Mergers and acquisitions are complex endeavors. While financial and cultural synergies often dominate the headlines, the true linchpin of long-term value creation lies beneath the surface: the M&A supply chain. Integrating two distinct, often global, supply networks is a monumental operational challenge. Failure to manage it effectively can erode projected synergies, cripple customer service, and ultimately doom the deal.

This guide provides a comprehensive, actionable framework for navigating M&A supply chain integration. We will move beyond theory to deliver a practical roadmap used by leading practitioners.

UNDERSTANDING THE M&A SUPPLY CHAIN CHALLENGE

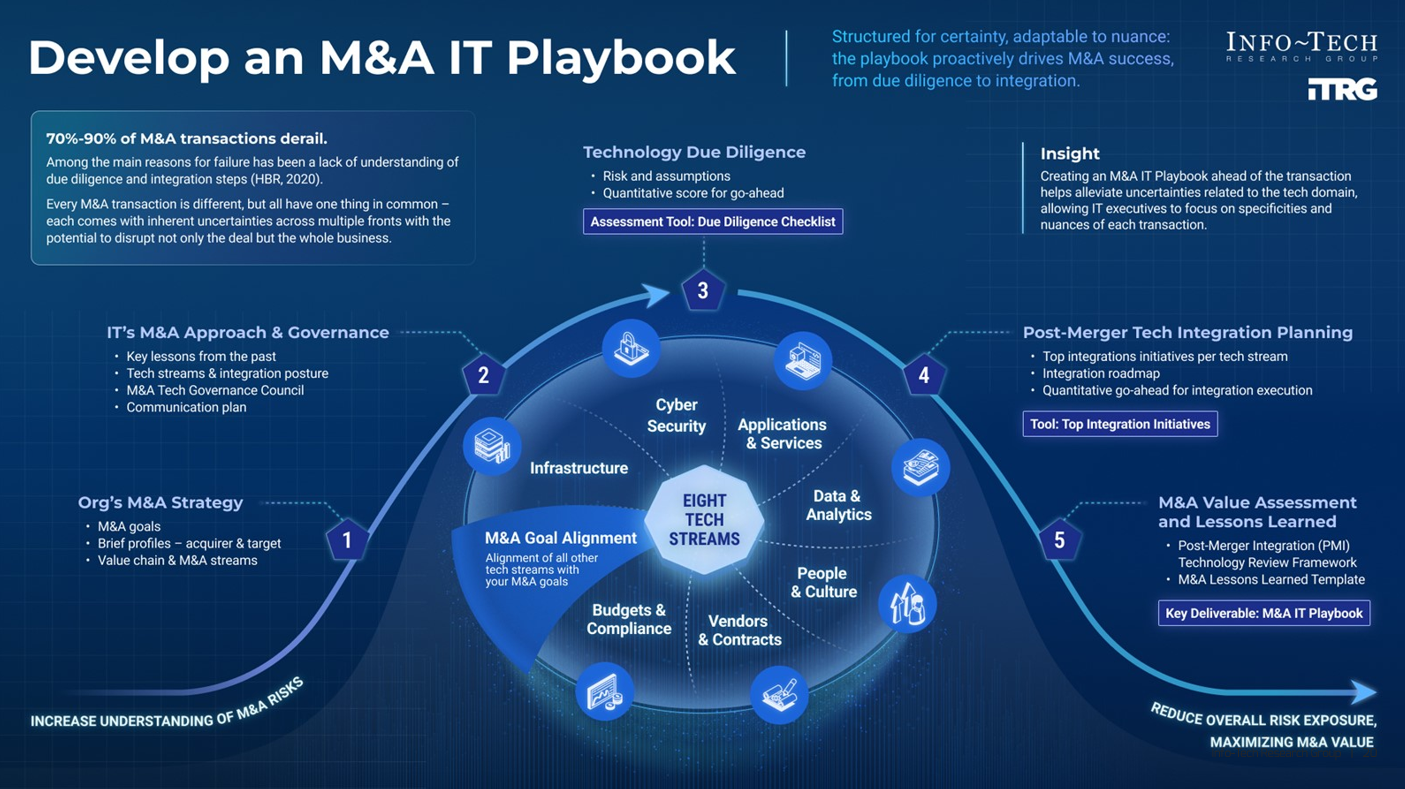

At its core, an M&A supply chain integration is about unifying two separate ecosystems of suppliers, manufacturing, logistics, warehousing, and distribution into one coherent, efficient, and resilient whole. The goal is not simply to combine, but to optimize. This process is fraught with risk. Disparate IT systems can cause data blackouts. Conflicting supplier contracts can lead to legal disputes and cost overruns. Incompatible warehouse management processes can halt shipments. A study by Harvard Business Review noted that between 70% and 90% of acquisitions fail to achieve their strategic objectives, with poor post-merger integration being a primary culprit, often due to operational silos like the supply chain (来源: Harvard Business Review).

The search intent behind “M&A supply chain” is primarily informational and transactional. Professionals are seeking strategies, frameworks, and solutions to mitigate risk and execute a successful integration. Related concepts, or LSI keywords, include supply chain due diligence, post-merger integration, synergy realization, and operational consolidation.

A CRITICAL PHASE: SUPPLY CHAIN DUE DILIGENCE

Many companies make the critical error of treating supply chain analysis as a post-deal activity. In reality, effective integration begins during due diligence. This phase is about uncovering hidden liabilities and identifying synergy opportunities long before the deal closes.

Key areas to investigate include:

– Supplier Contracts and Relationships: Review terms, termination clauses, performance history, and concentration risk. A single critical supplier with an unfavorable contract can become a major post-merger headache.

– IT and Data Infrastructure: Assess the compatibility of Enterprise Resource Planning (ERP), Warehouse Management Systems (WMS), and Transportation Management Systems (TMS). Data format mismatches are a common integration bottleneck.

– Logistics Network Design: Map both networks to identify overlapping facilities, redundant routes, and potential consolidation hubs.

– Inventory Policies and Levels: Differing approaches to safety stock and inventory turnover can significantly impact working capital post-merger.

According to my experience, we once advised a client whose target company had a seemingly robust supply chain. Our deep-dive due diligence revealed that their primary distribution center was operating on a legacy software platform entirely unsupported by the vendor. The cost and disruption of replacing it post-acquisition became a key point in final negotiations, saving our client millions in unforeseen capital expenditure.

THE 5-STEP M&A SUPPLY CHAIN INTEGRATION FRAMEWORK

Once the deal is signed, a structured, phased approach is non-negotiable. Here is a five-step operational guide.

Step 1: Establish the Integration Management Office (IMO) and Define the “To-Be” State.

Form a dedicated team with leaders from both organizations. This IMO must have clear authority. Their first task is to collaboratively design the future-state supply chain blueprint. Will you fully integrate, operate independently, or adopt a hybrid model? This strategic decision guides all subsequent actions.

Step 2: Execute a 100-Day Stabilization Plan.

The immediate post-close period is about preventing disruption. Focus on maintaining customer service levels. Key actions include communicating with key suppliers and customers, ensuring IT systems can “talk” for basic order processing, and aligning on immediate procurement priorities. Do not attempt radical changes in this phase.

Step 3: Conduct a Detailed Process and System Mapping.

With stability achieved, dive deep. Document every major process—from procurement to returns—in both legacy systems. Identify best practices from each company. This mapping exercise highlights redundancies, gaps, and integration points for your core IT systems.

Step 4: Implement Strategic Consolidation and Optimization.

This is where synergy capture happens. Based on your mapping, begin consolidating suppliers for volume leverage, rationalizing warehouse networks, and optimizing transportation lanes. Technology integration, such as merging onto a single ERP instance, typically occurs in this phase. Change management and training are critical here.

Step 5: Establish Performance Management and Continuous Improvement.

Integration is not a project with an end date; it is the launch of a new operating model. Establish new Key Performance Indicators (KPIs) for the unified supply chain. Implement a continuous improvement program to capture ongoing efficiencies and enhance resilience.

COMMON M&A SUPPLY CHAIN INTEGRATION PITFALLS

WARNING: Even with a good plan, teams fall into predictable traps. Be vigilant against these common mistakes.

– Underestimating the Cultural Divide: Two companies may have radically different approaches to risk, supplier relationships, and inventory management. Forcing one culture onto the other without buy-in leads to resistance and failure.

– Prioritizing Cost-Cutting Over Resilience: Aggressively consolidating suppliers or facilities to hit synergy targets can create dangerous single points of failure. The quest for efficiency must be balanced with supply chain robustness.

– Neglecting Talent Retention: Key supply chain personnel from the acquired company hold invaluable institutional knowledge. Failure to retain them can cripple integration efforts.

– Treating IT as a Back-Office Function: IT integration is not a technical afterthought; it is the central nervous system of the new supply chain. It must be a top-tier priority from day one of planning.

CHOOSING YOUR INTEGRATION APPROACH: A COMPARISON

Not all integrations are the same. The optimal approach depends on the strategic goals of the merger. The following table contrasts two primary models:

| Integration Aspect | Full Consolidation Model | Best-of-Breed Hybrid Model |

|---|---|---|

| Strategic Goal | Maximize cost synergies and operational control. | Preserve unique capabilities and accelerate integration. |

| IT Systems | Migrate all operations to a single, unified ERP/WMS platform. | Keep best systems from each company and build interfaces between them. |

| Supplier Base | Aggressive rationalization to a reduced set of preferred vendors. | Selective consolidation while maintaining specialized suppliers. |

| Network Design | Close redundant facilities and create a centralized network. | Optimize flows between existing facilities, closing only clear overlaps. |

| Best For | Horizontal mergers with significant overlap in products and regions. | Vertical integrations or mergers where each company brings unique expertise. |

A report from Deloitte emphasizes that companies with a clear integration strategy, aligned to deal type, are 2.5 times more likely to have a successful integration outcome (来源: Deloitte M&A Integration Report).

YOUR M&A SUPPLY CHAIN INTEGRATION CHECKLIST

Use this actionable checklist to guide your process from start to finish.

PHASE 1: DUE DILIGENCE

– Assemble a cross-functional supply chain due diligence team.

– Analyze all critical supplier contracts for risk and opportunity.

– Audit IT landscape for system compatibility and data integrity.

– Model network overlap and potential consolidation savings.

– Assess inventory health and working capital implications.

PHASE 2: PLANNING (PRE-CLOSE)

– Establish the Integration Management Office with clear leadership.

– Define the future-state “To-Be” supply chain operating model.

– Develop the 100-Day Stabilization Plan.

– Create a detailed communication plan for suppliers and customers.

– Identify key talent for retention in the acquired company.

PHASE 3: EXECUTION (POST-CLOSE)

– Launch the 100-Day Stabilization Plan; monitor customer service metrics.

– Complete detailed as-is process mapping for both legacy systems.

– Begin strategic projects: supplier rationalization, network redesign.

– Execute the core IT system integration roadmap.

– Implement new, unified KPIs and performance dashboards.

PHASE 4: OPTIMIZATION

– Launch continuous improvement programs (e.g., Lean, Six Sigma).

– Conduct a formal “lessons learned” review of the integration.

– Re-evaluate supply chain strategy for the new, combined entity.

– Explore advanced analytics and digital tools for the unified network.

Mastering the M&A supply chain is what separates deals that merely close from deals that create enduring value. By shifting focus from pure financial engineering to operational excellence, and by following a disciplined, phased framework, you can navigate this complexity and turn your combined supply chain into a formidable competitive advantage.