# The 2025 Forecast: A Deep Dive into the Impact of Supply Chain Issues on the Electronics Market

The global electronics market stands at a critical juncture. As we move through 2024 and look toward 2025, the lingering and evolving impact of supply chain issues on the electronics market 2025 remains the single most significant factor shaping its future. This is not just about delayed shipments or higher prices. It is a fundamental restructuring of how products are designed, sourced, manufactured, and sold. In this analysis, we will explore the multi-faceted consequences, from consumer shelves to corporate boardrooms, and outline the strategic shifts defining the new era.

UNDERSTANDING THE NEW NORMAL OF SUPPLY CHAIN DISRUPTIONS

Gone are the days of viewing supply chain problems as temporary shocks. The disruptions of the past few years have crystallized into a persistent state of volatility. For the electronics sector, this new normal is characterized by three core pressures: geopolitical tensions affecting key trade routes and semiconductor policies, climate-related events disrupting logistics and factory operations, and a chronic shortage of specialized components and skilled labor. These factors combine to create a perfect storm of uncertainty, making long-term planning exceptionally difficult for manufacturers.

The direct impact of these ongoing supply chain issues on consumer electronics is highly visible. Product launches are often staggered by region, and popular items like the latest gaming consoles or high-end smartphones can remain out of stock for months. However, the deeper, more structural impact of supply chain issues on the electronics market 2025 is felt upstream, forcing a complete rethink of operational philosophy.

A CLOSER LOOK AT CONSUMER PRICING AND PRODUCT AVAILABILITY

For the average buyer, the most immediate consequence is financial. Increased costs for raw materials, expedited shipping, and component scarcity are inevitably passed down. A report by Deloitte highlighted that global semiconductor lead times peaked at over 20 weeks in recent years, and while they have eased, they remain volatile, contributing to cost pressures (source: Deloitte 2023 Semiconductor Industry Outlook). This translates to higher retail prices or, interestingly, a phenomenon known as “feature shuffling,” where manufacturers remove certain components to hit a target price point.

Availability has become a game of patience and pre-orders. The “buy now” expectation has been replaced by “notify when in stock.” This shift has profound implications for brand loyalty. When a preferred product is unavailable for an extended period, consumers are more likely to explore alternatives, potentially eroding market share for dominant players. The impact of supply chain issues on the electronics market 2025, therefore, includes a reshuffling of competitive dynamics based on who can secure components and guarantee delivery.

STRATEGIC SHIFTS IN MANUFACTURING AND SOURCING

In response to these pressures, electronics companies are undertaking their most significant strategic pivots in decades. The overarching theme is a move from efficiency to resilience. This manifests in several key initiatives:

1. Nearshoring and Friendshoring: Companies are reducing dependence on single geographic regions, particularly for critical components. Building manufacturing capacity closer to key consumer markets (nearshoring) or within allied countries (friendshoring) is accelerating.

2. Supplier Diversification: The practice of relying on a single source for a crucial chip or material is being abandoned. Firms are actively cultivating a broader, more geographically spread supplier base, even at a higher initial cost.

3. Inventory Strategy Overhaul: The just-in-time inventory model is being supplemented with “just-in-case” stockpiles of essential components. This ties up capital but provides a crucial buffer against sudden shortages.

From my experience consulting with electronics firms, the most successful teams are those integrating supply chain risk assessment directly into their product design phase, choosing more readily available components over cutting-edge but scarce ones to ensure stable production.

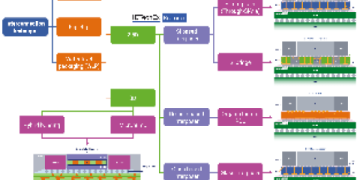

COMPARISON OF TRADITIONAL VS. RESILIENT SUPPLY CHAIN MODELS

The table below contrasts the old, efficiency-focused model with the emerging resilience-focused paradigm shaping the electronics sector.

| Factor | Traditional Model (Pre-2020) | Resilient Model (2025 Outlook) |

|---|---|---|

| Primary Goal | Cost Minimization & Lean Inventory | Risk Mitigation & Guaranteed Continuity |

| Geographic Sourcing | Concentrated in Low-Cost Regions | Diversified, with Nearshoring Elements |

| Supplier Relationships | Transactional, Many Suppliers | Strategic Partnerships, Fewer but Deeper Ties |

| Inventory Approach | Just-in-Time (JIT) | JIT + Strategic Buffer Stockpiles |

| Technology Reliance | Basic ERP Systems | AI-Powered Demand Forecasting & Logistics |

HOW BUSINESSES CAN ADAPT: A 5-STEP ACTION PLAN

For businesses operating within or selling to the electronics market, adapting is no longer optional. Here is a practical, step-by-step guide to building resilience.

STEP 1: CONDUCT A SUPPLY CHAIN VULNERABILITY AUDIT. Map your entire component and material flow. Identify single points of failure, whether they are specific suppliers, geographic regions, or logistics hubs.

STEP 2: DIVERSIFY YOUR SUPPLIER BASE. Proactively seek out and qualify alternative suppliers for your most critical items. This may involve looking at different regions or considering slightly different technical specifications.

STEP 3: STRENGTHEN SUPPLIER RELATIONSHIPS. Move beyond transactional interactions. Develop strategic partnerships with key suppliers through long-term agreements and open communication about forecasts and challenges.

STEP 4: INVEST IN SUPPLY CHAIN VISIBILITY TECHNOLOGY. Implement tools that provide real-time data on inventory levels, shipment locations, and potential disruptions. This allows for proactive, rather than reactive, decision-making.

STEP 5: REDESIGN PRODUCTS FOR FLEXIBILITY. Work with engineering teams to design products that can accommodate multiple component types or suppliers. This “design for availability” mindset is becoming a key competitive advantage.

COMMON MISCONCEPTIONS AND WARNINGS

A critical warning for industry observers: do not assume the impact of supply chain issues on the electronics market 2025 is solely about hardware. The software and services ecosystem is equally vulnerable. A shortage of specific chips can delay not just a device, but the entire ecosystem of connected services and software updates planned for it. Another common mistake is focusing only on tier-1 suppliers. Disruptions often originate deep in the sub-tier supplier network (the makers of substrates, specialty chemicals, or machine tools), which are harder to monitor but just as critical.

Furthermore, while reshoring production sounds like an ideal solution, it is a complex, decade-long endeavor. Building a semiconductor fab, for instance, costs tens of billions of dollars and requires a highly specialized workforce. The solutions will be hybrid and incremental.

THE ROAD AHEAD: INNOVATION AND OPPORTUNITY

Paradoxically, this period of constraint is driving remarkable innovation. The push for supply chain resilience is accelerating adoption of technologies like AI for predictive logistics, blockchain for component provenance tracking, and advanced robotics for automated warehousing. Furthermore, component shortages are forcing designers to create more efficient, modular, and repairable products, which could have positive long-term environmental effects.

The impact of supply chain issues on the electronics market 2025 is ultimately a story of transformation. The market that emerges will be less centralized, more technologically enabled, and strategically focused on stability over sheer scale. Companies that embrace this new paradigm will not only survive but are poised to define the next generation of electronics.

CHECKLIST FOR ELECTRONICS BUSINESSES PREPARING FOR 2025

To ensure your business is navigating these challenges effectively, use this actionable checklist.

IDENTIFY AND MAP ALL CRITICAL SINGLE-SOURCE COMPONENTS IN YOUR PRODUCTS.

ESTABLISH COMMUNICATION PROTOCOLS WITH KEY SUPPLIERS BEYOND PURCHASING DEPARTMENTS.

EVALUATE AND INVEST IN A SUPPLY CHAIN VISIBILITY SOFTWARE PLATFORM.

REVIEW PRODUCT DESIGNS FOR OPPORTUNITIES TO USE MORE COMMONLY AVAILABLE PARTS.

DEVELOP SCENARIO PLANS FOR AT LEAST THREE MAJOR DISRUPTION TYPES (GEO-POLITICAL, LOGISTICAL, CLIMATE).

EXPLORE OPPORTUNITIES FOR PRODUCT REFURBISHMENT OR COMPONENT RECOVERY TO ALLEVIATE NEW PART DEPENDENCE.

ALLOCATE BUDGET FOR STRATEGIC INVENTORY BUFFERS OF HIGH-RISK ITEMS.

CONDUCT REGULAR STRESS TESTS ON YOUR SUPPLY CHAIN MODEL TO FIND WEAKNESSES.