# The Cisco Systems Supply Chain: An Expert Guide to Its Strategy, Challenges, and Future

The Cisco Systems supply chain is not just a logistical operation. It is a complex, global ecosystem that powers the internet itself. From the silicon in a data center switch to the final router installed in a home office, every step involves precision, innovation, and immense scale. For IT professionals, business leaders, and anyone invested in network infrastructure, understanding this supply chain is crucial. This guide dives deep into how Cisco manages its global network, the unique challenges it faces, and the strategies that keep it resilient.

We will explore the core components of Cisco supply chain management, its evolution towards a more agile and predictive model, and the critical lessons other industries can learn. Whether you are evaluating Cisco products for your enterprise or studying world-class supply chain operations, this analysis provides the insights you need.

## The Architecture of Cisco’s Global Supply Chain Network

Cisco operates what is known as an “integrated global virtual supply chain.” This model relies heavily on outsourcing manufacturing to a network of contract partners while retaining tight control over design, intellectual property, and logistics. The company itself manufactures very few finished products. Instead, it focuses on core competencies like engineering, software development, and supply chain orchestration.

This approach allows for tremendous flexibility and scalability. Cisco can ramp production up or down by managing relationships with its partners, rather than owning and operating costly factories. The network includes suppliers of semiconductors, optical components, plastics, and metals spread across the globe. Central to this is Cisco’s Advanced Services and fulfillment system, which ensures products are configured, tested, and delivered to meet specific customer orders, often with complex software licenses and service agreements.

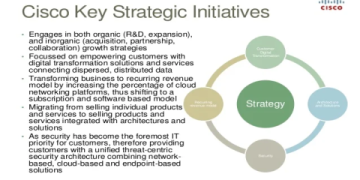

## Key Strategies in Cisco Supply Chain Management

Cisco’s supply chain success is built on several foundational strategies. These are not static but have evolved significantly, especially after major disruptions.

DIVERSIFICATION AND RISK MITIGATION: Following severe shortages during the early 2000s and again during the recent global chip shortage, Cisco learned the hard cost of over-reliance on single sources or regions. The company has since aggressively diversified its supplier base and increased buffer stocks of critical components. Their strategy now emphasizes multi-sourcing and regional flexibility.

DIGITAL TRANSFORMATION AND PREDICTIVE ANALYTICS: Cisco leverages its own technology stack to create a “digital twin” of its supply chain. Using data analytics, IoT sensors, and AI, the company models scenarios, predicts potential disruptions, and optimizes routing in real-time. For instance, they can simulate the impact of a port closure and reroute shipments days before a delay occurs.

SUSTAINABILITY AND CIRCULAR ECONOMY INITIATIVES: A modern supply chain must be responsible. Cisco has committed to ambitious environmental goals, including reaching net-zero greenhouse gas emissions across its value chain by 2040. A key component is its product takeback and refurbishment program, which extends the life of hardware and recovers valuable materials. This circular approach is becoming a core part of its supply chain design.

## Major Challenges and Disruptions Faced

Even for a leader like Cisco, the supply chain is a constant battlefield. The past few years have presented unprecedented tests.

THE SEMICONDUCTOR SHORTAGE: As a networking hardware giant, Cisco is a major consumer of advanced chips. The global shortage severely impacted its ability to fulfill orders, leading to extended lead times that sometimes exceeded a year for certain products. Cisco’s response involved long-term strategic agreements with key suppliers and redesigning some products to use more available components.

GEOPOLITICAL TENSIONS AND TARIFFS: Trade policies between the U.S., China, and other regions force continuous recalibration. Tariffs on Chinese imports directly affect costs, while export controls on certain technologies can restrict which components can be used or where they can be manufactured. Cisco must navigate these rules while maintaining efficiency.

LOGISTICS BOTTLENECKS: The congestion at global ports and skyrocketing freight costs during the pandemic highlighted the fragility of global logistics. Cisco’s reliance on air freight for high-value, low-volume items increased, but for bulkier equipment, navigating sea freight delays became a daily operational challenge.

## Cisco Supply Chain Software and Technology: The Enablers

Cisco doesn’t just build networks; it uses its own and partner technology to run its supply chain. This creates a powerful feedback loop where real-world needs drive product innovation.

At the heart of its operations is an integrated suite of enterprise resource planning (ERP), supply chain planning (SCP), and customer relationship management (CRM) systems. However, the real differentiation comes from layers of specialized software. Cisco utilizes AI for demand forecasting, blockchain for verifying component authenticity and provenance, and IoT for tracking high-value shipments in transit.

Furthermore, Cisco’s acquisition of companies like Jasper (IoT platform) and investments in cybersecurity for operational technology (OT) underscore how deeply technology is woven into its supply chain resilience. According to a report by Gartner, companies that integrate IoT data into their supply chain planning can improve delivery performance by up to 30%. (来源: Gartner, “Predicts 2023: Supply Chain Technology”)

## Comparison: Cisco’s Supply Chain vs. A Traditional Hardware Model

To appreciate Cisco’s model, it helps to contrast it with a more traditional, vertically integrated approach. The table below highlights key differences.

| Aspect | Cisco’s Virtual, Outsourced Model | Traditional Vertical Integration |

|---|---|---|

| CAPITAL INTENSITY | LOW: Capital is directed towards R&D and software, not factories. | HIGH: Significant capital tied up in manufacturing plants and equipment. |

| FLEXIBILITY & SCALABILITY | HIGH: Can quickly shift production between contract partners based on cost, capacity, or regional needs. | LOW: Scaling up requires building new facilities; scaling down leads to idle capacity. |

| CONTROL & QUALITY | MODERATE: Relies on stringent partner audits and process standardization. Risk of partner variability. | HIGH: Direct control over every manufacturing step ensures consistent quality. |

| SPEED TO MARKET FOR INNOVATION | FAST: Can prototype and launch new designs using partners’ existing production lines. | SLOWER: New products may require retooling of owned facilities, adding time and cost. |

| PROFIT MARGINS | POTENTIALLY HIGHER: Focus on high-value design and software; manufacturing margin goes to partners. | VARIABLE: Must absorb all manufacturing costs and risks, but captures full margin. |

## A 5-Step Guide to Navigating Cisco Product Lead Times

Based on my experience consulting with enterprise clients, dealing with extended lead times requires a proactive strategy. Here is a practical guide.

STEP 1: ENGAGE WITH YOUR CISCO ACCOUNT TEAM EARLY. Do not just place an order through a web portal. Discuss your project timeline and requirements with your account manager and systems engineer. They have access to allocation information and can provide realistic forecasts.

STEP 2: EXPLORE ALTERNATIVE PRODUCTS OR MODELS. Often, a different SKU within the same family may have better availability. Be open to models that may have a slightly different port configuration or feature set that still meets your core needs.

STEP 3: CONSIDER REFURBISHED OR CERTIFIED PRE-OWNED EQUIPMENT. Cisco’s own Certified Refurbished Equipment program offers fully tested hardware with a warranty, often with significantly shorter lead times. This can be an excellent option for non-mission-critical expansions or lab environments.

STEP 4: EVALUATE FINANCING AND SUBSCRIPTION MODELS. Programs like Cisco’s Network as-a-Service (NaaS) can change the procurement dynamic. You may be able to access needed hardware through a subscription, where Cisco manages the supply chain complexity as part of the service.

STEP 5: BUILD A MULTI-VENDOR STRATEGY FOR THE LONG TERM. For certain edge use cases, consider qualifying a secondary vendor. This not only mitigates supply risk but also provides negotiating leverage. However, be mindful of the increased operational complexity this introduces.

WARNING: COMMON MISCONCEPTIONS ABOUT CISCO’S SUPPLY CHAIN

A major mistake is assuming that because Cisco is a technology leader, its supply chain is immune to global forces. It is not. Another misconception is that paying a premium will guarantee faster delivery. During systemic shortages, allocations are often based on strategic customer tier, historical volume, and forecast accuracy, not solely on price. Finally, do not assume all delays are at the final assembly stage. The bottleneck is almost always at the component level, such as a specific chip or power supply, which delays the entire bill of materials.

## The Future: AI, Automation, and Regionalization

The future of the Cisco Systems supply chain is being written now. We see three dominant trends. First, AI will move from predictive to prescriptive, automatically making decisions to re-route, re-order, or re-configure products. Second, automation in warehouses and with partners will increase, using robotics and computer vision to handle configuration and testing. Third, a move towards “regionalization” – building more supplier and assembly capacity closer to key markets like the Americas and Europe to reduce geopolitical and logistics risk. A study by McKinsey found that 90% of supply chain professionals plan to increase resilience through regionalization over the next three years. (来源: McKinsey & Company, “The future of supply chains”)

From our team’s analysis of industry trends, the most resilient supply chains will be those that are transparent, collaborative, and powered by integrated data. Cisco, with its technology heritage, is poised to continue evolving its network into a truly self-healing, autonomous system. The journey from a linear chain to a dynamic, intelligent web is well underway.

CHECKLIST FOR EVALUATING SUPPLY CHAIN RESILIENCE INSPIRED BY CISCO:

– Map your critical component suppliers and identify single points of failure.

– Invest in a supply chain visibility platform that provides real-time data.

– Develop strong, collaborative relationships with key suppliers, not just transactional ones.

– Diversify your logistics partners and have contingency routes planned.

– Integrate sustainability and circular economy principles into your design and logistics.

– Regularly run stress-test simulations for various disruption scenarios.

– Foster cross-functional collaboration between procurement, logistics, and sales teams.