamental business drivers that could shape a company’s destiny. For a behemoth like Amazon, this exercise reveals a fascinating narrative of ambition, risk, and transformative potential. This deep dive aims to provide a comprehensive framework for thinking about Amazon’s stock trajectory to 2050, moving beyond simple guesses to a reasoned analysis.

UNDERSTANDING THE FOUNDATION: AMAZON’S CURRENT EMPIRE

Before we project forward, we must anchor ourselves in the present. Amazon is no longer just an online bookstore. It is a multi-trillion-dollar conglomerate built on three core, high-margin pillars: North America and International e-commerce, Amazon Web Services (AWS), and Advertising. AWS, in particular, is the profit engine. In 2023, AWS generated over 90 billion U.S. dollars in revenue and the vast majority of Amazon’s operating income (来源: Amazon Annual Report). This financial muscle funds relentless innovation in other areas. Any credible Amazon stock price prediction for 2050 must account for the evolution of these core segments and the success of its future bets.

KEY DRIVERS FOR THE 2050 AMAZON FORECAST

Several powerful forces will determine whether Amazon becomes a dominant force of the 21st century or faces unprecedented challenges.

Artificial Intelligence and Cloud Dominance: AWS’s future is inextricably linked to AI. The race to provide infrastructure, models, and tools for generative AI is the next frontier of cloud computing. Amazon’s investment in custom AI chips (Trainium, Inferentia) and services like Bedrock position it as a key enabler. Success here could make AWS even more indispensable and profitable.

Logistics and Global Commerce: Amazon’s logistics network is a competitive moat. By 2050, we could see a fully autonomous supply chain with drone delivery hubs, advanced robotics in warehouses, and perhaps even significant air freight capabilities. Expanding this network globally, especially in emerging markets like India and Brazil, represents a massive growth vector.

Healthcare and Biotechnology: This is one of Amazon’s boldest bets. Through Amazon Pharmacy, One Medical, and initiatives in health diagnostics, Amazon is aiming to disrupt a vast and complex industry. Success could open a multi-trillion-dollar revenue stream, while failure could result in significant write-offs.

Consumer Ecosystem Lock-in: The integration of Prime membership, streaming (Prime Video), smart homes (Alexa, Ring), and grocery (Whole Foods) creates a sticky ecosystem. The deeper this integration goes, the harder it is for customers to leave, creating recurring, predictable revenue.

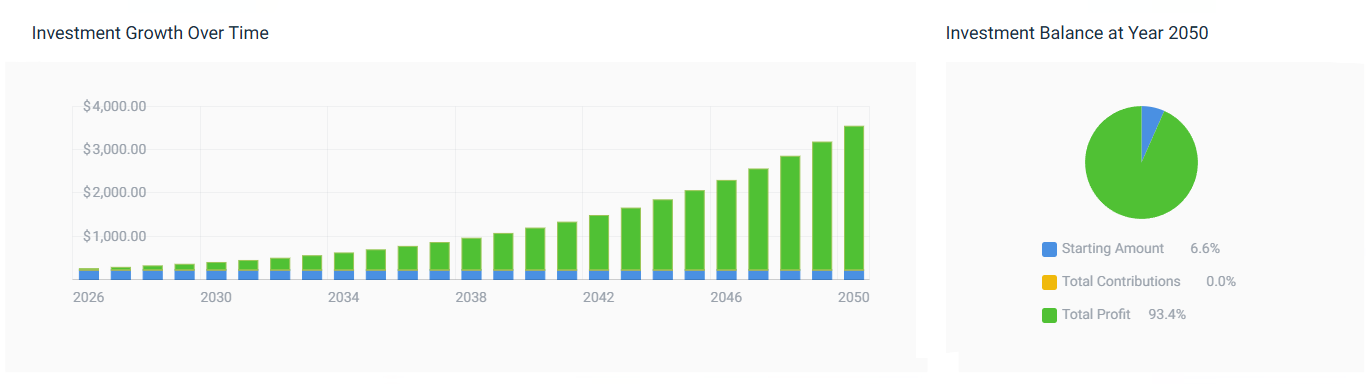

QUANTITATIVE MODELS AND LONG-TERM GROWTH ASSUMPTIONS

Financial analysts often use discounted cash flow (DCF) models for long-term valuation. These models rely on assumptions about revenue growth, profit margins, and discount rates. For a simplistic illustrative scenario, let us assume Amazon’s revenue grows at an average annual rate of 8% between now and 2050—a significant slowdown from its historical pace but respectable for a giant. Let us also assume operating margins improve as AWS and Advertising become larger profit contributors. Under a set of reasonable but optimistic assumptions, some models can extrapolate a future share price that is substantially higher than today’s. However, and this is crucial, these models are exceptionally sensitive to the inputs. A small change in the estimated growth rate or profit margin alters the terminal value dramatically. Therefore, any single-number Amazon share price forecast for 2050 should be viewed with extreme skepticism.

| Bull Case Scenario (2050) | Base Case Scenario (2050) | Bear Case Scenario (2050) |

|---|---|---|

| AWS becomes the dominant global AI infrastructure platform. | Steady growth in core segments (e-commerce, cloud, ads). | Intense regulation breaks up the company or severely limits operations. |

| Healthcare ventures achieve breakthrough scale and profitability. | New ventures (healthcare, Kuiper) show modest success. | AWS loses significant market share to Microsoft Azure and Google Cloud. |

| Global logistics network achieves near-total automation. | Amazon maintains its market leadership but growth slows. | Failed mega-investments drain capital without return. |

| Result: Exponential stock price growth. | Result: Solid, market-beating stock appreciation. | Result: Stagnant or declining shareholder value. |

MAJOR RISKS AND HEADWINDS

No analysis is complete without considering the threats. The path to 2050 is fraught with challenges that could derail even the most optimistic Amazon stock price prediction.

Regulatory and Antitrust Pressure: Amazon is under constant scrutiny from governments worldwide. Potential antitrust lawsuits could force divestitures of key assets (like AWS) or impose strict operational limitations, fundamentally altering its business model.

Execution Risk in New Ventures: History is littered with corporate moonshots that failed. Amazon’s massive investments in areas like healthcare and satellite internet (Project Kuiper) carry a high risk of failure. According to my experience analyzing tech giants, betting on new, unproven markets is the single biggest source of value destruction after regulatory risk.

Geopolitical and Macroeconomic Instability: Amazon operates globally. Trade wars, currency fluctuations, and regional conflicts can disrupt supply chains and international sales. A prolonged global recession could also dampen consumer and enterprise spending for years.

Technological Disruption: Could a new technology render Amazon’s logistics or cloud advantage obsolete? While hard to imagine today, the same was said about many industry leaders of the past.

HOW TO BUILD YOUR OWN LONG-TERM AMAZON INVESTMENT THESIS

You should not rely on any single article or prediction. Follow this structured approach to form your own view.

STEP 1: ANALYZE THE QUARTERLY EARNINGS. Go beyond the headline numbers. Focus on the growth rates of AWS, Advertising, and operating cash flow. Listen to management’s commentary on future investments.

STEP 2: TRACK THE MOONSHOT PROJECTS. Read the annual report sections on “Other Bets.” Monitor news for progress or setbacks in healthcare, Kuiper, and AI initiatives. Allocate only a small portion of your valuation to these for now.

STEP 3: ASSESS THE COMPETITIVE LANDSCAPE. Regularly compare AWS’s feature releases and market share data against Microsoft Azure and Google Cloud. In retail, watch Walmart’s and Shopify’s evolution.

STEP 4: MONITOR THE REGULATORY ENVIRONMENT. Follow major antitrust cases in the US and EU. Understand the arguments and potential outcomes.

STEP 5: USE SCENARIO PLANNING, NOT PRICE TARGETS. Do not fixate on a 2050 price. Instead, define what conditions would make you more bullish (e.g., AI leadership) or more bearish (e.g., losing cloud share). Adjust your investment stance as these conditions change.

COMMON MISCONCEPTIONS TO AVOID

WARNING: A common mistake for long-term investors is extrapolating past growth rates linearly into the future. This is known as the “constant growth fallacy.” Amazon’s explosive 20%+ annual growth of the past decade is mathematically impossible to sustain as its revenue base surpasses half a trillion dollars. Future growth will come from margin expansion, new markets, and share buybacks, not just top-line sales increases. Another critical error is ignoring the time value of money. A share price target of $10,000 in 2050 is not equivalent to $10,000 today. Discounted back to the present at a reasonable rate, that future value is far less in today’s dollars.

CONCLUSION

Creating a precise Amazon stock price prediction for 2050 is an exercise in humility. The true value lies not in a magical number, but in the process of understanding the forces that will shape one of the world’s most important companies over the next 26 years. Amazon’s future hinges on its ability to dominate the AI and cloud landscape, successfully incubate new giant businesses in healthcare and beyond, and navigate an increasingly complex regulatory world. For investors, the journey requires continuous monitoring, scenario-based thinking, and a focus on fundamental drivers rather than daily price fluctuations. The story of Amazon to 2050 will be a defining business saga of our time.

FINAL CHECKLIST FOR EVALUATING AMAZON’S 2050 POTENTIAL

TRACK AWS REVENUE GROWTH AND OPERATING MARGINS QUARTERLY.

EVALUATE PROGRESS AND CAPITAL ALLOCATION TO NEW VENTURES LIKE HEALTHCARE AND KUIPER.

STAY INFORMED ON GLOBAL ANTITUST AND REGULATORY DEVELOPMENTS.

COMPARE AMAZON’S AI/CLOUD INNOVATION CYCLE AGAINST MICROSOFT AND GOOGLE.

ANALYZE FREE CASH FLOW GENERATION AND ITS USE FOR SHARE BUYBACKS OR DIVIDENDS.

ASSESS CONSUMER AND ENTERPRISE SATURATION LEVELS IN CORE MARKETS.

CONSIDER MACROECONOMIC FACTORS THAT COULD IMPACT GLOBAL CONSUMER SPENDING.

REVIEW MANAGEMENT’S LONG-TERM VISION AND EXECUTION CAPABILITY ANNUALLY.

AVOID FIXATING ON SHORT-TERM STOCK PRICE VOLATILITY.

BASE INVESTMENT DECISIONS ON UPDATED FUNDAMENTAL ANALYSIS, NOT STATIC PRICE TARGETS.