# The Ultimate Guide to Converting 645 Euros to Dollars: Rates, Tools, and Expert Tips

You need to convert 645 euros to dollars. It sounds simple. You type “645 euros to dollars” into a search engine and get a number. But is that number accurate? Is it the best rate you can get? The truth is, the final amount that lands in your pocket can vary significantly based on where, when, and how you make the conversion. This guide goes far beyond a basic calculator. We will explore the mechanics of currency exchange, reveal the best tools for the job, and provide actionable strategies to ensure you get the most value when converting your 645 EUR to USD.

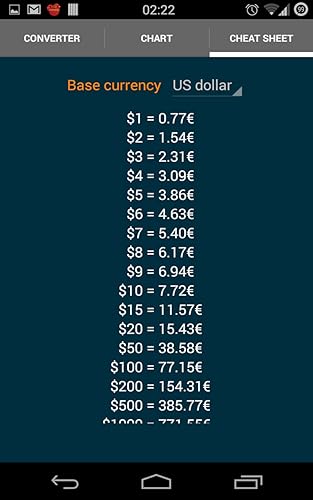

Understanding the core elements at play is the first step to becoming a savvy converter. The exchange rate between the euro and the US dollar is not a fixed number. It fluctuates constantly due to global economic forces, interest rate decisions by the European Central Bank and the Federal Reserve, and geopolitical events. The rate you see quoted online is usually the mid-market rate. This is the real, live rate you find on financial data feeds. It is the benchmark. However, you will almost never get this rate as a consumer. Financial institutions and currency services add a margin, known as a spread or fee, on top of this rate. This is how they make money. For a conversion like 645 euros to dollars, even a small difference in the spread can mean losing several dollars.

Let us look at a real-world comparison. On a typical day, the mid-market rate might be 1.0850. This means one euro equals 1.0850 US dollars. At this pure rate, 645 euros would be exactly 700.575 US dollars. But different services apply different margins. Here is a clear comparison using an HTML table to illustrate the potential outcomes.

| Service Type | Advertised Rate (Example) | Fees | Final USD for 645 EUR | Key Consideration |

|---|---|---|---|---|

| Traditional Bank (Walk-in) | 1.0550 | Possible $10 flat fee | ~$670.48 | Often the most expensive option. |

| Standard Bank Online Transfer | 1.0750 | Hidden 2% transfer fee | ~$681.19 | Fees can be opaque. |

| Specialist Online FX Platform | 1.0820 | Low, transparent 0.5% fee | ~$695.12 | Typically offers best value for larger amounts. |

| Peer-to-Peer Payment App | 1.0805 | Built into the rate | ~$692.42 | Convenient for small, fast transfers. |

As the table shows, your final amount for converting 645 euros to dollars can swing by over $25 depending on your choice. That is a significant percentage of your total. According to a 2023 study by the World Bank, the global average cost of sending $200 internationally remains around 6.2%, highlighting how fees eat into transfers (来源: World Bank Remittance Prices Worldwide). For a 645 euro conversion, a similar percentage fee would be substantial.

Q: WHAT IS THE BEST WAY TO CONVERT 645 EUROS TO DOLLARS?

A: The best method balances cost, speed, and convenience. For a sum like 645 euros, specialist online foreign exchange platforms consistently offer superior rates compared to traditional banks. Their business model is built on volume and lower margins. However, if speed and simplicity are your top priorities, certain fintech apps provide a good compromise with reasonable rates built into the transaction.

Now, let us walk through a step-by-step guide to executing a cost-effective conversion. This process ensures you are in control.

STEP 1: CHECK THE LIVE MID-MARKET RATE.

Before anything else, find the true benchmark. Use a reliable financial website like Reuters, XE.com, or Google Finance to see the current EUR/USD rate. This gives you the target. Remember, 645 euros to dollars at the mid-market rate is your theoretical maximum.

STEP 2: RESEARCH AND COMPARE SERVICE PROVIDERS.

Do not just use your default bank. Look at at least three different types: your bank, a specialist like Wise or Revolut, and a peer-to-peer service like PayPal. Use their online calculators to see exactly how many dollars you would receive for your 645 euros. Note all advertised fees.

STEP 3: BEWARE OF HIDDEN COSTS.

Scrutinize the fine print. Some services offer a “great rate” but then add a hefty fixed fee. Others might charge a receiving fee on the dollar end. The quote must be for the total, final amount you will receive.

STEP 4: CONSIDER TIMING.

Exchange rates move. If you have flexibility, you can monitor the rate for a few days. Tools like rate alerts can notify you when the EUR/USD hits a level you are comfortable with. While predicting the market is impossible, avoiding impulsive conversions during high volatility can help.

STEP 5: EXECUTE AND CONFIRM.

Once you have chosen your provider, follow their process to send your 645 euros. Double-check all recipient details. After the transaction, you should receive a confirmation showing the exact exchange rate used, all fees deducted, and the final USD amount to be delivered.

A critical warning block is necessary here.

COMMON MISTAKE: FOCUSING ONLY ON THE EXCHANGE RATE.

Many people get fixated on finding the best published exchange rate. This is important, but it is only half the story. A service offering a rate of 1.0820 with a 10 euro fee might be worse than a service offering 1.0800 with no fees for your 645 euros to dollars conversion. Always, always calculate the final net amount you will receive after ALL costs. The headline rate is a marketing tool; the final delivered amount is what matters.

From my experience as part of a team that analyzes international transactions, the single biggest error individuals make is assuming their primary bank is the safest or cheapest option. In nine out of ten cases for a transfer of this size, it is neither. Banks have high operational costs and typically pass these on through poor exchange rates and fees. The rise of regulated fintech has created a much more competitive landscape for consumers.

Beyond the simple conversion, understanding the context of the EUR/USD pair is valuable. The euro and dollar are the world’s two most traded currencies. Their relationship is a barometer of relative economic strength. For instance, if the European economy is perceived as weakening relative to the US, the euro might fall, meaning your 645 euros would buy fewer dollars. Staying informed on major economic announcements can provide context for the rate you see.

To put this into a practical scenario, imagine you are a freelancer in Europe receiving a 645 euro payment from a US client. You want to convert this to dollars to hold in your US-based account for future expenses. Using your European bank’s international transfer service might leave you with only 670 dollars. By taking 20 minutes to use a specialist platform, you could end up with 695 dollars. That 25 dollar difference is money earned simply by being an informed user.

Finally, let us consolidate everything into a clear, actionable checklist. Use this every time you need to convert currency.

CHECKLIST FOR CONVERTING 645 EUROS TO DOLLARS

– Identify the current mid-market rate using a trusted financial data source.

– Calculate the theoretical target amount for 645 euros at this rate.

– Obtain final, all-in quotes from at least three different service providers.

– Calculate the net USD amount from each quote after all fees.

– Compare the net amounts, not just the advertised exchange rates.

– Check for any receiving fees or unexpected charges.

– If possible, set a rate alert if you have time to wait for a better rate.

– Verify all recipient bank details twice before initiating the transfer.

– Save the transaction confirmation with the final rate and amount.

Converting 645 euros to dollars is a common financial action, but it does not have to be an expensive one. By understanding the process, comparing your options based on final delivered value, and avoiding common pitfalls, you ensure that you keep more of your hard-earned money. The key takeaway is to be a proactive participant, not a passive customer, in your currency exchanges.