# The Ultimate Guide to NFLX Debt to Equity Ratio: What Investors Must Know in 2024

Understanding a company’s financial health is crucial for any investor. For a streaming giant like Netflix, one key metric that sparks intense debate is the NFLX debt to equity ratio. This figure is more than just a number on a balance sheet. It tells a story of aggressive growth, strategic financing, and potential risk. In this comprehensive guide, we will dissect Netflix’s leverage, explain what it means for the company’s future, and show you how to interpret this critical data point like a seasoned analyst.

We will cover the current state of Netflix’s debt, compare it to industry peers, and explore the management’s strategy behind their capital structure. By the end, you will have a clear, actionable framework for evaluating NFLX stock beyond the headline subscriber numbers.

## What Is the Debt to Equity Ratio and Why Does It Matter for Netflix?

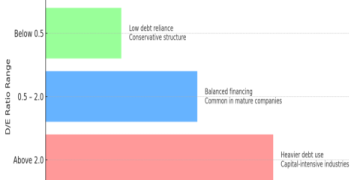

The debt to equity ratio is a fundamental leverage metric. It compares a company’s total liabilities to its shareholders’ equity. In simple terms, it shows how much of the company is financed by debt versus owned by its shareholders. A higher ratio generally indicates more debt and potentially higher financial risk.

For Netflix, this ratio is particularly significant. The company embarked on a massive content spending spree over the past decade, funding hit shows like “Stranger Things” and “The Crown” not just from profits, but heavily from debt. This strategy was a calculated bet: take on debt now to build an unassailable content library that drives global subscriber growth for years to come. Therefore, analyzing the NFLX debt to equity ratio is essentially analyzing the backbone of its growth strategy.

## Netflix’s Current Debt to Equity Position: A 2024 Snapshot

As of its most recent quarterly report in early 2024, Netflix’s financial picture shows a notable shift. For years, the company’s debt to equity ratio was a point of concern for conservative investors. However, a strategic pivot towards generating substantial free cash flow has changed the narrative.

Netflix has significantly slowed its reliance on debt markets. In fact, the company has begun aggressively paying down its debt. Management has stated its goal is to maintain a gross debt level of around $10 to $15 billion while building a cash war chest. This deliberate move towards a stronger balance sheet has positively impacted the NFLX debt to equity ratio, bringing it down from its previous highs. According to their Q1 2024 shareholder letter, Netflix generated over $6 billion in free cash flow over the trailing twelve months, a portion of which is being used for debt reduction.

## How Netflix’s Leverage Compares to Its Streaming Rivals

To truly understand Netflix’s position, we must look at it in context. How does its use of debt stack up against other major players in the media and streaming landscape? The answer reveals different corporate philosophies.

The table below provides a simplified comparison of key leverage metrics for major streaming-focused companies. Data is based on recent public filings and should be used for illustrative purposes.

| Company | Approx. Debt to Equity Ratio | Key Context & Strategy |

|---|---|---|

| Netflix (NFLX) | Moderate & Declining | Transitioning from high-growth debt financing to self-funded content via strong operating cash flow. Focus on reducing absolute debt. |

| Disney (DIS) | Moderate to High | Carries significant debt from acquisitions (e.g., Fox) and massive content/theme park investments. Leverage is part of a broader conglomerate strategy. |

| Warner Bros. Discovery (WBD) | Very High | Legacy of the Discovery-AT&T merger created one of the most leveraged balance sheets in media. Paramount focus on debt reduction is management’s top priority. |

| Apple (AAPL) | Very Low | Massive cash reserves. Uses debt strategically for shareholder returns (buybacks, dividends) but content spending is a minor part of its overall finances. |

This comparison highlights that Netflix is in a middle ground. It is not as leveraged as some traditional media companies undergoing consolidation, but it certainly used debt more aggressively than a tech cash giant like Apple. The trend for NFLX, however, is now firmly pointing towards deleveraging.

## The Strategic Rationale Behind Netflix’s Debt History

Why did Netflix take on so much debt in the first place? The answer lies in a classic land-grab strategy. In the early days of the streaming wars, the priority was scale and market dominance. Borrowing money at low interest rates to fund content creation was seen as a smart way to accelerate growth faster than competitors. This debt-fueled content engine allowed Netflix to build a global subscriber base that now exceeds 260 million.

From my experience analyzing media companies, this was a high-risk, high-reward move that, so far, has paid off. They secured the prime position in consumers’ minds as the default streaming service. However, the cost was a balance sheet that made value investors nervous. The current phase of generating positive free cash flow and paying down debt is the necessary next step to mature from a growth-at-all-costs startup to a sustainable, profitable enterprise.

## A 5-Step Guide to Analyzing NFLX Debt to Equity for Your Portfolio

You should not look at the debt to equity ratio in isolation. Here is a practical, five-step guide our team uses to evaluate Netflix’s financial health comprehensively.

STEP 1: Find the Raw Numbers. Locate the total liabilities and total shareholders’ equity on Netflix’s latest balance sheet (10-Q or 10-K filing on the SEC website). Divide liabilities by equity to calculate the ratio yourself.

STEP 2: Examine the Trend. Don’t just look at one quarter. Chart the NFLX debt to equity ratio over the past 5 years. Is it rising, falling, or stable? The direction is often more telling than the single point-in-time number.

STEP 3: Assess the Debt Cost. Look at the company’s income statement for interest expense. Then, check the cash flow statement for operating cash flow. Is the operating cash flow comfortably covering interest payments multiple times over?

STEP 4: Read Management Commentary. In every earnings release and shareholder letter, management discusses its capital allocation strategy. Search for keywords like “debt,” “leverage,” “balance sheet,” and “free cash flow” to understand their official stance.

STEP 5: Consider the Macro Environment. Interest rates have risen sharply. Evaluate if Netflix’s debt is at fixed or variable rates. A company with lots of fixed-rate debt locked in during low-rate periods is in a better position today.

## Common Misconceptions and Investor Warnings

A critical warning for investors is to avoid a superficial reading of the NFLX debt to equity ratio.

WARNING: A HIGH RATIO IS NOT ALWAYS BAD. For a company in a high-growth phase with predictable recurring revenue (like subscription-based Netflix), taking on debt can be a powerful tool to accelerate value creation. The key question is whether the return on invested capital (from content spending) exceeds the cost of that debt.

WARNING: A LOW RATIO IS NOT ALWAYS GOOD. An extremely low ratio could indicate a company is not using available leverage to grow, which might mean it is missing opportunities. It could also signal a lack of profitable projects to invest in.

The biggest mistake is comparing Netflix’s ratio to a company in a completely different industry, like a utility or a bank. Always use industry-specific peers for context, as we did in the comparison table earlier.

## The Future: Is Netflix’s Debt Sustainable?

Looking ahead, the sustainability of Netflix’s debt load hinges on one thing: consistent free cash flow generation. The company has demonstrated it can produce massive amounts of cash now that its subscriber base is maturing and content spending is stabilizing. Management has guided for continued strong free cash flow in 2024.

This self-funding model reduces the need for new debt. Furthermore, Netflix has no major debt maturities coming due in the near term that would cause a liquidity crunch. As long as the company maintains its pricing power and subscriber engagement, the current path of gradually improving the NFLX debt to equity ratio appears not just sustainable, but likely.

## Final Checklist for Evaluating NFLX Debt and Equity

Before making any investment decision based on Netflix’s financial leverage, run through this final checklist. Ensure you have answers to all these points.

CALCULATE the current debt to equity ratio from the latest report.

CHART the ratio’s trend over a multi-year period.

CONFIRM the interest coverage ratio from cash flow.

READ the latest management commentary on capital allocation.

COMPARE the ratio to direct streaming and media peers.

ANALYZE the debt maturity schedule for upcoming obligations.

EVALUATE the macro interest rate environment’s impact.

ASSESS the company’s primary use for free cash flow (debt paydown vs. other uses).

REVIEW the growth rate of operating income relative to interest expense.

SYNTHESIZE all factors into a holistic view of risk and strategy.

By methodically working through this guide and checklist, you move beyond a simple number to a deep, nuanced understanding of one of the most critical aspects of Netflix’s investment profile. The NFLX debt to equity ratio is a dynamic indicator, and its recent improvement signals a new, more mature chapter for the streaming pioneer.