# Introduction: Why the Retailing Industry in India Matters Now

The retailing industry in India is going through tremendous change. But why all the buzz now? With over 1.4 billion people and a young consumer base, India offers vast growth opportunities for retailers. According to the India Brand Equity Foundation, the country’s retail market is expected to reach $1.8 trillion by 2030 (来源: IBEF). That number alone is breathtaking! But, evolving consumer expectations, rapid digitalization, and government reforms are rewriting the retail playbook. So, what’s driving this transformation, and how can companies tap into these changes?

# H2: The Structure of the Retailing Industry in India

India’s retail sector is unique compared to Western markets. It includes a mix of organized retail—like malls, supermarkets, and branded chain stores—and a huge unorganized segment: think family-run shops and roadside vendors. Organized retail makes up just around 12% of the market, while traditional kirana stores still dominate the landscape (来源: Deloitte 2023 Report).

Let’s break it down with a simple comparison:

| Type | Main Features | Share in Market |

|---|---|---|

| Organized Retail | Supermarkets, franchise chains, e-commerce players | 12% |

| Unorganized Retail | Kirana shops, local vendors, street markets | 88% |

This division creates both opportunities and hurdles for newcomers and market leaders alike.

# H2: Key Drivers Reshaping the Retailing Industry in India

Many forces are reshaping how retailing works across the country. The most prominent drivers include:

1. **DIGITALIZATION:** The rise of smartphones and cheap data plans brings e-commerce into remote towns.

2. **URBANIZATION:** More Indians are moving to cities, raising the demand for malls and megastores.

3. **GOVERNMENT REFORMS:** The introduction of GST and relaxed FDI norms attract foreign and domestic investments.

4. **CHANGING CONSUMER PREFERENCES:** Younger consumers are brand-conscious and value convenience.

According to my team’s close monitoring, Indian shoppers today expect more than just low prices. They want easy returns, quick delivery, and omnichannel experiences. That might sound like a challenge, but it’s also a golden opportunity for innovation.

# H2: Actionable Guide: Entering and Thriving in the Retailing Industry in India

So, you want to make a mark in India’s vibrant retail sector? Here’s a hands-on step-by-step guide:

1. RESEARCH LOCAL CONSUMER BEHAVIOR

Understand city-to-village differences. A Delhi shopper and a small-town consumer have distinct needs.

2. CHOOSE YOUR MARKET ENTRY MODEL

Will you launch an online store, build physical outlets, or use a hybrid approach?

3. COMPLY WITH LEGAL & REGULATORY REQUIREMENTS

Register your business, understand local taxation (like GST), and secure required permits.

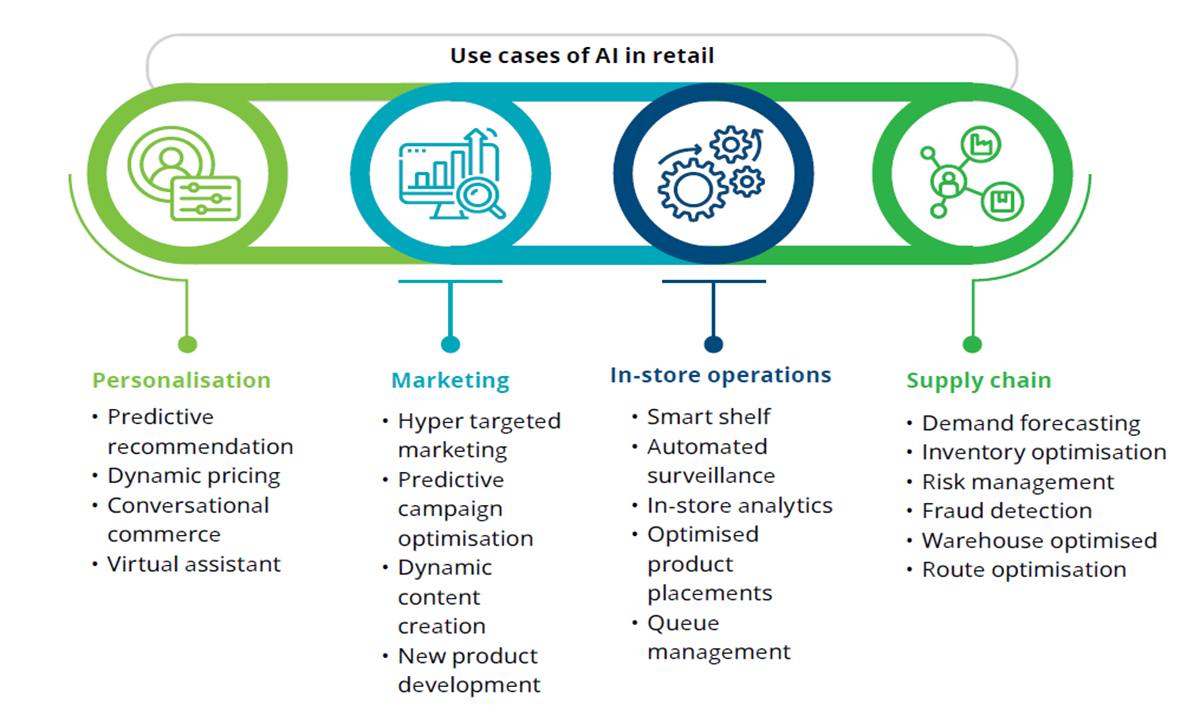

4. ADOPT TECHNOLOGY

Invest in robust POS systems, inventory management, and online presence to streamline operations.

5. FOCUS ON SUPPLY CHAIN EFFICIENCY

Build resilient supplier networks and optimize distribution for both urban and rural markets.

Following this roadmap, retailers stand a much better chance of sustainable growth in the retailing industry in India.

# H2: Case Example: How Digital Disruption Is Creating Success Stories

Look at Reliance Retail and Amazon India. Reliance blended its supermarket presence with digital ordering via JioMart, tapping both urban and rural shoppers. Amazon, on the other hand, revolutionized last-mile delivery with local store tie-ups for speedy fulfillment.

Here’s the interesting part: Mid-size kirana stores are adapting fast. By joining online platforms (like Udaan, BigBasket, or Amazon), these local shops offer online ordering while maintaining personalized relationships with customers. This fusion model is unique to India’s retail scenario and a reason for its incredible market resilience.

# H2: Common Pitfalls in the Indian Retail Industry

Many global and domestic brands rush in, only to stumble over the same mistakes. Here’s what to watch out for.

## NOTICE: Frequent Missteps

– Ignoring local customs and supply preferences

– Underestimating the logistics required for rural markets

– Assuming Western business models will simply “copy-paste” in India

To avoid these errors, it’s crucial to localize your product offerings and continuously invest in market intelligence.

# H2: Future Trends and Opportunities

E-commerce is expected to account for 11% of India’s retail sales by 2026. Social commerce (think: shopping through WhatsApp, Facebook) is also surging, especially in smaller towns.

From our experience, phygital strategies—mixing online tools and physical experiences—are producing the most success. Retailers who can personalize experiences at scale and embrace technology will likely lead.

Moreover, sustainability is emerging as a deciding factor. Eco-friendly packaging and ethical sourcing now influence younger shoppers, driving brands to innovate further.

# H2: Conclusion

India’s retailing industry is complex, dynamic, and full of remarkable opportunities. By recognizing the unique market structure, embracing digital tools, and focusing on localized customer engagement, retailers can achieve lasting growth.

# H2: Action Checklist for Retail Success in India

– Clarify your target segment (mass, premium, online, or omni-channel)

– Secure all legal registrations and licenses before launching

– Invest in digital platforms for both sales and supply chain management

– Hire and train staff with local knowledge and language skills

– Launch pilot operations and collect customer feedback for rapid iteration

– Build contingency plans for logistics or regulatory setbacks

– Continuously monitor consumer trends and adapt your strategy

The retailing industry in India offers incredible rewards, but only to those ready for relentless adaptation and local insight.