The world of supply chain finance is no longer about static reports and monthly reconciliations. In 2025, the ability to see, analyze, and act on financial data as it flows through your supply network is not a luxury. It is a fundamental requirement for resilience and growth. This shift is powered by a new generation of supply chain finance tools with real-time analytics 2025. This guide will dissect what these tools are, why they are critical, and how to select and implement them to future-proof your operations.

# Understanding the 2025 Shift: From Static to Dynamic Finance

Traditional supply chain finance operated on delays. Invoice data, payment statuses, and risk assessments were snapshots in time, often days or weeks old. This created blind spots. A supplier facing sudden liquidity issues or a port delay impacting a critical shipment would only become visible after the fact, forcing reactive and costly interventions.

Modern supply chain finance tools with real-time analytics 2025 change this paradigm. They integrate directly with IoT sensors, ERP systems, logistics platforms, and banking APIs. This creates a live data stream. You are not looking at a photograph of your supply chain’s financial health. You are watching a live video feed. This enables proactive management of working capital, dynamic discounting, and predictive risk mitigation. According to a 2023 report by McKinsey, companies leveraging real-time data in their supply chains improve their working capital efficiency by up to 30 percent (来源: McKinsey & Company).

# The Core Architecture of Next-Gen Tools

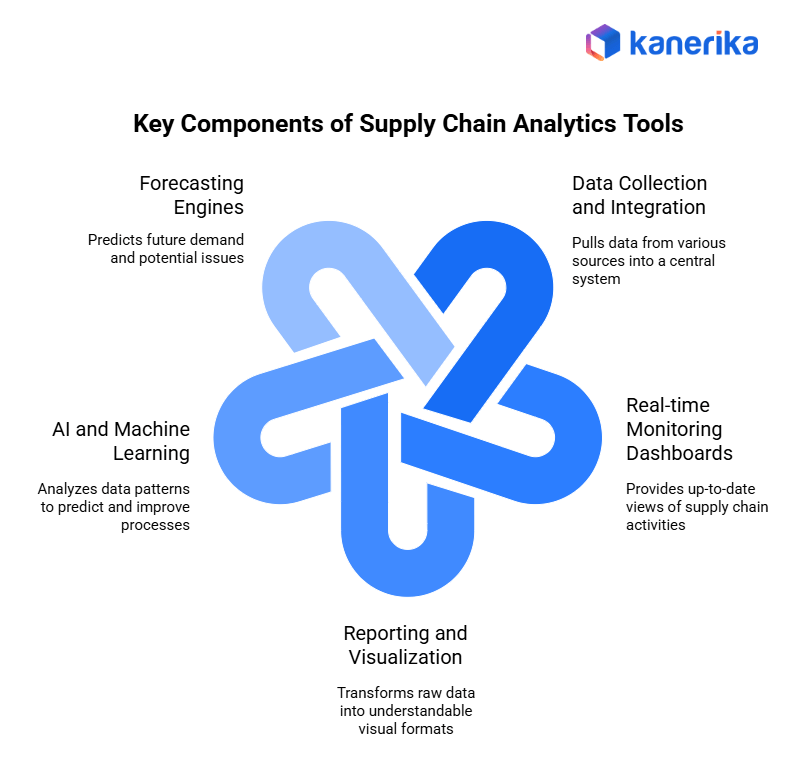

What makes these tools tick? They are built on a foundation of interconnected technologies.

First, there is seamless API integration. The tool does not exist in a vacuum. It pulls data from your procurement software, your transportation management system, your warehouse management system, and your bank. Second, advanced analytics engines process this data stream. They use machine learning algorithms to identify patterns, predict delays, and flag anomalies. Third, the user interface is designed for action, not just observation. Dashboards highlight exceptions, recommend optimal payment times, and visualize cash flow impacts instantly.

A key component often overlooked is data normalization. In our team’s experience evaluating multiple platforms, the biggest technical hurdle is not collecting data, but making sense of it. A top-tier tool will automatically normalize data from disparate sources into a single, clean format for analysis.

# 7 Non-Negotiable Capabilities for 2025

When evaluating supply chain finance tools with real-time analytics 2025, look for these seven essential capabilities.

1. LIVE CASH FLOW VISIBILITY: See projected cash inflows and outflows across your entire multi-tier supply chain, updated by the minute based on shipment milestones and invoice approvals.

2. PREDICTIVE RISK SCORING: Go beyond static credit reports. The tool should score supplier financial risk in real-time, incorporating market news, geopolitical events, and even weather data that could impact their stability.

3. AUTOMATED DYNAMIC DISCOUNTING: The system should automatically identify early payment opportunities based on real-time supplier need and your current cash position, executing discounts without manual intervention.

4. IOT-DRIVEN INVENTORY FINANCE: Connect financial tools directly to warehouse IoT sensors. This allows for financing based on verified, real-time inventory levels rather than estimated paper values.

5. SCENARIO MODELING & WHAT-IF ANALYSIS: Simulate the financial impact of a supplier delay, a currency fluctuation, or a change in payment terms before making a decision.

6. BLOCKCHAIN-ENHANCED AUDIT TRAIL: While not universal, leading tools use distributed ledger technology to provide an immutable, real-time record of all transactions and data points, building unparalleled trust.

7. ACTIONABLE ALERTING: Receive smart alerts not just when something is wrong, but with a contextualized recommendation for action, such as “Supplier A’s risk score increased by 40 points. Recommend diverting the next purchase order and reviewing alternate sources.”

# Comparing Leading Tool Archetypes

Not all platforms are created equal. Some focus on the buyer’s perspective, some on the supplier’s, and others on financiers. The table below contrasts two primary archetypes you will encounter in the market.

| Feature | Buyer-Led Platform (e.g., Taulia, PrimeRevenue) | Bank-Led Digital Platform (e.g., J.P. Morgan, HSBC) |

|---|---|---|

| Primary Goal | Optimize buyer working capital and strengthen the supply chain. | Extend bank’s financing services and deepen client relationships. |

| Real-Time Data Source | Deep integration with buyer’s ERP and procurement systems. | Focus on banking transaction data and client-submitted documents. |

| Supplier Onboarding | Often driven by buyer mandate, can be rapid through a portal. | Can be slower, tied to traditional bank KYC and credit processes. |

| Analytics Strength | Superior for supply chain risk and performance analytics. | Superior for credit risk and global treasury analytics. |

| Best For | Large corporations wanting control and deep supply chain insights. | Companies prioritizing integration with existing global banking services. |

# A 5-Step Implementation Roadmap

Adopting these tools is a strategic project. Follow this phased approach.

STEP 1: INTERNAL PROCESS AUDIT. Map your current accounts payable, procurement, and treasury processes. Identify pain points and data silos. You cannot automate a broken process.

STEP 2: DEFINE KEY PERFORMANCE INDICATORS. What does success look like? Is it Days Payable Outstanding (DPO) reduction, supplier stability score improvement, or reduction in supply disruptions? Set clear, measurable goals.

STEP 3: SELECT THE RIGHT PARTNER. Use the 7 capabilities list and the comparison table as a starting point for vendor evaluations. Insist on a proof-of-concept using your own data.

STEP 4: PILOT WITH A CONTROLLED GROUP. Start with a small group of strategic suppliers and a single business unit. This allows you to iron out issues, demonstrate value, and build internal advocacy.

STEP 5: SCALE AND OPTIMIZE. Roll out the tool incrementally. Continuously use the analytics to refine your supply chain finance policies, such as dynamic discounting rates or payment term structures.

# Common Pitfalls and How to Avoid Them

WARNING: THE DATA QUALITY TRAP. The most sophisticated real-time analytics engine is useless with garbage data. A common mistake is rushing implementation without first cleansing and standardizing master data from your ERP, like supplier names and IDs. The tool will generate conflicting or meaningless insights, leading to immediate distrust from users.

Another critical error is treating this as solely an IT or finance project. Success requires buy-in from procurement, supply chain operations, and executive leadership. The tool provides cross-functional visibility, so its implementation must be a cross-functional effort.

# The Tangible Impact: Beyond Theory

The value proposition is concrete. A study by the Global Supply Chain Finance Forum found that programs utilizing advanced data analytics reduced processing costs by over 50 percent and increased early payment discount capture by 35 percent (来源: Global Supply Chain Finance Forum). But the impact goes deeper.

It transforms supplier relationships from transactional to strategic. By offering real-time visibility and reliable financing options, you become a buyer of choice. This enhances your supply chain’s overall resilience. In an era of constant disruption, that is the ultimate competitive advantage. Investing in supply chain finance tools with real-time analytics 2025 is an investment in stability and strategic growth.

# Your 2025 Action Checklist

To move from understanding to action, use this practical checklist.

– Conduct an internal audit of AP, procurement, and treasury data flows and pain points.

– Define three primary KPIs for a new supply chain finance initiative.

– Shortlist at least three vendor platforms that match your primary archetype (buyer-led vs. bank-led).

– Secure a proof-of-concept commitment from your top vendor candidate.

– Form a cross-functional implementation team with representatives from finance, procurement, IT, and operations.

– Identify a pilot group of 5-10 strategic suppliers for the initial rollout.

– Develop a internal communication plan to articulate the benefits to all stakeholders.

– Plan a data cleansing project for supplier master data before integration begins.