# The Ultimate Guide to Understanding the Indian Rate of Inflation in 2024

The Indian rate of inflation is more than just a number in the financial news. It directly impacts your grocery bill, your savings, and your long-term financial planning. For businesses, investors, and everyday citizens, understanding this metric is crucial. This guide will provide a comprehensive, expert-level breakdown of what drives inflation in India, how it is measured, and what it means for you.

We will explore the current trends, delve into the complex causes, and offer practical strategies to protect your finances. By the end, you will have a clear, actionable understanding of one of India’s most critical economic indicators.

## What Exactly Is the Indian Rate of Inflation?

In simple terms, the Indian rate of inflation measures how much the general price level of goods and services is rising, and subsequently, how purchasing power is falling. The Reserve Bank of India (RBI), the country’s central bank, has a mandate to keep inflation within a target band, currently set at 2% to 6%. This target is crucial for maintaining economic stability.

The primary gauge for the Indian rate of inflation is the Consumer Price Index (CPI). The CPI tracks the price change of a basket of goods and services commonly purchased by households. This basket includes food, fuel, clothing, housing, and services like healthcare and education. When we talk about the headline inflation number in the news, it is usually the year-on-year percentage change in the CPI.

Another important measure is the Wholesale Price Index (WPI), which tracks prices at the wholesale level. However, for monetary policy decisions, the RBI primarily focuses on CPI as it better reflects the cost of living for consumers.

## The Key Drivers of Inflation in India

The Indian economy is vast and diverse, and its inflation is driven by a mix of domestic and global factors. Identifying these drivers is key to forecasting and managing the Indian rate of inflation.

FOOD AND FUEL PRICES: These are often the most volatile components. A poor monsoon can spike vegetable prices, while global crude oil fluctuations directly affect transportation and manufacturing costs. Food inflation has a disproportionate impact on household budgets in India.

DEMAND-PULL FACTORS: When the economy grows rapidly, consumer demand can outpace supply, leading to price increases. Government spending and private investment can also create demand-pull inflation.

COST-PUSH FACTORS: This occurs when the cost of production rises. Examples include increases in raw material prices, higher wages, or supply chain disruptions. The global supply chain issues post-pandemic were a classic cost-push trigger.

EXTERNAL FACTORS: The exchange rate of the Indian Rupee plays a significant role. A weaker rupee makes imports like oil and electronics more expensive, contributing to inflation. Global commodity price shocks also transmit directly to the Indian economy.

MONETARY POLICY: The RBI uses tools like the repo rate to control money supply. Lower rates can stimulate spending but risk inflation, while higher rates can cool inflation but may slow growth.

## How the Indian Rate of Inflation Is Measured: CPI vs. WPI

It is essential to understand the difference between the two main indices. The following table provides a clear comparison.

| Aspect | Consumer Price Index (CPI) | Wholesale Price Index (WPI) |

|---|---|---|

| PRIMARY PURPOSE | Measures retail inflation from the consumer’s perspective. | Measures inflation at the wholesale or producer level. |

| BASE YEAR | Currently 2012. | Currently 2011-12. |

| ITEMS TRACKED | Basket of 299 items across categories like Food, Housing, Clothing, etc. | Basket of 697 items covering Primary Articles, Fuel & Power, and Manufactured Products. |

| DATA COLLECTION | Prices collected from retail markets and service providers. | Prices collected from factories and wholesale markets. |

| KEY USERS | Reserve Bank of India for monetary policy. Common citizens for cost-of-living assessment. | Businesses, government for trade and policy formulation. Less used for monetary policy now. |

| IMPACT | Directly affects interest rates on loans and savings. | Indicates future consumer inflation trends. |

## Current Trends and the 2024 Outlook

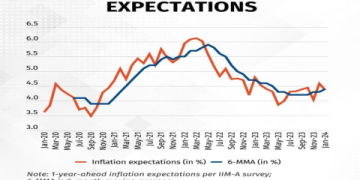

As of early 2024, the Indian rate of inflation has shown signs of moderation but remains susceptible to shocks. After peaking above 7% in 2022, CPI inflation has gradually eased, moving closer to the RBI’s upper tolerance band of 6%. For instance, the CPI inflation for January 2024 was reported at 5.1% (source: Ministry of Statistics and Programme Implementation).

However, core inflation, which excludes volatile food and fuel prices, has been stickier. This suggests underlying price pressures in services and manufactured goods. The outlook for 2024 hinges on several factors: the trajectory of global oil prices, the performance of the monsoon season, and the pace of global economic growth. Most expert forecasts, including those from the RBI, project an average inflation rate of around 4.5% to 5.5% for the fiscal year 2024-25, assuming a normal monsoon and stable commodity prices.

## A 5-Step Action Plan to Protect Your Finances from Inflation

Simply understanding the Indian rate of inflation is not enough. You must act to safeguard your wealth. Here is a practical, step-by-step guide.

STEP 1: AUDIT YOUR BUDGET. Go through your last three months of expenses. Identify categories where costs have risen the most. This awareness is the first step toward adjustment.

STEP 2: PRIORITIZE HIGH-YIELD SAVINGS. Move idle cash from regular savings accounts to instruments that can potentially outpace inflation. Consider liquid funds, high-yield savings accounts, or short-term fixed deposits for your emergency fund.

STEP 3: DIVERSIFY YOUR INVESTMENTS. Do not keep all your money in fixed-income assets. Allocate a portion to equity-linked instruments like mutual funds (especially index funds) or stocks, as they have historically provided inflation-beating returns over the long term.

STEP 4: REVIEW YOUR DEBT. If you have existing loans, especially with floating interest rates, understand that RBI may raise rates to combat high inflation. Consider prepaying high-cost debt. Conversely, if you are a saver, rising rates can be beneficial for new fixed deposits.

STEP 5: INVEST IN SKILLS. The best hedge against inflation is an increase in your earning capacity. Use resources to upskill or learn new competencies that can lead to a higher income.

## Common Misconceptions About Inflation in India

WARNING: AVOID THESE COMMON PITFALLS.

Many people hold mistaken beliefs about inflation that can lead to poor financial decisions. One major myth is that ZERO inflation is good for the economy. In reality, mild inflation is a sign of a growing economy. Deflation, or falling prices, can lead to delayed purchases and economic stagnation.

Another misconception is that inflation affects everyone equally. It does not. Inflation is a highly regressive tax. Lower-income households, who spend a larger proportion of their income on essential food and fuel, are hit much harder than wealthier households. Furthermore, savers who rely on fixed-interest returns lose purchasing power, while borrowers benefit as they repay loans with money that is worth less.

## The Role of the Reserve Bank of India in Controlling Inflation

The RBI is the primary institution tasked with managing the Indian rate of inflation. It uses monetary policy tools, chiefly the repo rate, to influence liquidity and demand in the economy. When inflation is high, the RBI typically increases the repo rate. This makes borrowing more expensive for banks, which in turn charge higher interest rates on loans. This cools down consumer and business spending, reducing demand-pull pressures.

The RBI also uses open market operations and the cash reserve ratio to manage the money supply. According to my experience analyzing RBI policy statements, their communication and forward guidance have become as important as the rate decisions themselves, shaping market and public expectations.

## Historical Context and Major Inflation Episodes

Understanding the past helps contextualize the present. India has experienced several severe inflationary episodes. The oil price shocks of the 1970s and the period following the 1991 economic crisis saw very high inflation. More recently, in 2013, the Indian rate of inflation soared into double digits, driven by high global commodity prices and domestic supply bottlenecks.

The period from 2020 to 2022 was another significant chapter, where pandemic-related supply disruptions, followed by the Ukraine war, caused a global surge in food and energy prices, pushing India’s CPI above the 7% mark. These historical instances highlight the economy’s vulnerability to external shocks.

## Final Checklist for Navigating Inflation

Use this practical checklist to ensure your finances are resilient against rising prices.

TRACK THE CPI AND CORE INFLATION NUMBERS monthly when they are released.

REBALANCE YOUR INVESTMENT PORTFOLIO at least once a year to maintain your desired asset allocation.

AIM FOR INVESTMENTS with a real return potential that exceeds the average inflation rate.

REDUCE UNNECESSARY EXPENSES on discretionary items that have seen sharp price increases.

FOCUS ON APPRECIATING ASSETS like real estate or equities over the long term rather than holding excessive cash.

CONTINUALLY ENHANCE YOUR PROFESSIONAL SKILLS to increase your income, which is the ultimate inflation hedge.

The Indian rate of inflation is a dynamic and complex force. By understanding its mechanics, monitoring its trends, and taking proactive steps with your finances, you can not only protect yourself but also find opportunities to grow your wealth even in a challenging economic environment. Stay informed, stay diversified, and focus on long-term financial health.