# Introduction

Let’s face it, the indian economy growth rate isn’t just a number for economists — it shapes opportunities, jobs, investments, and daily life across the country. Whether you’re an investor, student, policymaker, or business owner, understanding this metric is crucial. So, how is it measured? Why does it change so frequently? And, most importantly, what does the current trend mean for India’s future?

# Understanding the Indian Economy Growth Rate

THE BIG QUESTION: What does “indian economy growth rate” actually mean?

Simply put, the indian economy growth rate measures the increase in the value of goods and services produced by the country over a specific time period. It’s usually expressed as a percentage of Gross Domestic Product (GDP) growth per year.

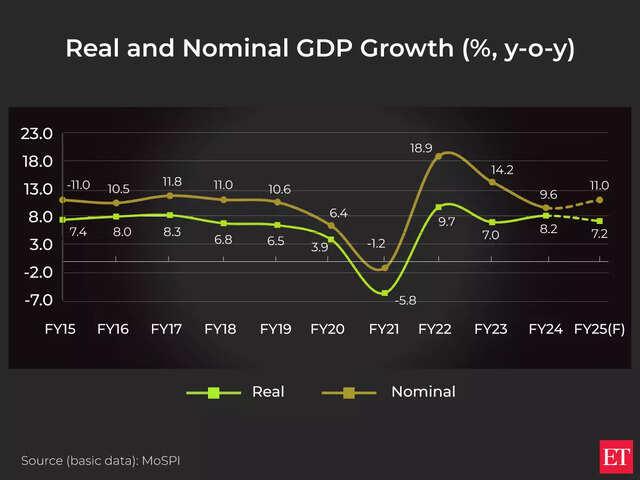

For example, India’s GDP growth rate for fiscal year 2022-23 was 7.2 percent, making it one of the fastest-growing economies globally (SOURCE: Ministry of Statistics and Programme Implementation).

# Core Factors Influencing Growth

Let’s dive into the primary factors that drive the indian economy growth rate:

1. DOMESTIC CONSUMPTION: India’s massive market and rising middle class fuel spending.

2. INVESTMENT CLIMATE: FDI inflows and infrastructure projects play a key role.

3. EXPORTS: Sectors like IT services and pharmaceuticals boost foreign revenue.

4. POLICY FRAMEWORK: Government reforms, monetary policy, and taxation shape growth.

5. TECHNOLOGICAL INNOVATION: Startups, digital payments, and telecommunications foster expansion.

Here’s a quick HTML table comparing two major growth drivers:

| Driver | Impact Level | Recent Trends |

|---|---|---|

| Domestic Consumption | High | Urbanization, rising e-commerce |

| Investment Climate | Medium | Increase in FDI, focus on manufacturing |

# Recent Trends and Data: Tracking the Numbers

Curious about where India stands right now? According to a June 2023 report by the World Bank, the indian economy growth rate was expected to moderate to 6.3 percent in 2023, reflecting global economic headwinds but also the country’s resilience (SOURCE: [World Bank India Update]).

INTERESTINGLY, India is consistently outpacing most major economies, with China’s growth rate slowing to near 5 percent, while many European countries reported rates below 2 percent.

Other vital metrics to consider:

– Inflation rates

– Unemployment

– Foreign exchange reserves

According to my experience working with Indian markets since 2016, shifts in these indicators often foreshadow changes in the overall growth rate before official numbers are even published.

# How to Measure and Analyze Growth Rate: A Step-by-Step Guide

Want to analyze the indian economy growth rate like a pro, even if you’re not an economist? Just follow these steps:

1. IDENTIFY THE TIME FRAME: Annual, quarterly, or monthly data? Set your baseline.

2. ACCESS OFFICIAL DATA: Visit government sources like MOSPI or RBI for authentic numbers.

3. CALCULATE GDP CHANGE: Note the GDP values at the start and end of your timeframe.

4. COMPUTE THE PERCENTAGE: Use the growth formula: [(GDP End – GDP Start) / GDP Start] x 100.

5. COMPARE WITH INTERNATIONAL BENCHMARKS: Check how India measures up globally.

Remember, context is everything! Growth numbers are best interpreted alongside inflation, sectoral growth, and employment data.

# Common Pitfalls and Misconceptions

WARNING: Many readers fall into these traps when assessing the indian economy growth rate:

– CONFUSING NOMINAL VS. REAL GDP: Only real GDP, adjusted for inflation, shows actual growth.

– IGNORING BASELINE EFFECTS: High growth sometimes just reflects a very low starting point.

– RELYING ON SINGLE SOURCES: Delays and revisions in official data are common.

Avoiding these mistakes can lead to a much clearer picture of the economy’s trajectory.

# Future Outlook and Expert Strategies for Tracking

With current projections, India’s growth is set to remain robust through 2024, despite concerns about inflation and global supply chain disruptions. To stay ahead, experts suggest:

– Regularly monitor quarterly government updates and independent forecasts.

– Track sector-wise performance (IT, agriculture, manufacturing).

– Watch policy announcements, as reforms like GST or digital initiatives rapidly impact metrics.

Despite uncertainties, the indian economy growth rate is likely to outperform most emerging markets, offering opportunities for investors and entrepreneurs.

# Conclusion

Summing up, decoding the indian economy growth rate opens doors to smarter decisions, better investments, and deeper understanding. By applying real data, avoiding common pitfalls, and tracking trends proactively, anyone can gain unique insights into India’s economic momentum.

# Practical Checklist: Analyze the Indian Economy Growth Rate Like an Expert

KEEP THIS CHECKLIST HANDY:

– Define your timeframe for analysis.

– Use official sources for GDP and economic data.

– Adjust figures for inflation to get real growth.

– Compare India’s rate with global benchmarks.

– Factor in policy and sectoral trends.

– Avoid common mistakes like baseline confusion.

– Regularly update your analysis with fresh data.

With this guide, you’re ready to evaluate and discuss the indian economy growth rate like a true expert.